Gold markets fell during the trading session on Wednesday, reaching down towards the trendline that has been intact for several weeks. At this point it is likely that the market is going to continue to build up pressure, which makes quite a bit of sense considering that we get the jobs figure on Friday. At this point I anticipate that we will continue to see the markets undulate between risk and fear, and at this point gold has served as a quick place to run to when things get skittish. Needless to say, there has been plenty of things to be skittish about as of late.

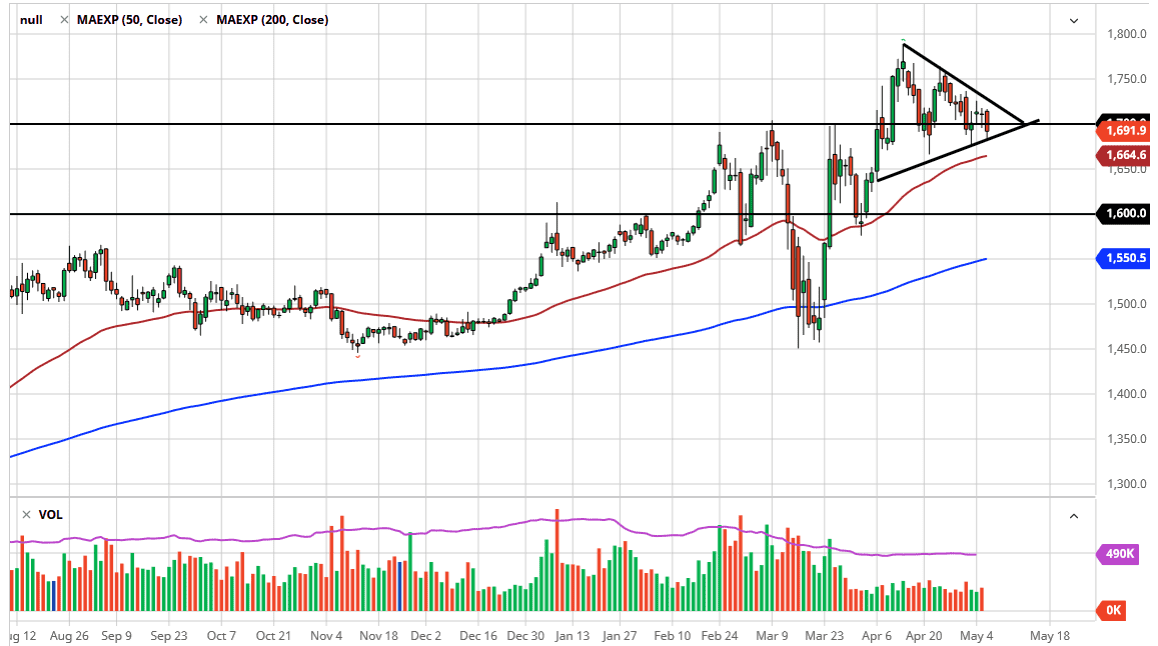

That being said, we are forming a massive triangle, and typically a symmetrical triangle does mean that there is a 50-50 chance as to which direction we go. That being said, it should be noted that we are in an uptrend and there are plenty of reasons to think that people will go looking towards gold again. The one major concern that gold might have is a strengthening US dollar, or perhaps even more likely, the forced liquidation in order to cover the margin calls in other markets.

The 50 day EMA is sitting just below the triangle, and it of course should show plenty of support. Ultimately, if the market were to break down below the 50 day EMA, it could be a bit of a shift, but the gold market has seen plenty of pullbacks in the past that simply looked at as they were going to be buying opportunities and in fact did proved to be over the longer term. To the upside, the market is likely to go looking towards the $1800 level, and then possibly even the $2000 level given enough time. To the downside, it is not until we break down below the $1600 level that I would be a massive seller. Even then, I would only do it if it is more of a grind in less of a massive liquidation in order to cover other problems in global portfolios. Longer-term, I still believe that buyers will continue to be a major pressure in this market, and at this point we are simply waiting for the jobs number to give us an idea as to how the US dollar may move, and of course that will have a major influence on gold as well. With this, I remain a buyer from everything I see.