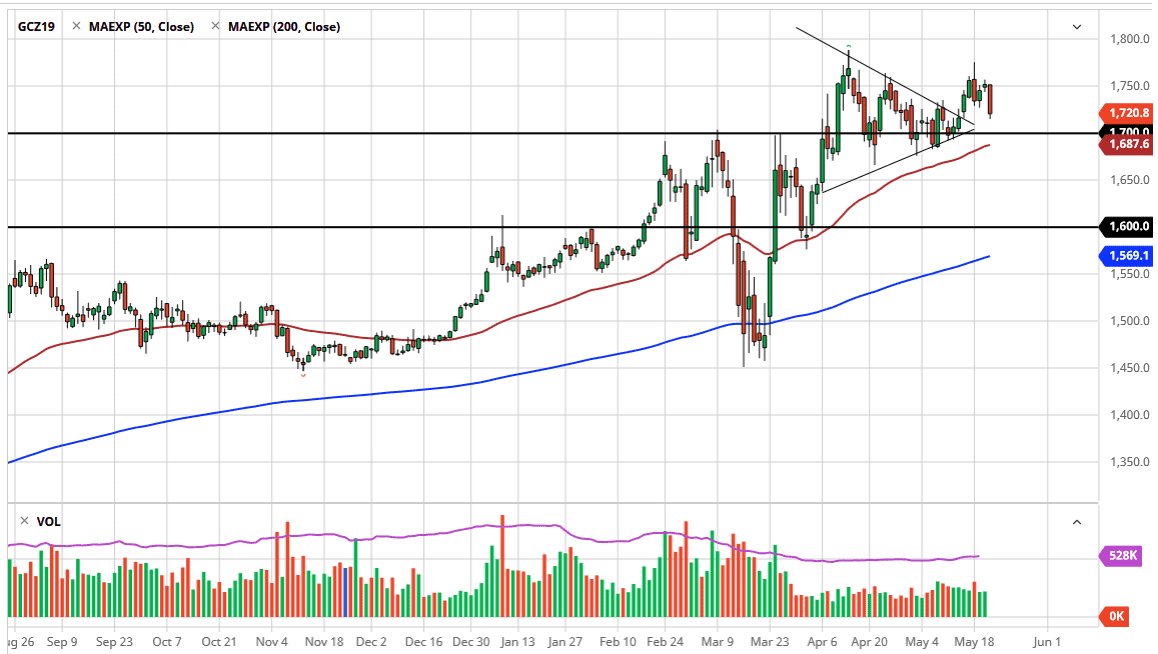

The gold markets broke down significantly during the trading session on Thursday as we have pulled back from the $1750 level. At this point, the market had reached the top of a major range, and it is not a huge surprise that we have pulled back the way we have over the last couple of days. The size of the candlestick is of course rather important due to the fact that it wiped out the previous five candlesticks.

That being said, the market has been in a strong uptrend for quite some time, as we have seen the market rally all the way from the $1450 level. Over the last couple of months, we have seen more or less sideways trading, with a support level starting at the $1690 level, perhaps even down to the $1680 level. On the other hand, at the top of the range it is more or less the $1760 level. The market continues to grind back and forth, and as a result it is highly likely that we will eventually see buyers underneath so I think that this pullback will end up being a nice buying opportunity given enough time.

Furthermore, the $1700 level of course is an area that is going to attract a lot of attention as it had previously been resistance before it became so supportive. Ultimately, this is a market that also has the 50 day EMA grinding higher and sitting near the $1690 level. We had previously been in a symmetrical triangle, but if we pull back enough it is possible that we may be looking at more or less a rectangle. Either way, it is a consolidation shape that typically leads to continuation.

Furthermore, the gold market is something that is quite often looked at as a way to fight the massive amount of liquidity that the Federal Reserve has thrown into the market in a devaluation of currency in general. I think that is going to continue to be a major issue, and of course gold also is looked at as a safety trade. Either way, gold is going higher over the longer term so I think that longer-term traders will simply look at this dip is yet another opportunity to go long. In fact, I do not even have a scenario right now where I am looking to short gold, so it is just a matter of buying it at lower levels to pick up “cheap gold.”