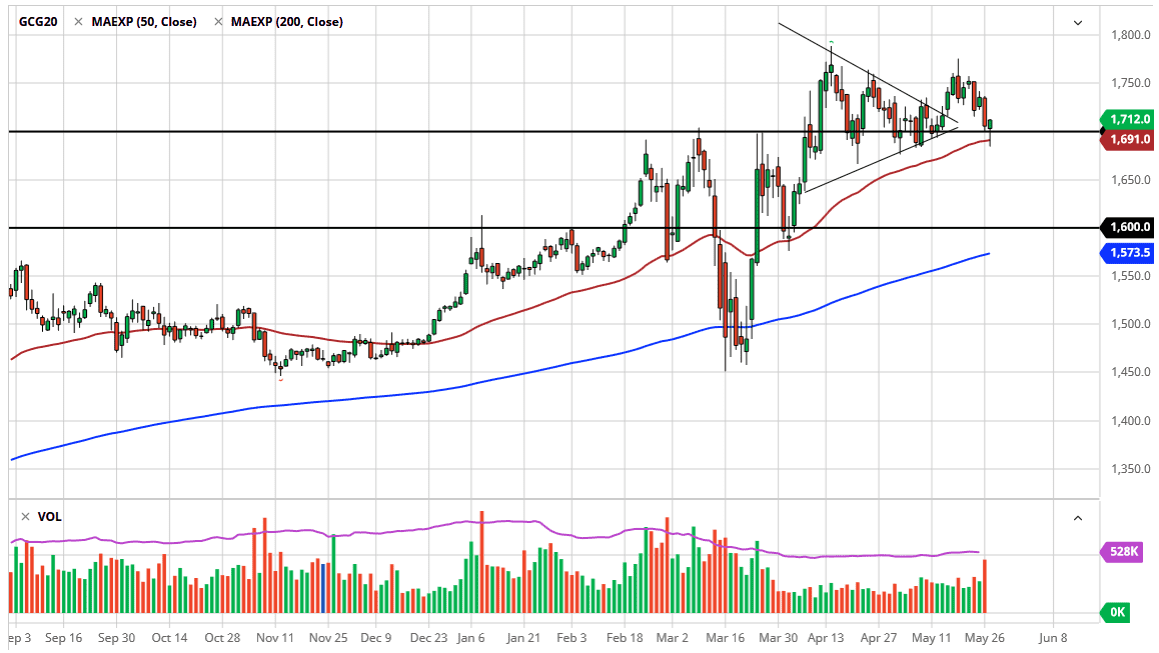

Gold markets initially broke down during the trading session on Wednesday, breaking well below the $1700 level. However, we turned around to rally rather significantly and it looks as if the market is ready to continue going higher. At this point, the market is likely to continue to see buyers jump in and based upon the reaction during the day, it certainly looks as if there are plenty of people willing to buy gold “on the cheap.”

I do believe that this is a market that will reach towards the $1750 level above, which is the top of the overall consolidation area. The market ended up forming a hammer, and that of course is one of the most bullish candlesticks out there. The $1750 level above is the beginning of resistance that extends to the $1760 level. It will be difficult to break above there, but once we do it is likely that the market will continue to go even higher, perhaps reaching towards the $1800 level which I believe is the longer-term target. If we can break above there, then it is likely that the market then goes looking towards the $2000 level which is a large, round, psychologically significant figure.

To the downside, if we break down below the bottom of the candlestick for the trading session on Wednesday, that would be a negative sign, perhaps reaching down towards the $1650 level and maybe even as low as the $1600 level given enough time. At the $1600 level, I would anticipate the 200 day EMA being close to their, so that of course will attract a certain amount of attention as well. At this point, I am very bullish of gold because of the precious metal trade and of course the fact that the central banks around the world continue to print money like it is going out of style. Furthermore, the fear trade is fully intact, as there is a lot of concern around the world with the coronavirus numbers, the slowing down of the global economy, and of course a whole host of other issues, not the least of which would be the US/China trade situation which looks to be getting worse. Ultimately, this is a market that I think will find a reason to go higher one way or another, even though the US dollar probably strengthens, as both can rise over the longer term despite what people will tell you.