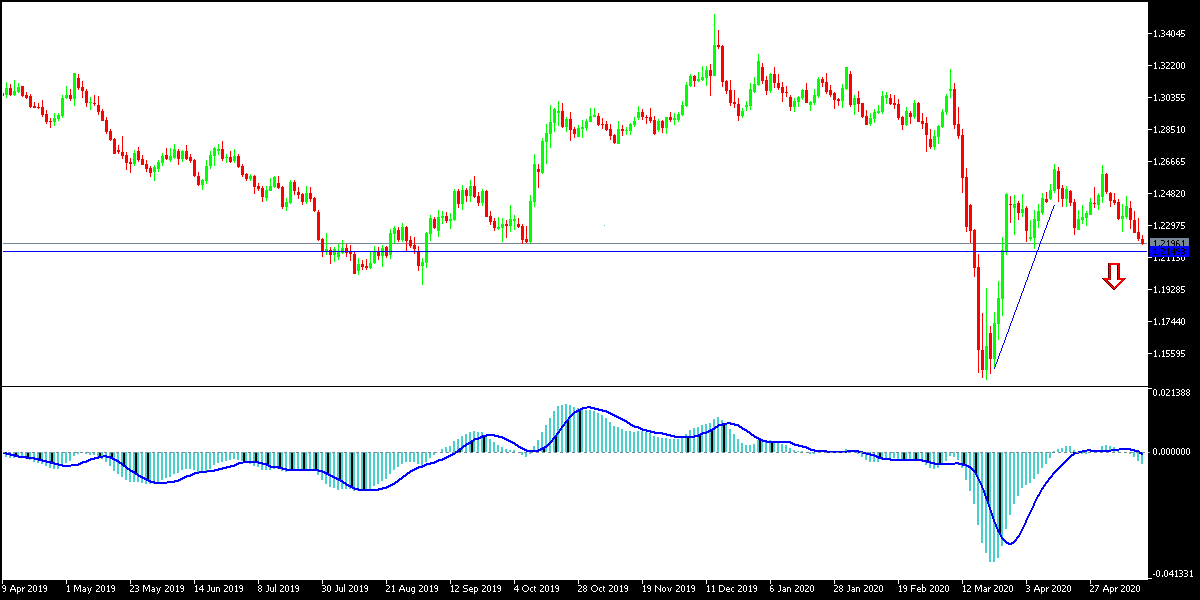

For the tenth consecutive day, the GBP/USD pair is in a strong downtrend, it pushed it towards the 1.2209 support, its lowest in more than a month, before settling around the 1.2233 level in the beginning of Thursday's trading. As I mentioned in the recent technical analyses, the sterling is still facing more pressure, which may motivate it to further collapse, and one of factors contributing to its losses is the economic weakness in the era of Corona. Yesterday's results came to confirm. On Wednesday, the UK government warned of a "major" recession after official figures showed that the British economy contracted by - 2% in the first quarter of 2020 although it only included one week of the economy closing to contain the coronavirus.

The National Statistical Office found that the recession was deepening at the end of the quarter, with production declining - 5.8% in March alone, the month in which the British government began imposing restrictions on daily life. Prime Minister Boris Johnson put the country in complete closure on March 23, days after bars, restaurants and schools were closed.

The March figures show the size of the future collapse of the coronavirus, with the Bank of England warning, for example, of the largest annual contraction since 1706. Commenting on the results, statistician Jonathan Atho said: “With the epidemic arriving, every aspect of the economy has been affected around March, pushing growth to a record monthly low”.

The quarterly decline is the largest recorded since the fourth quarter of 2008 at the height of the global financial crisis. Since 1955, when the records began, there were only four quarters worse. Like others, the British economy has been slumped into recession at unprecedented proportions, with many economists predicting that the second quarter could see economic output shrink by a quarter, or even more.

Last week, the Bank of England warned that the British economy could drop by about - 30% in the first half of the year, before a strong recovery in the second half of the year, leaving its size 14% smaller by the end of 2020. Even with this expected recovery in the second half, the annual decline will be the largest in more than 300 years. The British government hopes to be able to reopen large portions of the economy as soon as possible in order to reduce the scale of the recession. The depth of the slump - and the subsequent recovery - will depend on how long the closing procedures will remain.

According to the technical analysis of the pair: the performance of the GBP/USD was widely expected. Stability below the 1.2200 support will increase losses, pushing the pair to the 1.2000 psychological support, as the sterling still faces more risks, as aside of the economic weakness and the possibility of the country late abandoning of the closure policy, doubts remain about the post-Brexit future, as well as increased demand for the purchase of the US dollar as a safe haven. Gains will continue to be sold and the closest resistance levels are currently 1.2285, 1.2365 and 1.2500, respectively. Forex investors ignored the technical indicators reaching strong oversold areas.

With regards to the economic calendar data today: The pound will react to the comments of the Governor of the Bank of England Billy. During the American session, there will be the announcement of the weekly unemployed claims.