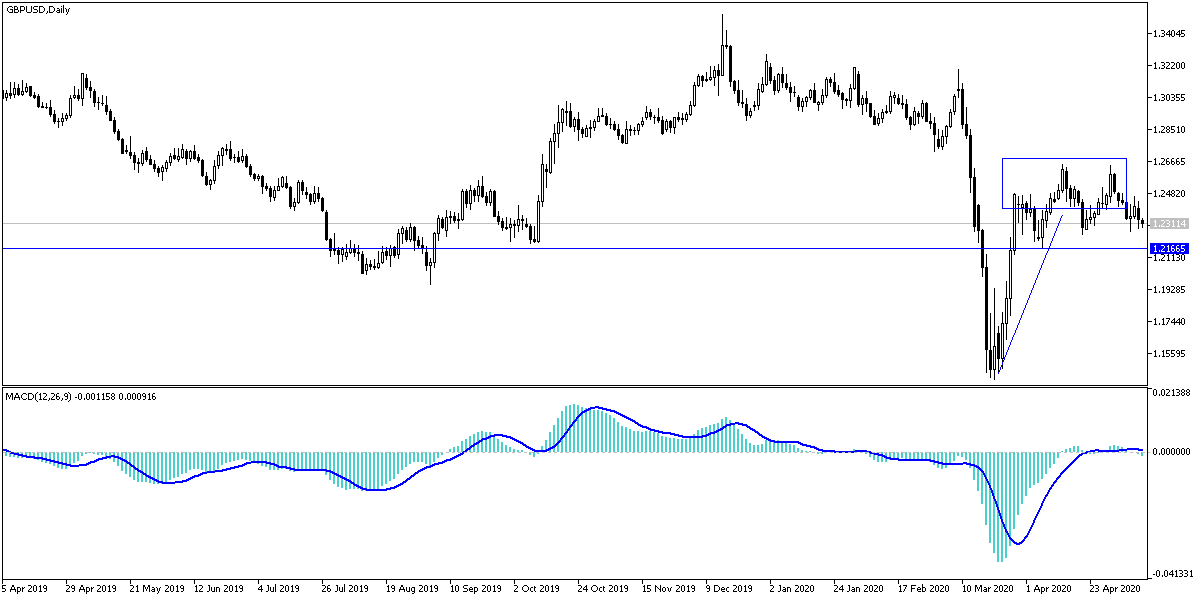

The GBP/USD currency pair failed again to correct upwards, as the pair tumbled in the beginning of this week's trading to the 1.2282 support after gains at the end of last week's transactions reached the 1.2466 resistance and settled around the 1.2335 level in the beginning of Tuesday's trading. According to what was reported in the pair’s recent technical analyses, gains will remain under pressure from many factors, foremost among which are the concerns of the Brexit negotiations and the renewal of the conflict between the two largest economies in the world, which will be a gain for the USD as a safe haven, alongside the UK’s lead in the European death toll from the Coronavirus and with cautious reopening of the British economy. Gains after the announcement of US job numbers evaporated quickly because markets were pricing them before the results were announced.

It seems that the British pound will remain under pressure during the coming days and weeks, as the British economy begins a long way to return to normal life compared to its counterparts from the global economies, where Prime Minister Boris Johnson said on Sunday night that it is likely that August is the nearest time that most of the economy will open again. Johnson added that it is too early to get rid of the shutdown completely as there is a possibility that coronavirus infection rates will begin to rise again, and a cautious approach is needed to restart the economy.

The cautious approach is likely to ensure the UK wins the medical battle against the Covid-19 epidemic, but for the services-oriented UK economy, the outlook is bleak as, the coming months will see millions of companies - small and large - driven to collapse. So the British economic recovery is likely to be U shaped, as it will be slow and protracted.

This will be important for the British pound, as the British economy is likely to outpace other economies that are emerging from closings in a more substantial and confident manner. In the coming weeks, the Forex currency market is likely to start shifting away from the bilateral “risk-on/risky-off” response to coronavirus and focus instead on the relative performance of post-closure economies.

“We expect that the main driver of the market in the coming weeks will be whether countries will succeed in their exit plans from the closure” said Athanasios Vampfakidis, strategist at Bank of America Merrill Lynch. “We know that the closure was bad for the economy, and therefore any openness must be positive. However, if infection rates begin to rise again, countries may have to go back and increase containment measures again. ”

According to technical analysis of the pair: Until now, the price of the GBP/USD pair, according to the performance on the daily chart, is still neutral, but with a more downward tendency, especially with stability below the 1.2320 support. With the control of the bears, we do not rule out reaching 1.2000 psychological support again, especially if the skirmishes between the two sides of Brexit increase, or negotiations become complicated between the two largest economies in the world. As I mentioned in recent analyses, the 1.2600 resistance will remain the beginning of stronger bull control over performance again. I still prefer to sell the pair from every upper level.

As for the economic calendar data: All focus will be on the announcement of US inflation figures, the consumer price index and the statements of some US Federal Reserve Bank members.