I still expect that the GBP gains will remain under the influence of the future negotiations between the two sides of Brexit and the economic situation as a result of the Corona epidemic. With investors recently taking on risk, gains of the GBP/USD pair increased to the 1.2642 resistance level, the highest for two weeks, before closing the week's trading around the 1.2492 level. The Bank of England will announce its latest policy decision and update its economic forecasts next Thursday at 07:00, earlier than usual, and markets will remain on the lookout for more details on the exit of the economic closure in addition to developments on Brexit negotiations via video conferencing. With fundamentals in the UK set aside, the price of the British pound will also be affected by investors’ risk appetite. The pound fell nearly 1 percent in the last session of the week after President Donald Trump's comments raised concerns about new trade tensions between the United States and China.

There is still scope for the Pound to continue its weak performance. This is with the United Kingdom lagging behind as global economies head towards opening up and abandoning closure policies. At the same time, the Bank of England is moving to expand its quantitative easing plans and the government is grappling with the UK exit file.

British Prime Minister Boris Johnson is expected to draw up a plan to lift the UK closure next Sunday, and details reported by the Telegraph newspaper at the weekend indicate that students in early years will be able to return to school from June 1. But it is not clear when non-core companies will be able to reopen for business, despite the possibility that any such date will be a few weeks after most other major European economies are reopened. Germany, Italy, Spain and France have all made plans that will see many restrictions eased this month, which will mark the beginning of their economic recovery, but the painful thumbs for investors will be the future of the Brexit dossier.

Fears renewed in the markets of a huge dispute between the United States of America and China, this time not because of trade, but because of the epidemic that paralyzed the global economy as a whole, as the US President, Trump, said he has a "high degree of confidence" that the coronavirus originates from the Wuhan Virus Institute. "We are looking exactly where it came from, where it came from, and how it happened," he added. Trump said that evidence to confirm his statements would be published in the near future, and if the matter was credible, we could see some notable geopolitical shifts as Western countries reformulate their relations with China. This is important for the British pound, as it continues to interact with broader market trends since the Covid 19 crisis took over market sentiment.

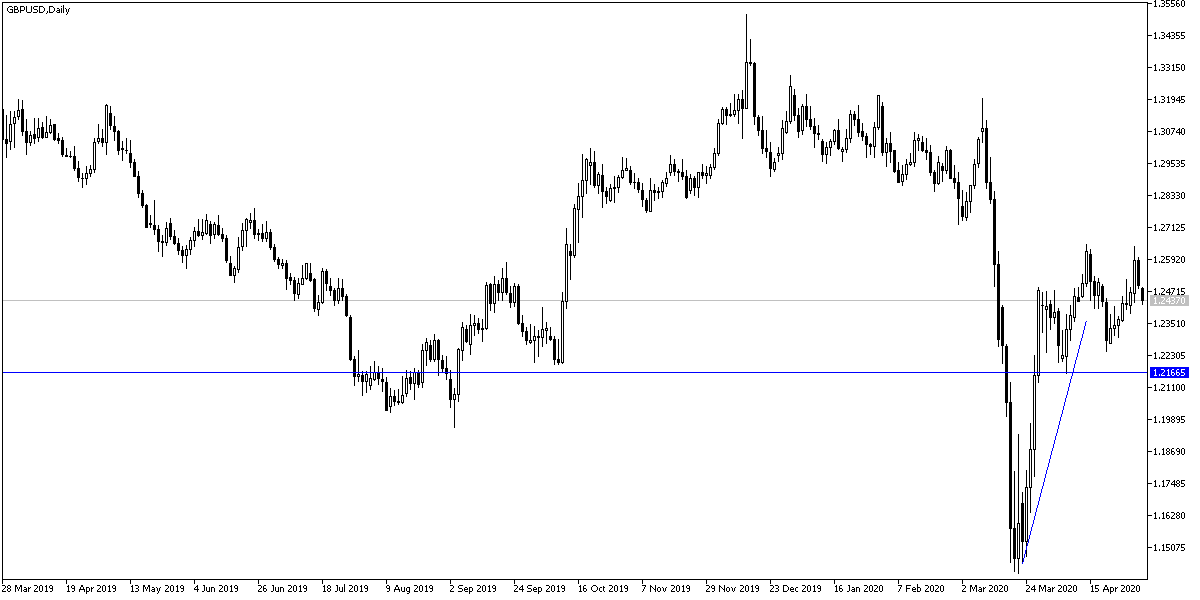

According to the technical analysis of the pair: the GBP/USD head and shoulders formation on the daily chart has been confirmed, and it represents technical pressure on any gains. The nearest resistance levels are now 1.2585, 1.2660 and 1.2720, respectively. Support at 1.2320 remains supportive for the bear's return to control.

There are no significant UK economic releases today. From the United States, factory orders will be announced.