As expected in recent technical analyzes of GBP/USD, the pair's bearish momentum may push it towards the 1.2320 support, which in turn may increase the pair's bearish momentum and pave the way for stronger support levels. In early Thursday trading, it fell back to 1.2310 support ahead of the Bank of England announcement of the monetary policy decisions. A new record reading for US jobless claims. Adding pressure to the GBP during yesterday's session was that stocks, commodities and other risk assets also fell after ADP numbers revealed the largest one-month drop in US payrolls. Meanwhile, the rise of US-China tensions at the forefront after Secretary of State Mike Pompeo reiterated the claim that there was "important evidence" that the coronavirus was leaked from a research laboratory in Wuhan, China.

Forex traders will be monitoring the Bank of England policy decision for May, as markets expect to see the interest rate steady at 0.10% and 645 billion pounds of QE without change. Investors, analysts and economists still widely expect BoE to add hundreds of billions to the QE program at some point, but even if it does not do so on Thursday, the bank is unlikely to show any support for the British pound.

The BoE will announce its policy decision list earlier than usual at 07:00, while the press conference will take place two hours later at 09:30. Markets will watch with interest the new set of forecasts to be issued by the Central Bank. The more the Bank of England and its new governor, Andrew Pelly, emphasize inflation risks, the more the market will suspect that the weakening of the British pound will be good for UK policymakers.

The Coronavirus crisis placed exceptional demands on Britain’s public treasury which were unprecedented in the modern era and at a time when the government balance sheet was less able to absorb the relevant increases in government debt, so much that investors fled the bond market in March, prompting the Bank of England to intervene with an additional 200 billion pounds of quantitative easing and subsequently agree to an unlimited extension of the overdraft from the bank's HM Treasury.

The same applies to most other countries affected by the virus, although it is the UK and the sterling that have the largest current account deficit in the developed world when imbalances in percentages of GDP are measured. This deficit makes the British pound dependent for a portion of its value on the continued inflows of foreign capital that could be deterred by the credit risk arising from government borrowing along with the rate hike by the Bank of England.

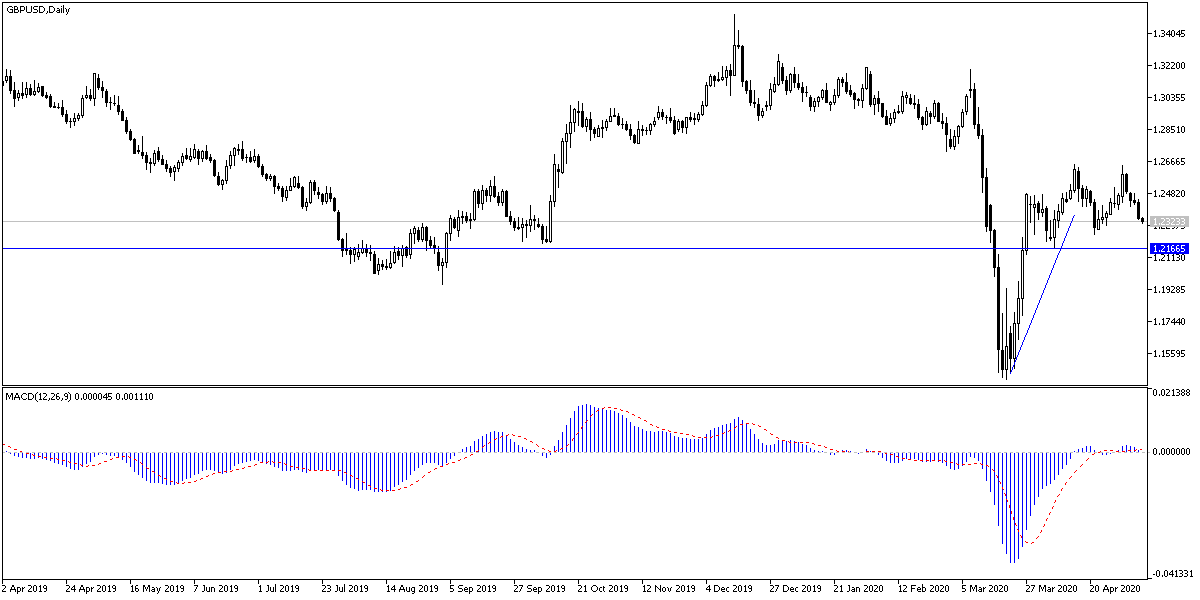

According to the technical analysis of the pair: On the GBP/USD daily chart below, it seems clear that a break of recent bullish channel, and this break confirmed the head and shoulders formation, which supported technical sell-offs that pushed it to the threshold of 1.2300 support. The closest support levels for the pair are currently at 1.2245 and 1.2180 respectively . On the other hand, to return to the bullish channel, it is necessary to return to the vicinity of the 1.2600 resistance again.

As for the economic calendar data today: The beginning will be with the Bank of England's announcement of monetary policy, the content of the British inflation report and the update of economic forecasts. From the United States of America, claims of unemployed and non-farm productivity data will be announced.