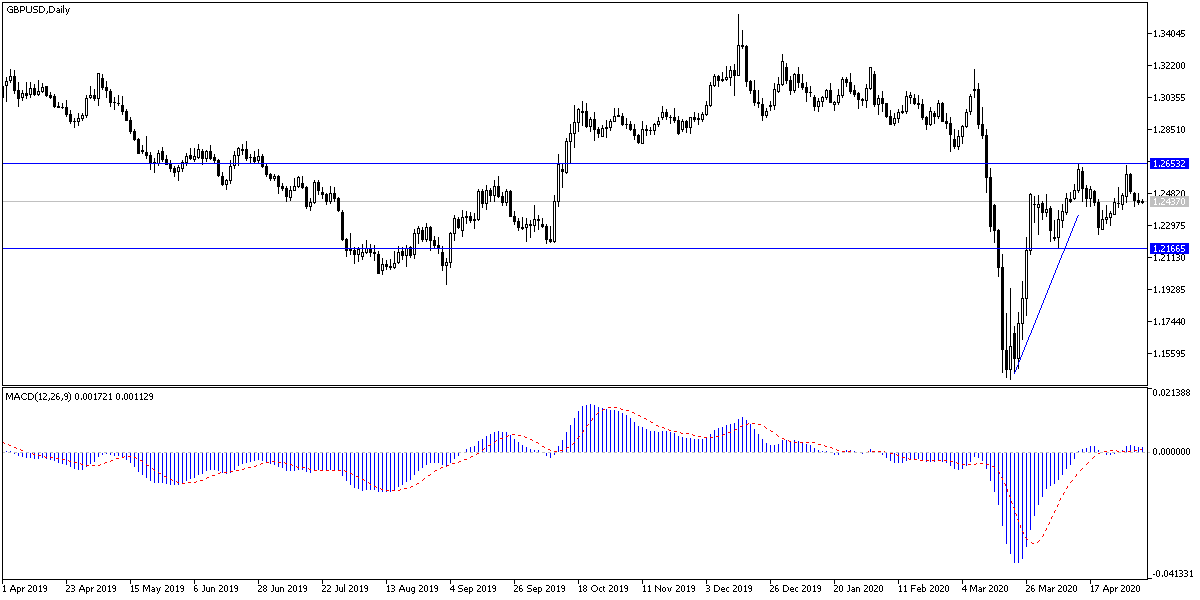

During yesterday's trading, we did not witness a significant move for the GBP/USD pair, as the movement was in the range of 1.2420 and 1.2483 levels and began today’s trading around the 1.2444 level. This cautious performance confirms the pair's wait for the Bank of England monetary policy decisions and details of important US job numbers during Corona crisis era, which caused the loss of millions of jobs. Investors' risk aversion will not be in the interest of the British pound.

On economic news: Final survey data from IHS Markit showed that the UK service sector shrank sharply in April as emergency public health measures to eradicate the coronavirus epidemic affected business activity. The UK Services PMI fell to 13.4 in April from 34.5 in March. The expected reading was 12.3. Two months ago, the survey's lowest record level reached 40.1 in November 2008. The latest data indicated a survey record for new work, accumulation and employment across the service economy. In addition to the downward pressure on sales, new business from abroad declined in April. A combination of lower salary costs, fuel prices and office overheads has resulted in lower average cost burdens for the first time since the survey began in July 1996. At the same time, the average decrease in average fees has been the fastest in the survey historically.

The US service sector was not far from falling apart. As the US services sector contracted for the first time since December 2009 in April. ISM said its non-manufacturing index fell to a reading of 41.8 in April from 52.5 in March, and any reading of the index below the 50 level indicates a contraction in service sector activity. The non-manufacturing index fell to its lowest level since it reached 40.1 in March of 2009 but is still above economists' estimates with a reading of 36.8.

A note by economists at the Oxford University of Economics indicated that the index would have fallen further had it not been for the record rise in the supplier delivery index due to supply chain turmoil. The report said that the supplier delivery index rose to a record level of 78.3 in April from 62.1 in March. Economists at Oxford Economics University said that “the overall non-manufacturing conditions are dire, as business and employment have fallen to record low levels while new orders indicate sparse activity in the future.” .

The sharp drop in the main index came as the business activity index decreased to 26.0 in April from 48.0 in March and the new orders index decreased to 32.9 from 52.9. The employment index also showed a decrease to 30.0 in April from 47.0 in March, indicating that employment in the services sector contracted for the second consecutive month.

According to the technical analysis of the pair: A neutral performance of the GBP/USD pair on the daily chart, with a downward slope, may strengthen in the event of movement towards the 1.2320 support because it will confirm breaking the general downtrend. Head and shoulders formation on the daily chart still presses any gains for the pair. Therefore, selling may be preferred if the pair moves towards the resistance levels of 1.2535 and 1.2660, respectively. As I mentioned earlier, I now confirm that fears of the Brexit negotiations and the British economic situation in the Corona era will continue to support the dollar as a safe haven.

As for the economic calendar data today: From Britain, the construction sector PMI reading will be announced. From the U.S, the ADP measure of change in the number of non-farm jobs will be announced.