Abandoning the US dollar as a safe haven amid improved financial market gains and investor’s risk appetite brought the GBP/USD an opportunity to bounce back up to the 1.2362 resistance, the highest level for two weeks, before settling around the 1.2330 level in the beginning of today’s trading. The risk assets rose and the dollar, the yen and the franc fell in along with improved market sentiment as investors showed increased confidence that the global economy is emerging from strict closures imposed by the rapid spread of the Coronavirus. The US dollar maintains its inverse relationship with global investor sentiment, due to its position as a safe haven and its role as a global reserve currency, as it tends to rise when markets sell and falls when they rise.

State-run media reported yesterday that Chinese President Xi Jingping told the military to increase training and war preparations at the last leg of the 2020 NPC meeting. The call came amid ongoing talk of war with the United States, regarding the outbreak of the Coronavirus and China's attempt to give Mainland security services a greater role in the work of Hong Kong police, which rekindled pro-democracy protests this weekend.

A draft decision by the Chinese authorities was making its way through the Chinese parliament on Tuesday, but it could risk a "strong" response from the United States, with some officials saying it could include sanctions against both China and Hong Kong, which could threaten the city's position as a prominent financial center in Asia.

Economists believe that the escalation of tension between China and the United States poses a negative threat to the global economic recovery after Covid-19. They note that China's purchases of American goods are far behind the obligations of the Phase 1 trade deal. Tacitly, China will need to more than double most imports from the United States this year.

All of this happen barely more than a week after China imposed tariffs on a group of Australian exports in clear retaliation for Australian campaign to conduct a global investigation into the Coronavirus, which causes pneumonia, which infected 5.5 million globally until yesterday. Tensions between China and other countries can spoil the optimistic mood, but for the time being at least, investors have chosen to celebrate the gradual opening up of major economies.

The DXY dollar index has fallen more than 1% for this week while Sterling and Euro currencies are up 1.6% and 0.7%, respectively. This comes after Prime Minister Boris Johnson set plans to loosen modest "closure" restrictions, but gradually, from June 01, amid reports that the European Union will reduce its ambition to maintain the status quo on fishing rights in Brexit talks.

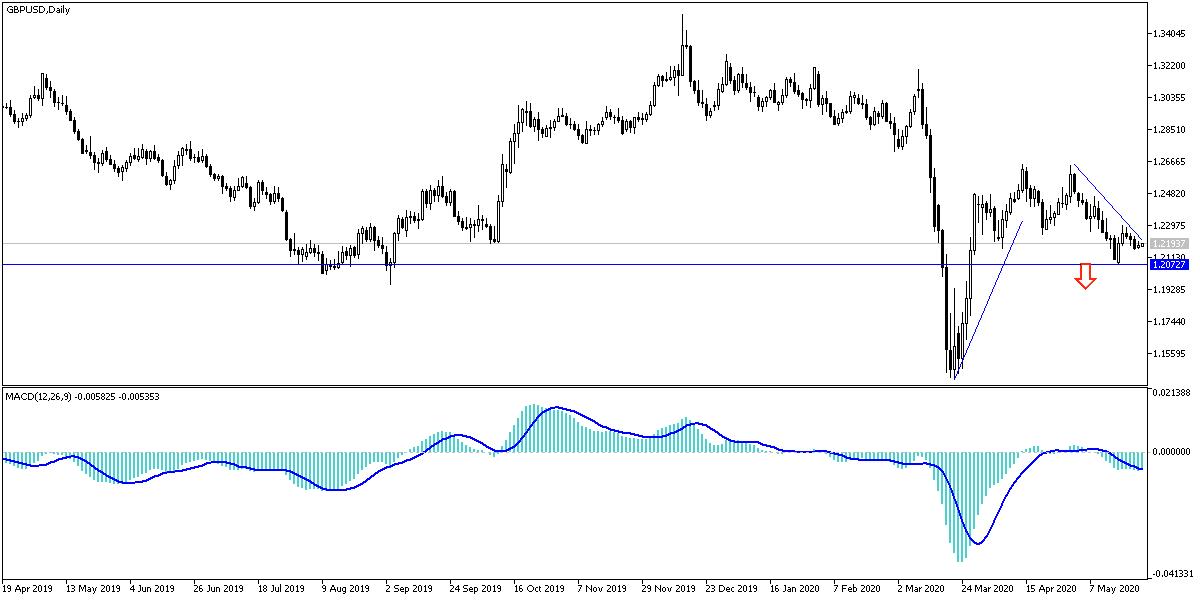

According to the technical analysis: On the GBP/USD daily chart, there is a beginning of a break of the last downward channel that the pair formed from the end of April. The pair still needs to test stronger resistance levels to confirm the opposite trend, which are 1.2395 and 1.2475, respectively. I still prefer to sell the pair from every higher level, as Brexit problems will not end and the eradication of the Corona epidemic is still months away. On the downside, the support the 1.2245 support is a return to the downside path again.

Today's economic calendar has no important economic releases, whether from Britain or the United States of America.