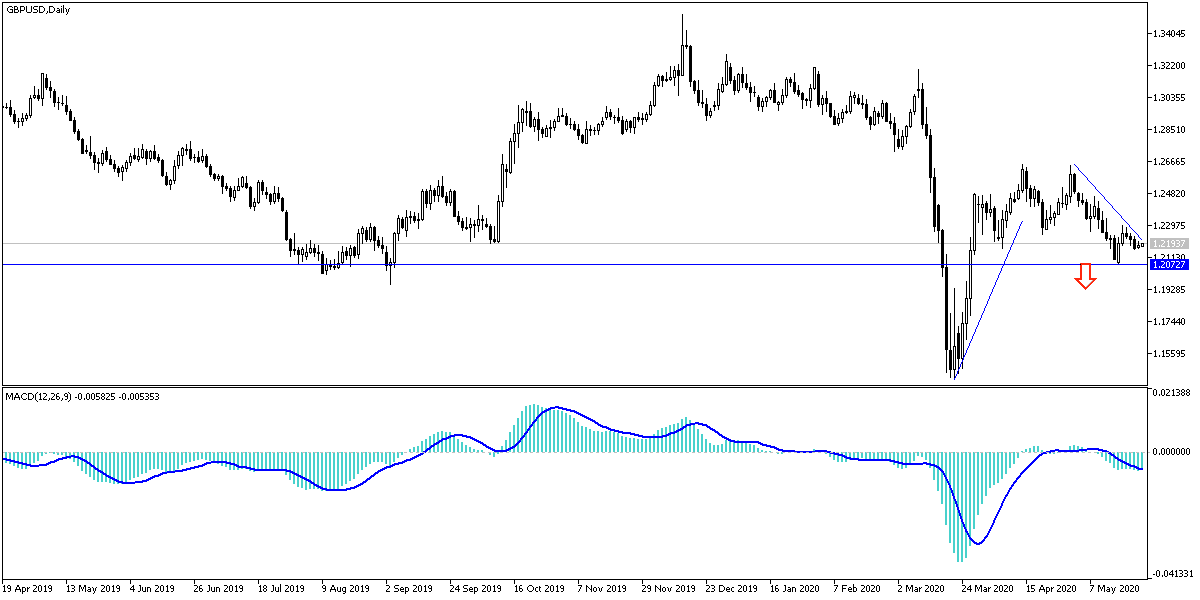

For five consecutive trading sessions, the GBP/USD pair has been moving in a very limited and narrow range with a downtrend, and this performance technically foreshadows a strong movement coming in either direction. The holiday in early trading this week in Britain and the United States of America was a strong contributor to the weak liquidity in the markets. The pair is settling around the 1.2240 support at the time of writing. In light of the British government's efforts to counter the effects of the Coronavirus, the government softened its plan last week to reopen schools as of June 1 after 13 local councils controlled by the opposition party refused to reopen them. The government's plan to reopen didn’t ease the widespread safety concerns that are being exploited, so the country will find itself in a situation where many schools can remain closed until September, at the same time as economies are reopening elsewhere in Europe and the world.

Regarding British monetary policy. Two BoE policymakers, the bank’s chief economist, and even the governor himself appeared last week, all appearing to be keen to confirm that below zero interest rates are already part of the bank’s toolbox and that they have not been excluded for the coming months. Interest rate pricing was referring to a negative base rate for the Bank of England from mid-2021 early last week, but it has shifted to mean that government borrowing costs will be below zero by November 2020. This has negatively affected the British pound already and could continue as it is with the approach of the Bank of England monetary policy decision on June 18.

This decision coincides with the European Council meeting from 18 to 19 June, which could see Prime Minister Boris Johnson away from the negotiating table, at least for a while. All of these factors are sufficient to keep the British Pound under constant pressure for a longer period.

Local criticism of Boris Johnson government has increased recently. As the Prime Minister Assistant insisted that he would not resign because of his long-distance drive in England while the country was under strict ban - a trip he made without first informing the Prime Minister. So the government faces a wave of anger from politicians and the public over the discovery of Dominic Cummings 'travel more than 250 miles (400 km) from London to his parents' home, northeast England, at the end of March. Cummings says he has traveled so the family can take care of his 4-year-old son if he and his wife, who are suspected of contracting the Coronavirus, are infected, and say the three remain in isolation in a building on his father's farm.

"Of course, I regret the confusion, anger, and pain people feel," Johnson said at the government's daily press conference. "That is why I wanted people to understand exactly what happened." The Johnson government faces criticism for its response to a pandemic that hit Britain more than any other European country. With the official death toll in Britain from the Coronavirus reaching 36,914 people, it is the second highest confirmed total in the world after the United States of America.

According to the technical analysis: On the GBP/USD daily chart, the general trend is still bearish and the bears are still targeting the 1.2000 psychological support to confirm control for a longer period. As I mentioned before, I now confirm that there will not be an opportunity to break the current descending channel without breaching the 1.2393 resistance, and this may happen only if positive signs appear for the Brexit future and the number of British infections and deaths from the Coronavirus is limited.

For the second consecutive day, the economic calendar has no significant British economic data. from the United, Consumer confidence and new home sales numbers will be announced.