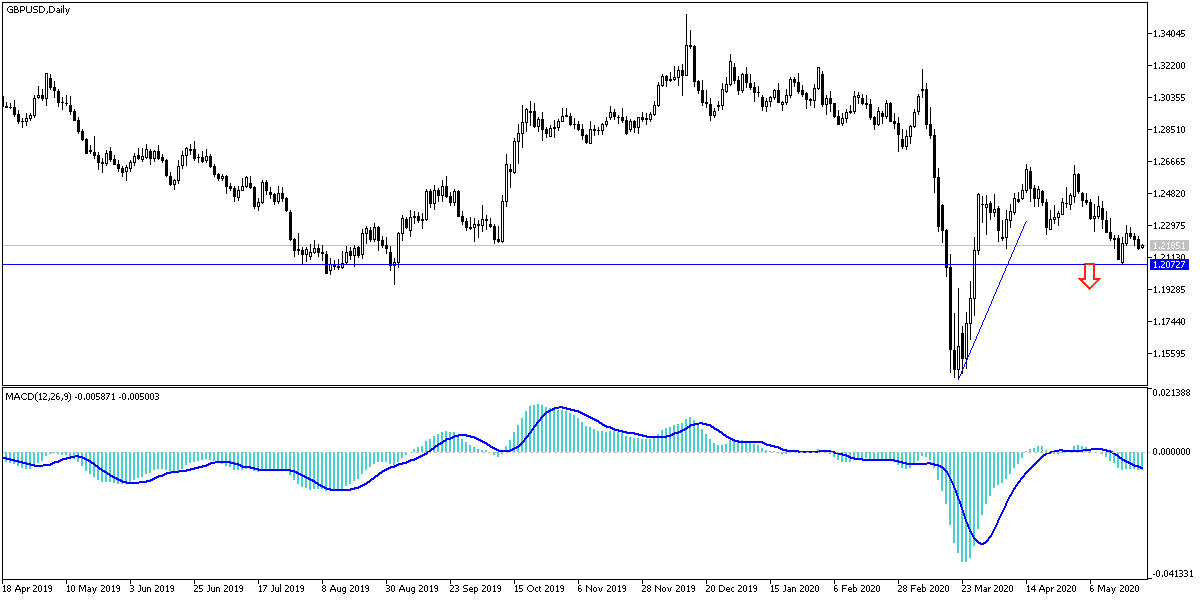

The GBP/USD pair has returned to move within the descending channel, with losses that reached it to the 1.2161 support, where the pair is stable around the time of writing, and at the beginning of this week's trading. Attempts to for an upward correction during last week's trading did not exceed the 1.2296 resistance. Expectations of negative interest rates approval by the Bank of England, are the nearest of multiple pressure factors, which brought the Sterling more losses. In this regard, BoE Deputy Governor Dave Ramsden supported taking interest rates to negative territory, and retail sales in the country dropped at a record pace in April due to closures to contain the spread of the Coronavirus.

Data from the Office for National Statistics showed that the volume of retail sales in Britain fell - 18.1 percent on a monthly basis, the largest monthly drop ever. Economists had expected sales to drop - 16 percent, after falling - 5.2 percent in March. Excluding auto fuel, retail sales fell by -15.2 percent on a monthly basis in April, more than economists' expectations of 15 percent and a drop of 3.8 percent in March. On an annual basis, retail sales volume fell by -22.6% compared to March's decrease of -5.8% and economists' expectations of -22.2%. Excluding auto fuel, retail sales fell by -18.4% in April after falling 4.2% in March. Economists had expected a decline of 18.2 percent.

In a separate statement, the Office for National Statistics said that the British budget deficit widened to a record in April due to the unprecedented increase in borrowing by the government amid the Covid-19 pandemic. In April, net public sector borrowing excluding public sector banks reached 62.1 billion pounds, an increase from 51.1 billion for the same period last year. This was the highest borrowing ever.

Ramsden told Reuters that there are negative risks to the post Covid-19 recovery and the real expectations of the economy may be worse than the bank had imagined. So the BoE Deputy Governor said that he is open to pushing the key interest rate below zero. Ramsden noted that the Bank of England still has "too much room" to buy more bonds.

The economic and political headwinds led to a sharp drop in the price GBP/USD during May, and the bad news continues to flow heavily and quickly. The British pound will enter current week as the British government worries about the controversy, and investors are likely to fear another clash between the United States and China due to new protests in Hong Kong this weekend that led to clashes between demonstrators and the authorities. All of these factors will support investor risk aversion, thus further reducing the price GBP/USD.

According to technical analysis: The GBP/USD pair has returned to move within its declining channel that was formed since the end of April, with the pair abandoning the 1.2642 resistance. The last correction may support the pair to move towards the 1.2000 psychological support, which confirms how strong the bears control is. There will be no opportunity for the pair to start higher again without crossing the 1.2393 resistance as shown on the daily chart below, and in general I still prefer to sell the pair from each higher level.

In light of an American and British holiday today, we expect quiet moves for the pair throughout the todays’ trading.