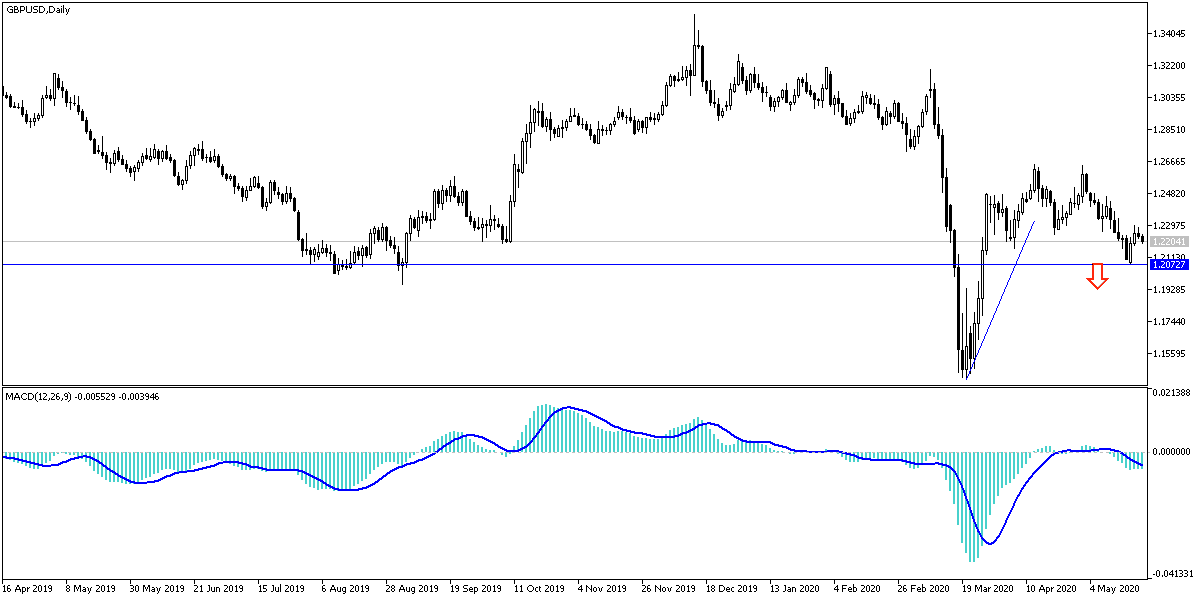

The GBP/USD is trying hard to avoid a breakdown below the 1.2200 support so that technically hopes of completing the upward correction does not evaporate. The bears return to control performance as is the case in the long run. Recent gains stopped at 1.2296 and settled around 1.2240 at the time of writing. Indeed, the pair needs a miracle to avoid new losses in the coming weeks, which confirms the validity of our permanent expectations of selling the pair from each upper level. The pound was the least profitable among other major currencies, despite the optimism that prevailed in the markets recently. The Japanese Yen and Swiss Franc rose 0.31% and 0.61%, respectively, during the last trading session. The Canadian dollar linked to oil also rose 0.40%, while the Australian and New Zealand currencies, the most affected by China, rose by 0.86% and 1.01%, respectively.

The USD fell amid investor risk appetite, amid hopes of finding a vaccine to counter the Coronavirus soon. Sterling's poor performance was evident both before and after BoE Governor Andrew Bailey told the Treasury Committee he had changed his views on negative interest rates and would not rule out resorting to them in the future. Pelly appeared in Parliament hours after the Debt Management Office sold UK government bonds at a negative interest rate for the first time, a move that came after two-year UK bond yields fell to below zero last week. This also comes days after Bank of England chief economist Andy Haldane stated that the bank still considered negative interest rates as part of its toolkit.

The US dollar came under pressure over expectations that investors were betting that the Federal Reserve will resort to negative interest rates in the next year, at a time when it witnessed implicit interest rates for other countries, including the United Kingdom, which begins to suggest that negative rates was possible for them. Since then, the market has moved from pricing a mid-2021 shift to negative sterling prices, to December 2020 falling below zero.

Much of the price action this week was driven by the hope that a vaccine to tackle the Coronavirus will be available soon, but attention has shifted from this optimism to focus on the resurgence of increased tensions between the United States and China due to routine trade issues between them as well as more new complaints about the Chinese government's handling of the first outbreak of the coronavirus.

According to the technical analysis of the pair: The GBP/USD gains are still a selling target as we emphasized in previous technical analyzes. Therefore, the resistance levels at 1.2320, 1.2400 and 1.2485, respectively maybe reached for this to happen. Restoration of stability below 1.2200 support may support move towards next psychological support at 1.2000 soon. The pressure factors on the pound continue and are increasing, which weakens investors' appetite for the GBP on the long run.

As for the economic calendar data today: The pair will first react to the announcement of the PMI reading for the important industry and services sectors in the UK. US session data contains the announcement of unemployed claims, the Philadelphia Industrial Index, the Manufacturing PMI, existing US home sales and later statements by Federal Reserve Governor Jerome Powell.