As expected a lot, Sterling gains will remain a selling target, and after two trading sessions in which the GBP/USD witnessed an upward correction that contributed to the pair's rebound towards the 1.2296 resistance, the pair returned to stability around the 1.2240 support in the beginning of trading today, and before the announcement of British inflation figures. The cable gained momentum from improved moods in the market in response to signs of progress towards a vaccine for the Coronavirus, and besides, investors reacted positively to the comments of Federal Reserve Chairman Jerome Powell, through which he sought to reassure the world about the future of the US economy in the Corona era. Although it is not clear that the vaccine will come in numbers large enough and close enough to make a difference in the timetable for reopening the global economy, optimism has contributed to stronger gains for global stock markets, commodity prices and currency exchange rates that correlate with investor willingness to take risks, including sterling.

Returning to British affairs. The Bank of England policy could affect the pound in the future, but Brexit will also return to the forefront as a strong influence, as the UK is still on its way to be the last major economy to actually emerge from the internationally followed closure to contain the rapid spread of Corona, which It could make the UK economically far behind in comparison to the rest of the developed world. So far, there has been "limited progress" that resulted from Brexit's trade talks with one other round before the deadline that will see Prime Minister Boris Johnson choose between the request to extend the transition period or abandon the talks altogether in favor of renewing preparations for the "No-deal" Brexit after the end of 2020.

On the economic side. Unemployment claims in Britain jumped by 69% in April, as the "Covid19" epidemic dominated the labor market, and in this context, the National Statistics Office announced that unemployment claims increased from 856000 claims to 2.1 million in April compared to the previous month. Commenting on this, Jonathan Atho, deputy chief of statistics, said the figures covered only the first weeks of the closure.

"In March, work continued to do well, as unidentified workers were still counted as employees, but hours of work decreased sharply in late March, especially in sectors such as hospitality and construction," he added.

In this regard, Minister of Labor and Pensions, Therese Covey, told BBC that the government is focusing on those who claim benefits under universal credit, which are care payments for those who need help, including the unemployed. "I think so far that the employment statistics really point to the end of March and we will not have a more detailed understanding until another month," she said. And "Currently, Universal Credit Prosecutors are the place where we focus our attention."

British Prime Minister Boris Johnson has come under heavy criticism for his handling of the coronavirus crisis, and as with US President Donald Trump and his pre-election tactics for dealing with China, the prime minister may now feel compelled to retreat to a hardline stance on trade talks for domestic political reasons. A request to extend the transitional period, in contradiction to electoral pledges and often repeated speeches, may be more difficult and less palatable as a political option – which is a serious risk to the British pound.

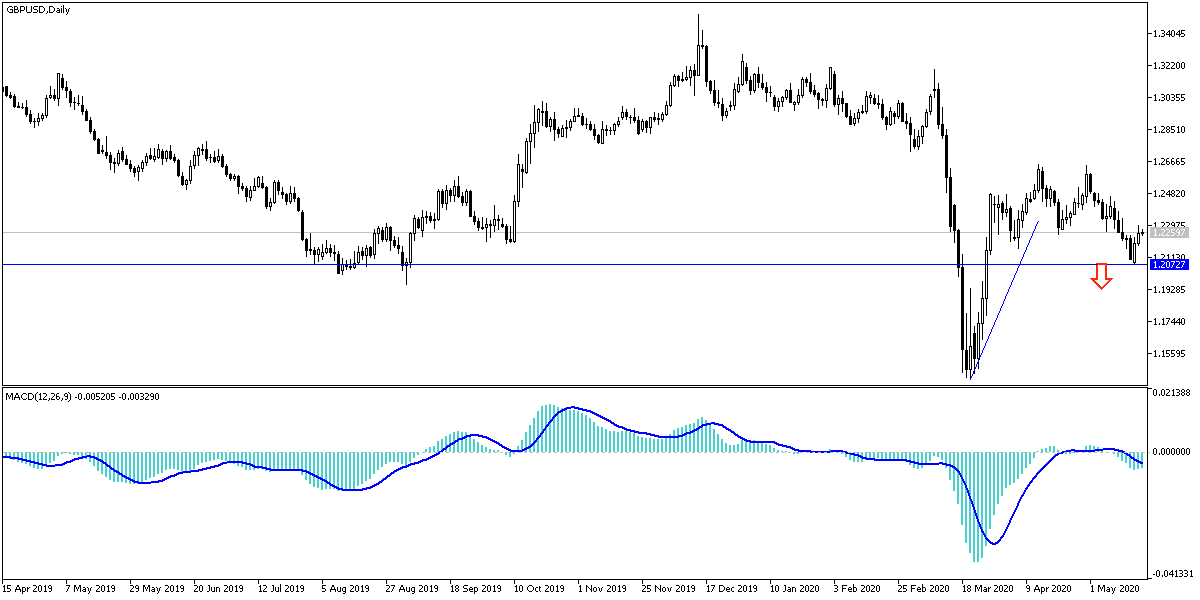

According to technical analysis: On the daily chart, gains of the GBP/USD pair are still not up to the strength of the bullish correction. The path inside its descending channel is still the strongest. Emphasizing on the factors identified before, gains will remain a selling target, with the closest resistance levels for the pair are currently 1.2320 and 1.2400 respectively. Returning to stability below 1.2200 may support the strong expectations again of reaching the 1.2000 psychological support at the earliest time.

As for the economic calendar data today: From Britain, inflation figures, consumer price index and producer prices will be announced, and later there will be statements by the Governor of the Bank of England. From the United States, minutes of the last meeting of the American Central Bank will be announced.