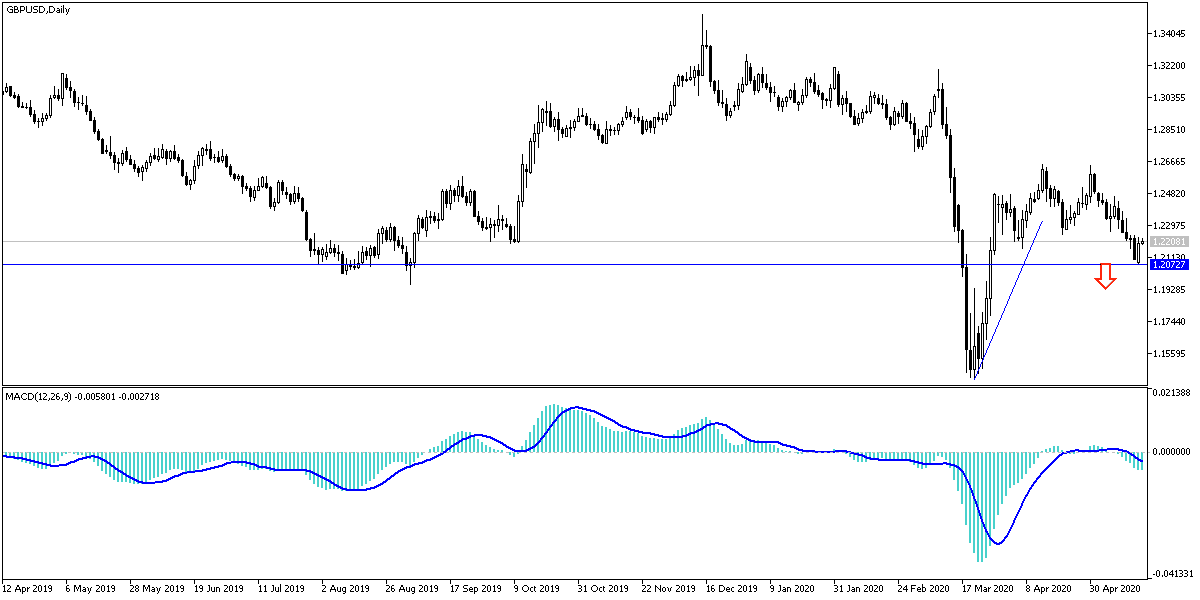

The risk appetite increased after Jerome Powell's optimistic statements, which contributed to cautious gains for the GBP/USD pair, reaching the 1.2227 resistance after stronger losses in the beginning of this week’s trading, reaching the 1.2073 support, the pair's lowest level for nearly two months. The pair is holding around the 1.2190 level at the time of writing, and ahead of the announcement of the British jobs and wages figures. Markets suffered a recession in most of May, a scenario that allowed issues related to Brexit trade negotiations and expectations of the Bank of England policy, to control the performance of the pound and exert negative pressure against most other major currencies.

However, the rebound in the global stock markets at the beginning of this week eased some of these negative forces and allowed the pound to benefit from the recovery experience.

Economists argue that the imminent easing of closures across the United States and Europe continues to provide a source of optimism and anxiety alike given the potential effects, if they work or not. Nevertheless, Jerome Powell's hints calm the markets and investors, regardless of the outcome of the impending closure-easing policies. Both Powell and Lagarde are leading the approach of appeasement by emphasizing that "all it takes" can be done to deal with this crisis.

In this context, Andy Haldane, chief economist at the Bank of England, said before opening the foreign exchange markets that more easing measures - including negative interest rates - could be taken to ease the economic recession caused by the Coronavirus pandemic. Haldane's comments come a few days after the bank's deputy governor for monetary policy, Ben Broadbent, discussed the matter, indicating that a cut in interest rates below zero may be the focus of attention for the Bank of England's monetary policy committee. Haldane said that negative interest rates were not an ideal result, but he failed to exclude them, which led to a depreciation of the pound as a result.

In general, low interest rates are important to the British pound, as the return provided by financial assets in the UK has historically attracted large inflows of foreign capital. The lower the interest rates at the Bank of England, these assets become less attractive to foreign investors, which in turn affects demand for the British pound.

According to the technical analysis of the pair: Despite the GBP/USD gains, the general trend is still bearish and the pressure factors that we mentioned previously remain a constant threat to any gains for the pair. These factors include Brexit negotiations, British economic performance in the Corona era and stimulus plans. Besides the renewed conflict between the United States and China. The closest resistance levels for the pair are currently 1.2265 and 1.2320, while the 1.2000 psychological support will continue to be a legitimate target for the bears.

As for the economic calendar data today: From Britain, jobs and wages figures will be announced. During the American session, building permits and US housing starts will be announced. Later, will be an important testimony by Federal Reserve Governor Jerome Powell.