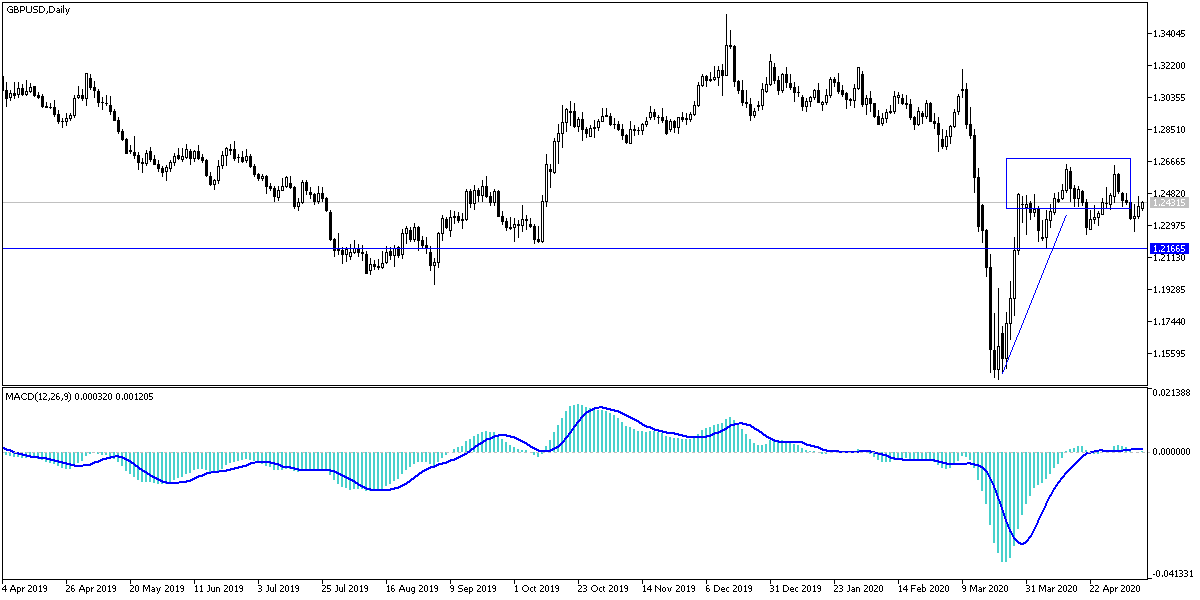

The downward pressure on the GBP/USD pair during last week's trading pushed it towards the 1.2265 support, the lowest for two weeks, and at the end of the week's trading, the pair got the momentum for a bullish correction with gains that reached the 1.2466 resistance, after announcing the alarming numbers for the American labor market, which confirms the greater economic impact from Coronavirus. The cable did not find additional momentum to complete the correction, and accordingly, the drop returned to the 1.2385 support at the beginning of this week’s trading. The cable is under technical and economic pressure, preventing stronger gains.

The pound did not react much to UK Prime Minister Boris Johnson's announcement of a modest easing of the country's coronavirus closure, as he outlined the "road map" on how to lift additional restrictions in the coming months. In a televised speech to the nation, Johnson said that people with jobs that cannot be done from home will be encouraged to return to work, saying, "This is not the time, simply, to end the closure this week." He said it would be "crazy" to loosen restrictions so dramatically that a second boom would emerge in cases.

"We must continue to control the virus and save lives," Johnson added. "Yet we must realize that this campaign against the virus has cost the country a tremendous bill."

On the American side. Looking at the weekly jobless claims numbers, PMI and ISM, ADP report, and other important economic releases, a record loss of more than 22 million jobs will not be surprising even if the numbers are shocking. There is no doubt that the United States is shrinking sharply, and the job market is in a free fall. Nearly 33.5 million Americans have applied for unemployment benefits in the past seven weeks.

The risk assets, including the sterling and the weak dollar, were strengthened after US and Chinese officials confirmed that they were on their way to implement the Phase1 deal that was concluded last January, which weakened previous fears about a possible new bout of tensions between the two largest economies in the world, and investors abandoned the dollar also after increasing expectations that the Federal Reserve will have to work with negative interest rates to face the current economic downturn.

Sterling's gains were limited after being affected by expectations that the Bank of England will increase the size of its quantitative easing program in June, as well as new concerns about the lack of progress in Brexit’s negotiations.

According to the technical analysis of the pair: The charts still confirm the continuation of the bearish technical pressure for the GBP/USD pair with the support of the head and shoulders formation, which is apparent on the daily chart below. The 1.2320 support still supports the bear's control of the performance, and its breaking below it will push the pair stronger support, including 1.2280 and 1.2190, then the 1.2000 psychological support, respectively. On the upside, there will be no real opportunity to eliminate the head and shoulders formation without breaking the 1.2600 resistance again.

In light of an empty economic calendar, the pair will have more influence in the future of the Brexit negotiations and reaction to the US job numbers.