With UK businesses slowly returning to an adjusted economic and social environment, the realization that a slow recovery lies ahead positions companies, consumers, and the government to plan accordingly. Hopes of a V-shaped recovery are fading quickly globally, allowing for sustainable measures to be implemented. The most significant threat remains a new infection wave over the summer months, as many countries attempt to rush the reopening process. Prime Minister Johnson urged patience, which may lead to a delayed recovery, but a more massive and sustainable one. Rising bullish momentum in the GBP/USD is anticipated to lead to a renewed breakout sequence.

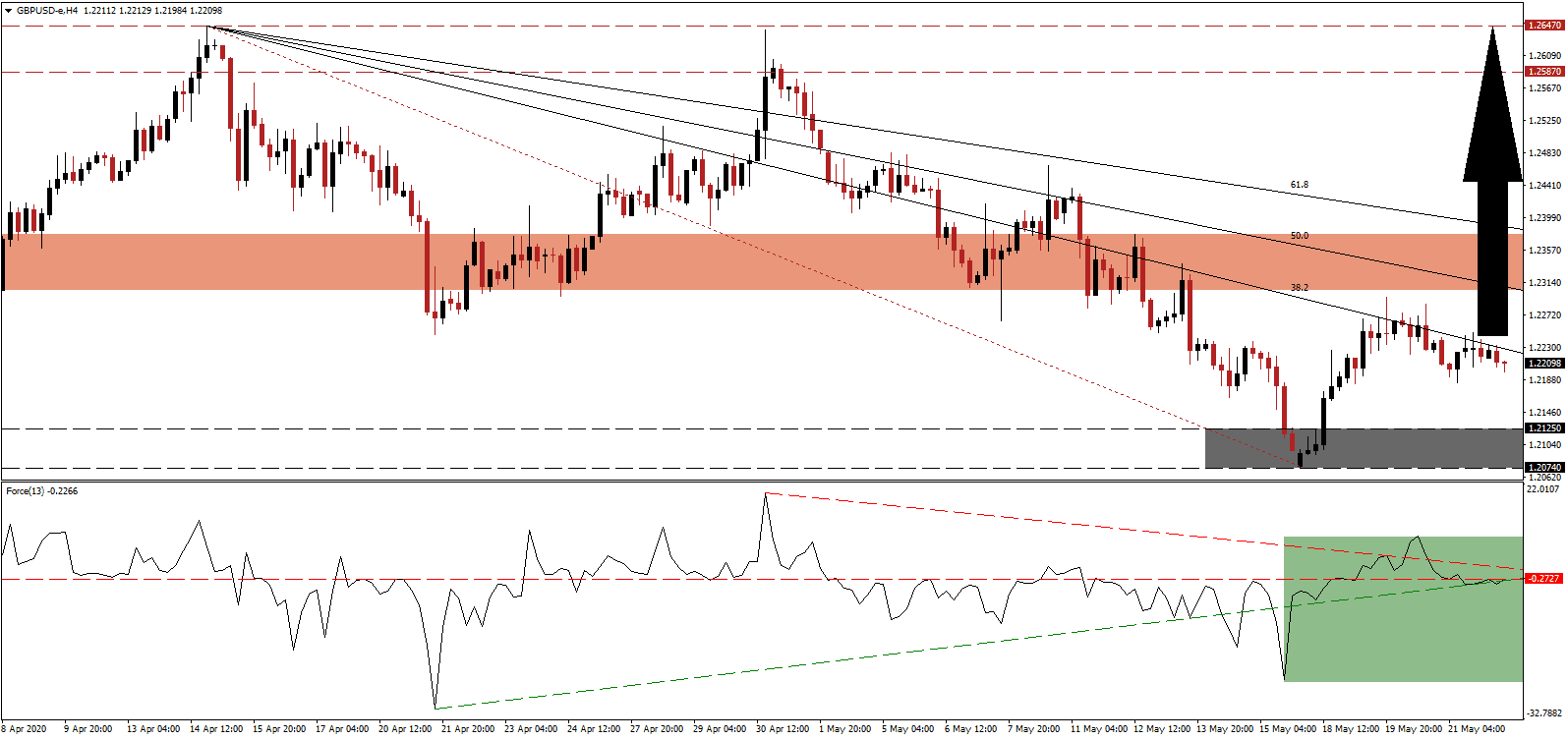

The Force Index, a next-generation technical indicator, recovered from its lows but has since reversed below its horizontal resistance level, as marked by the green rectangle. The bullish momentum was able to stabilize after reaching its ascending support level and is now expected to accelerate through its descending horizontal resistance level. This technical indicator is on the verge of crossing into positive territory, which will grant bulls control over the GBP/USD.

According to the UK’s Office for National Statistics, hotels and restaurants reported the highest number of reopenings in May, followed by construction and manufacturing. A slow and sustainable recovery, ensuring healthy consumers, is more favorable than the increasing potential of a double-dip recession or W-shaped recovery. The breakout in the GBP/USD above its support zone located between 1.2074 and 1.2125, as marked by the grey rectangle, was temporarily paused by the descending 38.2 Fibonacci Retracement Fan Resistance Level. It expresses a necessary development, keeping the bullish bias intact before a more massive push to the upside materializes.

US initial jobless claims remain dangerously elevated, and the increase in continuing claims points towards more extended joblessness. Nearly 40 million Americans lost employment since March, and while optimism is elevated, a new study suggests 42% represent permanent job losses. Many consumers have not yet realized the severity of the Covid-19 pandemic, mirroring complacency by politicians. The GBP/USD is well-positioned to spike into its short-term resistance zone located between 1.2305 and 1.2377, as identified by the red rectangle. Given ongoing fundamental progress, an extension into its resistance zone between 1.2587 and 1.2647 is probable, followed by more long-term gains.

GBP/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.2210

Take Profit @ 1.2645

Stop Loss @ 1.2100

Upside Potential: 435 pips

Downside Risk: 110 pips

Risk/Reward Ratio: 3.96

Should the Force Index be rejected by its descending resistance level, the GBP/USD could retrace its current breakout. Forex traders are recommended to take advantage of any breakdown attempt in this currency pair with new net buy positions, with the next support zone located between 1.1877 and 1.1972. The UK maintains a superior long-term economic outlook over the US, adding a distinct bullish catalyst.

GBP/USD Technical Trading Set-Up - Confined Breakdown Scenario

Short Entry @ 1.2035

Take Profit @ 1.1900

Stop Loss @ 1.2100

Downside Potential: 135 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 2.08