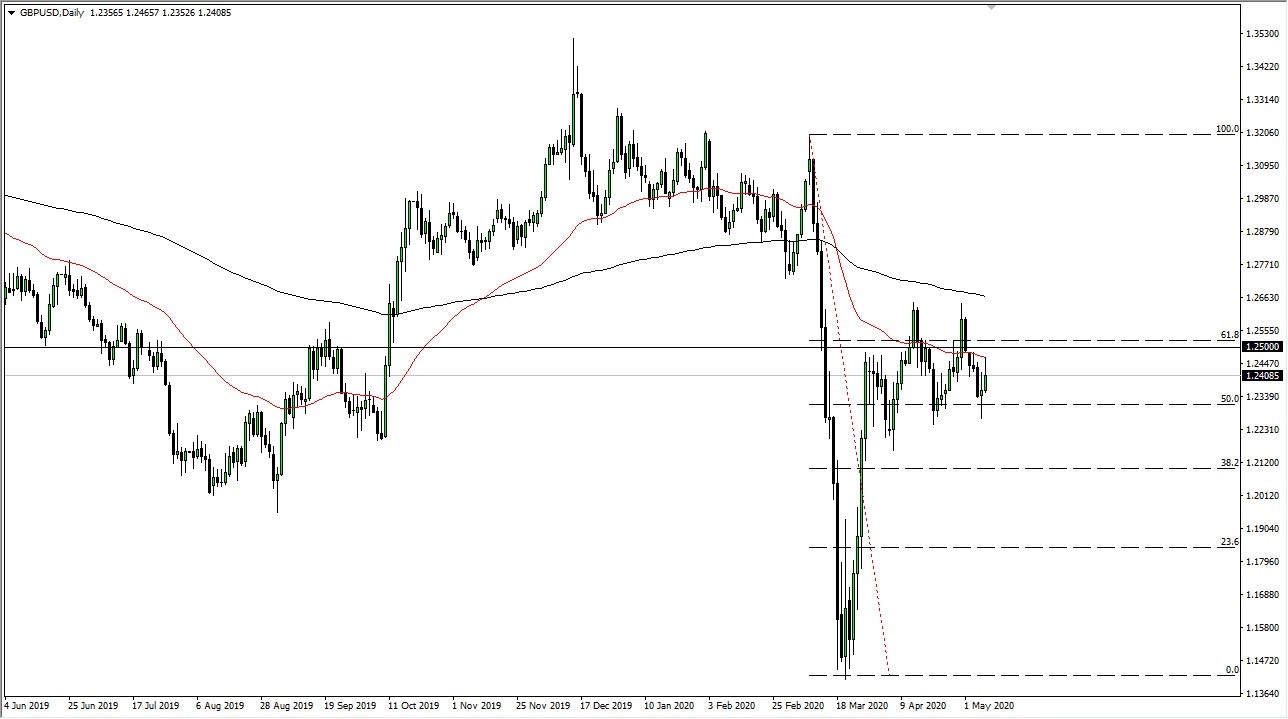

The British pound rallied a bit during the trading session on Friday, reaching towards the 50 day EMA before pulling back a bit from the indicator. At this point, the market is very choppy, and it should be noted that the 1.25 level should cause quite a bit of resistance due to the fact that the level is a large, round, psychologically significant figure, and of course an area that features the 50 day EMA, and the 61.8% Fibonacci retracement level. In other words, there are a lot of different technical factors that could come into play in this general vicinity, and therefore it is likely that we will see market failed to continue going higher.

The British pound of course has to worry about the United Kingdom itself, which has the largest death count in the European theater as far as coronavirus is concerned, and the infection rates are quite drastic. That being said, the economy had been locked down in the United Kingdom for quite some time and will take quite a bit of time before to recover. Ultimately, the market has been chopping around in this area for some time, and it does suggest that we are running out of momentum. If that is going to be true, this market is highly likely to rollover from here.

If we were to break down below the candlestick from the Thursday session, it is likely that we will initially reach towards the 1.22 level underneath, and then eventually the 1.20 level after that. The 1.20 level will be just as important as the 1.25 level is. In other words, we may bang around in this 500 point range but right now what I see is a lot of exhaustion and resiliency in the resistant barrier. Having said that, if we were to break above the 200 day EMA, it is likely that we would go much further. Ultimately, this is a market that should continue to be difficult to navigate, as we have a lot of concerns when it comes to the UK, but we also have the situation in America deteriorating at the same time. The US dollar will continue to be favored from a longer macroeconomic standpoint, but right now it looks as if the market is ready to simply grind back and forth around the 50 day EMA. At this point, simply selling rallies as they occur.