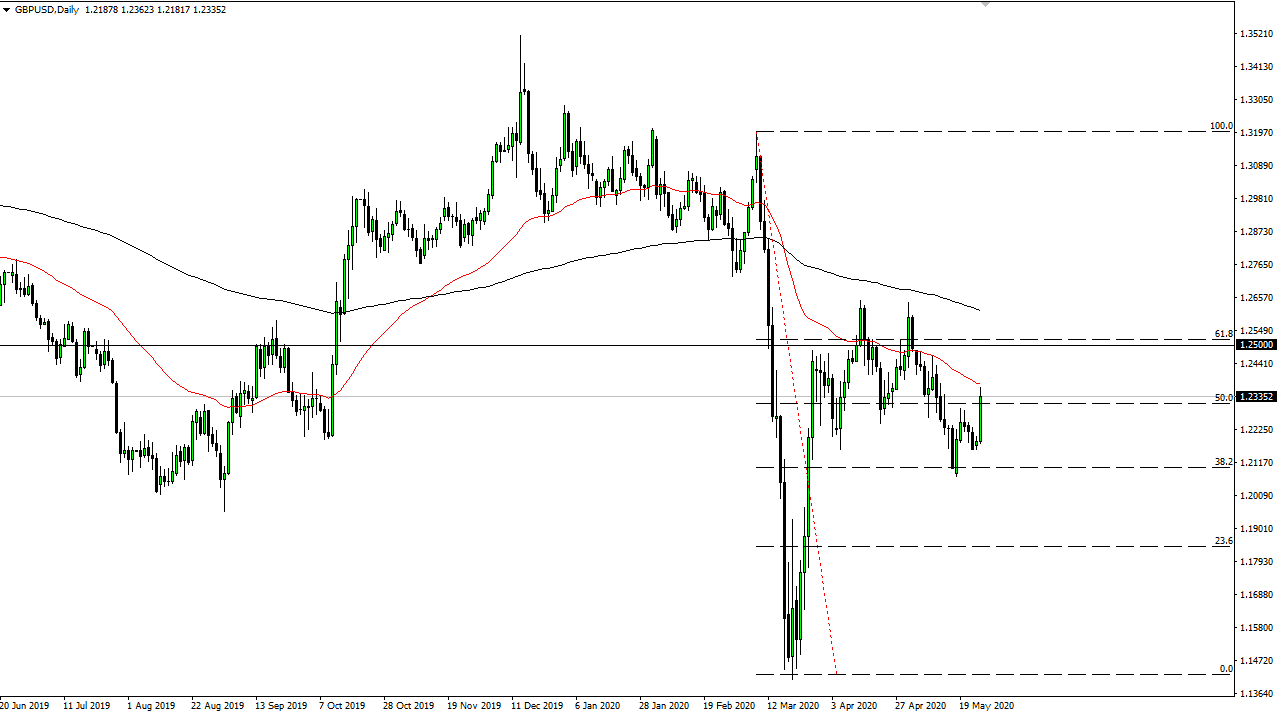

The British pound pulled back a bit from the 50 day EMA, as the trading public came back on Tuesday. At this point, it makes quite a bit of sense that we pull back from this level, because it is a significant technical indicator. Furthermore, it also hugs right around the 1.2350 level, which is an area that has been important more than once. All things being equal, the market does look like it is simply trying to retest the previous consolidation area, so at this point I think it is probably only a matter of time before we pullback.

That pullback would be a continuation of the negativity that we have seen, and at this point I think it is difficult to imagine that this market is simply going to turn around a start riffing to the upside. The 1.25 level above should be massive resistance, as it is a large, round, psychologically significant figure, and it is also the 61.8% Fibonacci retracement level. The 200 day EMA is starting to reach down towards that level so I think it is only a matter of time before the sellers would show up in that general vicinity.

To the downside, if we break down below the 1.23 level it is likely that the market goes down to the 1.22 handle, possibly even the 1.21 level after that. If we break down to a fresh, new low then I think the market will eventually find the 1.20 level, an area that is crucial in general.

For me, it is exceedingly difficult to go long the British pound due to the fact that the United Kingdom economy is suffering so much, and of course we have the Brexit that we have to deal with going forward. In other words, it is not just about the virus for the UK, it is also about dealing with that massive headache just waiting to happen. I think at this point the market participants will continue to see the British pound as a source of potential danger, so I do not think that this pair will go higher for the longer term. At this point, the market looks very likely to rollover sooner or later, but we may have another day of positivity before we get the true break down, which has been the pattern during trading weeks as of late, a lot of positivity in the first day or two, followed by some selling.