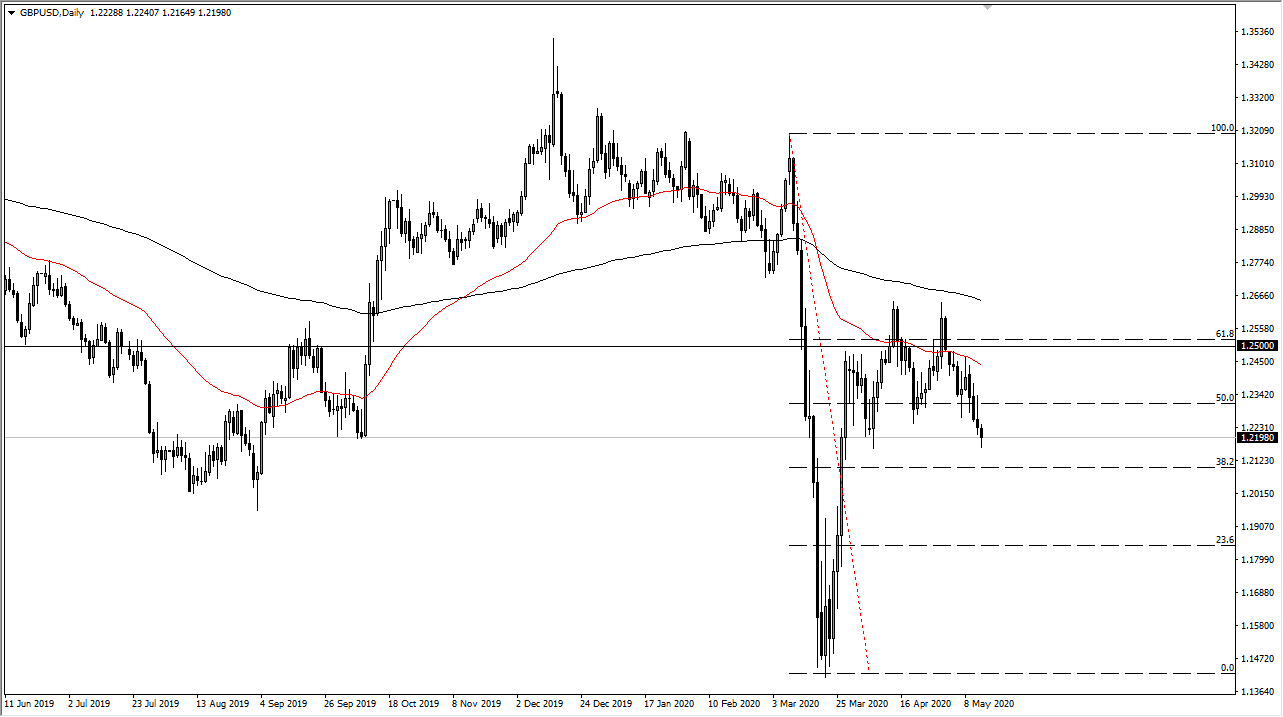

The British pound has broken down significantly during the trading session on Thursday but then bounced to show significant support. At this point, we are getting remarkably close to making a longer-term decision as the candlestick for the Thursday session is going to be a hammer but the candlestick before that was an inverted hammer. In other words, we are seeing a lot of pressure squeeze this market from both directions, and for some type of major move.

With that in mind, if we break above the top of the inverted hammer from the Wednesday session, then I will start looking for selling opportunities at higher levels. We are clearly seen a longer-term squeeze to the downside but if we break down below the bottom of the candlestick from Thursday, that means the bottom of this pair will more than likely give out and we could see a bigger move to the downside. If that is going to be the case, then the 1.20 level will be targeted, and then possibly the 1.1750 level after that. If we break higher, there are a multitude of places where we could see issues come into play.

The market may have just formed a major “double top”, but it appears that the British pound has a lot of fight left into it. Looking at this chart, I believe that the 50 day EMA will be an interesting area for sellers to get involved in, and I think that we will continue to see a lot of US dollar buying in general, as the US Treasury market continues to attract a lot of inflow. At this point in time, I am ignoring buy signals, and waiting for nice opportunity to start shorting. The British pound has a lot to worry about, not the least of which will be the UK economy.

The British economy is going to suffer due to the fact that the coronavirus has absolutely crippled it, but we also have to worry about the Brexit coming down the road, which is a long way from being sorted out. With all of the fighting going on between the UK and the EU, the clear winner in that scenario is more than likely going to be the United States. As the US dollar is considered to be a “safety currency”, it makes sense that in these turbulent times people prefer to hold greenbacks.