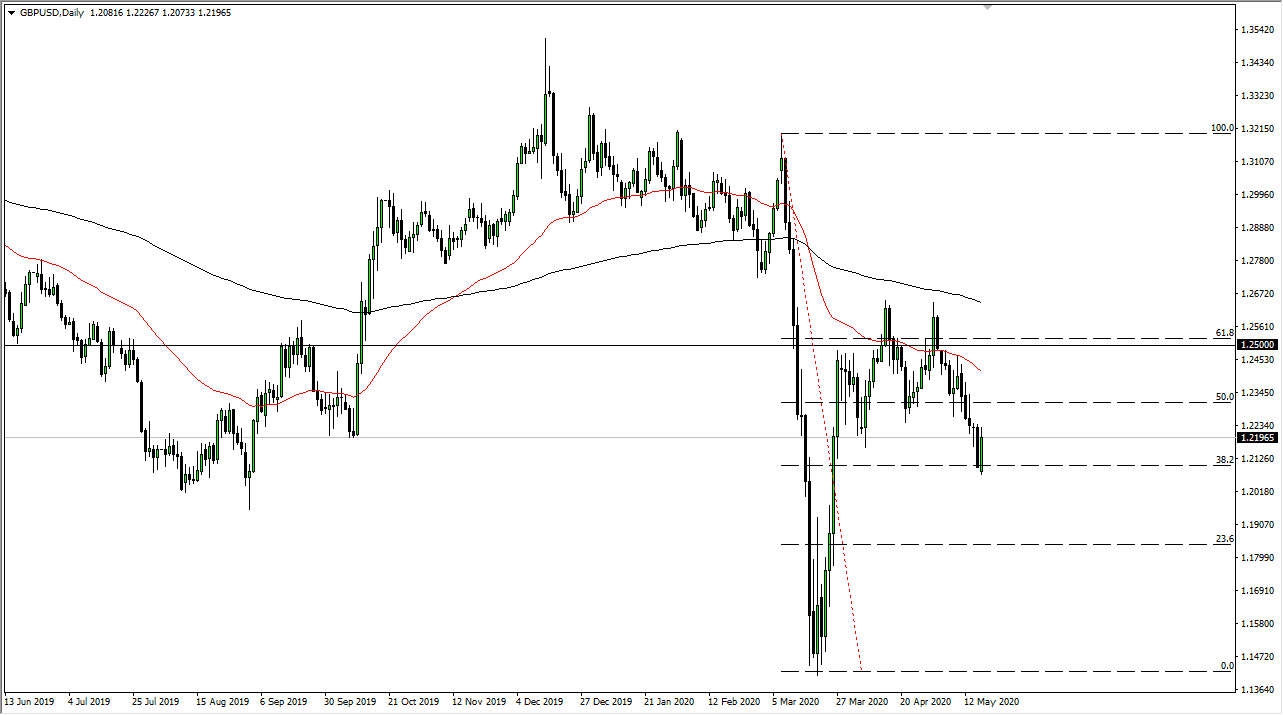

The British Pound has seen its fair share of bullish behavior during the trading session on Monday, but seems to be failing near the 1.22 level, an area that has previously been supportive. Furthermore, I think there is a lot of resistance extending all the way to the 1.2350 level, so I am a seller of this market given enough time. I think signs of exhaustion will continue to be the best way going forward but I will admit that the “risk on” trade on Monday was quite impressive. That does not mean anything has changed, just that perhaps the market has gotten ahead of itself.

For what it is worth, I have noticed that Mondays tend to be a bit more “risk on” than most other days as of late, and this seems to be a bit of a pattern. That being said, I think that we will probably need to see some type of reason to get moving in one direction or another, and therefore I would have to assume that the breakdown on Friday was real. The market participants continue to look at the US dollar as a safety currency and will be looking to buy treasuries at the first signs of trouble. This of course is extremely negative for anything that is not labeled “US dollar”, and of course the British pound has a major issue around it involving the Brexit situation that has not changed. Ultimately, I like the idea of selling this market, and I do believe that we will probably go looking towards 1.20 level sooner rather than later.

For the bullish case, I would need to see the market break above the 1.25 level at the very least to consider it. There is a significant amount of demand for the greenback in times of uncertainty, and we certainly have a lot of uncertainty. With this, I believe that the British pound will continue to be shunned, not only due to the greenback portion of the equation but also the fact that the United Kingdom is just now trying to open up a bit, and quite frankly the coronavirus numbers there have been much worse. Adding more fuel to the fire is that the Bank of England has suggested that negative interest rates are a definite possibility, something that is essentially kryptonite for a currency and therefore will continue to see the British pound being sold off longer term.