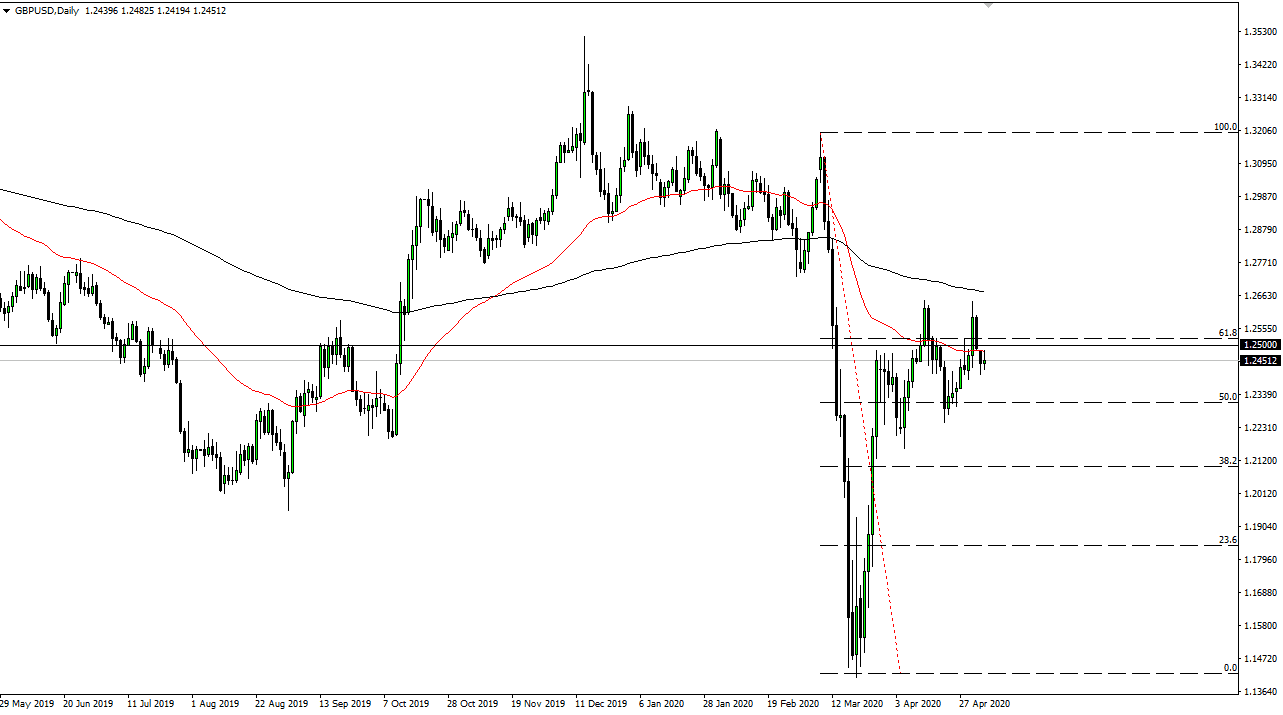

The British pound went back and forth during the trading session on Tuesday as we continue to dance around just below the 50 day EMA. The 50 day EMA is an area that attracts a lot of attention, so at this point in time it looks as if the traders are in fact paying attention to this level. The 1.25 level is an area that has attract a lot of attention over the longer term, and it should be noted that the 61.8% Fibonacci retracement level is in the same neighborhood. Between that and the 50 day EMA, it makes sense that we may struggle a bit here, and perhaps fall towards the 1.23 level, possibly even the 1.22 level.

If we turn around and rally though, we could go towards the 1.2650 level, an area that has been resistance a couple of times already. Just above there, we have the 200 day EMA which could also come into play and offer a significant amount of resistance. I do believe that shorting signs of exhaustion should continue to work, as the United Kingdom has a whole slew of concerns when it comes to dealing with the European Union, opening up the economy, and of course the horrific economic numbers that continue to come out of London. On the other side of the Atlantic, you have the United States which is in the midst of trying to open up, and of course enjoys the benefit of being the world’s reserve currency.

At this point, it is probably worth noting that the jobs number comes out on Friday so it is likely that we will see a lot of choppy and sideways action, with perhaps more of an eye towards the “risk off” type of trade. This in and of itself should put a bit of resistance just above the market anyway, so at this point I like the idea of being this patient is possible or if you are a little bit more short-term incline, you can simply look for short-term selling opportunities. All of that being said, the market breaking above the 200 day EMA would of course a very bullish sign and could be a change in the overall trend. I would anticipate a complete recovery of the entire break down from the 1.32 handle. That seems to be a bit unlikely in the short term though.