The British pound has been all over the place during the Thursday session, as the Bank of England chose not to do anything during this announcement cycle. That being said though, in the statements it can clearly be seen that there is a good possibility of something happening in June. That is the bearish argument for the British pound, because quite frankly the Bank of England is likely to cut rates and also has to deal with an extraordinarily negative economic environment. Beyond that, Great Britain has to worry about the Brexit negotiations, so therefore traders will be a bit skittish hanging onto the British pound for a longer-term move.

All of that being said, during the trading session on Thursday, the Fed Funds Futures Rate for December 2020 went negative, something that signifies that traders are betting on treasury yields going even lower, and perhaps even negative by the time we get to December. If that is going to be the case, it is extremely negative for a currency. Having said all of that, there are a whole slew of reasons to think that you should not be buying the British pound at the moment, and as a result it is important to pay attention to those factors from a longer-term standpoint.

The United Kingdom has largest death toll in the European area right now, surpassing Italy. Furthermore, there is an extreme amount of economic damage that has been done to the United Kingdom and of course there are horrific economic figures out there as the Bank of England had suggested that this would be the worst recession that the United Kingdom has seen in over 300 years. That is a pretty dire statement, so it of course will have its influence on this currency as well.

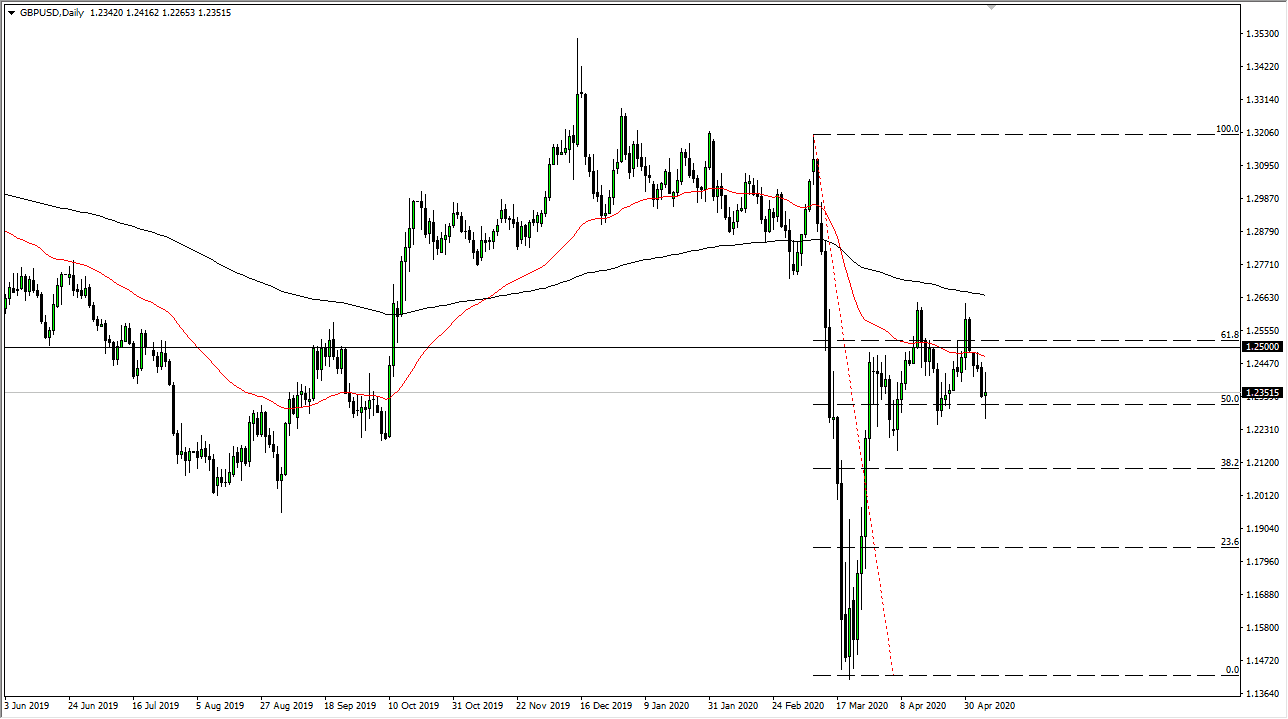

To the upside, the 50 day EMA above is going to offer a significant amount of resistance, so I would be more than willing to fade this market in that general vicinity. The 1.25 level above is a significant round figure that people will pay quite a bit of attention to as well, and of course the 61.8% Fibonacci retracement level sits right there. In other words, we may rally from here but I think any gain that the British pound gets will probably be somewhat limited going forward as the United Kingdom has a whole host of issues out there that it needs to deal with, not the least of which is a continuation of negotiating the Brexit scenario.