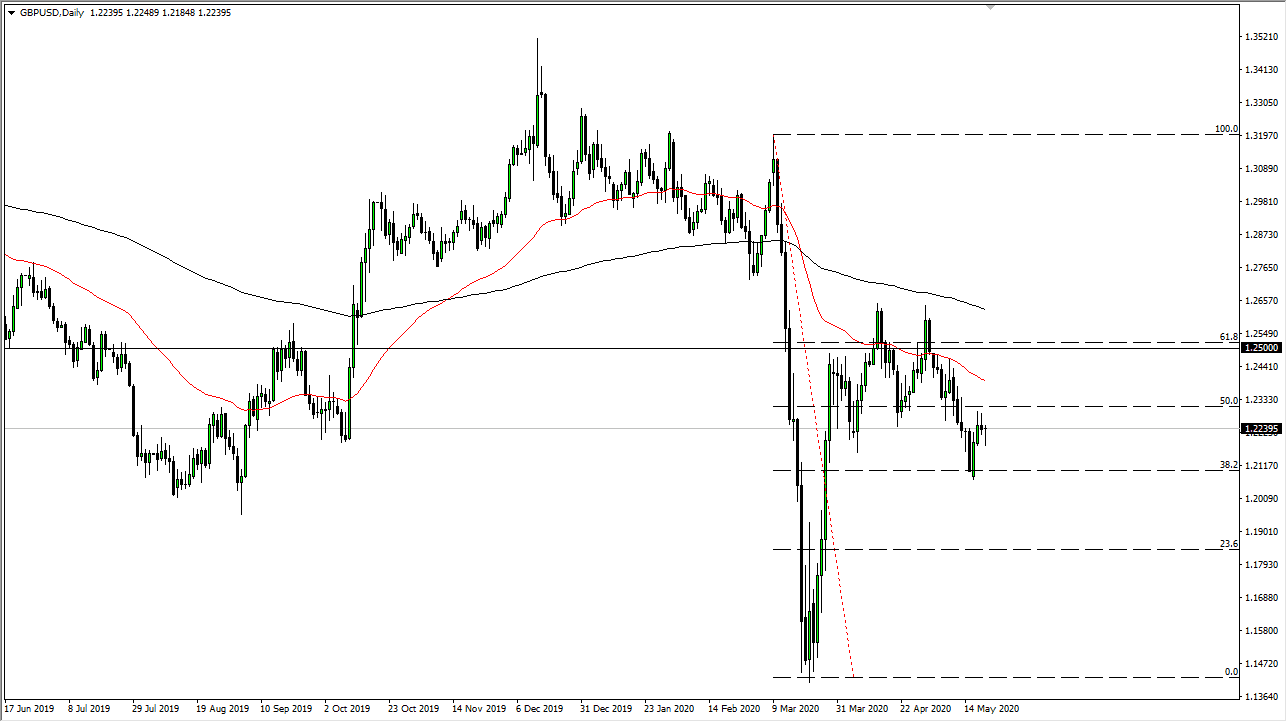

The British pound broke down significantly during the trading session on Thursday, as there was more of a “risk off” type of trade. We then bounced a bit only to fall again and then bounce again. In other words, the British pound has been all over the place and therefore it makes sense that we look a bit confused at this point in time. Looking at the candlestick, you can see that there is a lot of bullish pressure underneath but there is also a couple of candlesticks previously that showed just how resistant the market is to be going out above this general vicinity. With that, I think it is only a matter of time before we have to make a bigger decision, and I still favor the downside due to the fact that we are in a downtrend.

That being said, the fact that the market did bounce a bit during the day it probably means that we are going to continue to see a lot of fight. That being said, economic gravity is starting to come into the picture, and therefore it is likely that the market drifts down towards the 1.21 handle. A breakdown below that level could send this market looking towards the 1.20 level after that.

The alternate scenario is of course that we break above the highs from both Wednesday and Thursday, which would be a bullish sign, but it only has so far to go before we run into resistance. That being said, it seems to be less likely bit of course it is a potential move that this market could make. With that, I expect to see a lot of noise in this market over the next couple of days but there is still a certain amount of concern that you have to worry about in the United Kingdom when it comes to the British pound, at the least of which of course is going to be the Brexit situation.

Furthermore, the economic figures in the United Kingdom certainly are far worse than the United States, but then you also have the fact that the US dollar is backed by US Treasuries, which have seen an insatiable demand for some time. Remember, the US dollar is the ultimate “safety currency”, and therefore as long as we have a whole plethora of concerns out there, it makes quite a bit of sense that the greenback is still in demand.