The British pound broke down significantly during the trading session on Friday, reaching towards 1.21 handle. At this point, it looks as if the British pound will continue to be sold, as the UK economy is falling apart and of course it has a much bleaker outlook than the United States economy does. With the British pound you have to worry about the coronavirus numbers rising, and then of course you have to worry about the Brexit down the road. Furthermore, the US dollar continues to be a beacon of safety, with the United Kingdom a complete mess.

The market is highly likely to continue going lower, perhaps reaching towards the crucial 1.20 level. The 1.2150 level was minor support, and it did get slice through late in the day on Friday, showing a real lack of risk appetite. I think that this will be the continuing theme into next week, and therefore selling is something that you should be looking into. Rallies at this point are opportunities to short the British pound and start picking up the US dollar again, as we have plenty of reasons to believe that this market will falter.

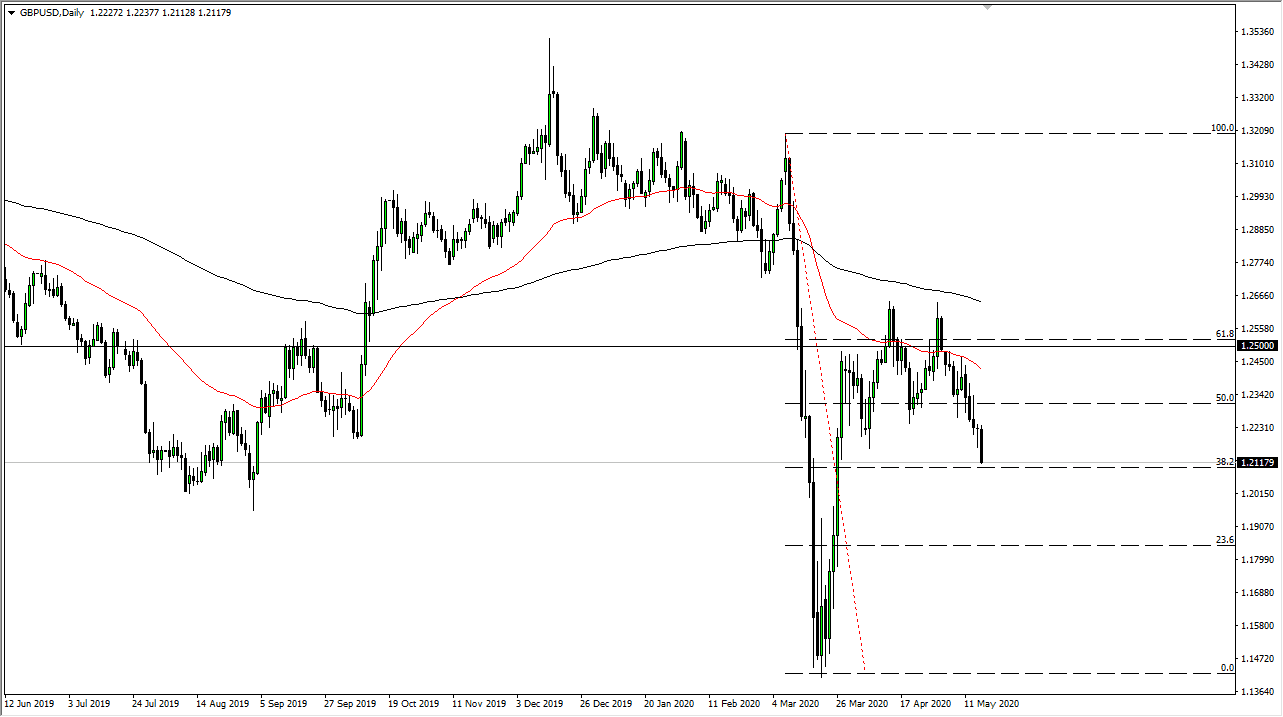

The 61.8% Fibonacci retracement level offered enough resistance to send this market lower, and the fact that we are closing at the very bottom of the range tells me that there is probably further to go. Ultimately, I like the idea of fading short-term rallies and then adding on the way down. Quite frankly, sometimes the market whispers what it is going to do, and other times it will scream. One thing that I can say is that the volume of the voices most certainly is getting much lower. Rallies at this point will run into trouble at the 1.22 handle, and then possibly the 1.2350 level.

To the downside, breaking below the 1.20 level will accelerate the downside, and most certainly will attract quite a bit of attention as it is a large round number. Ultimately, it is more than likely only a matter of time before we see a lot of downward pressure, and a break below the 1.20 level will certainly get the CNBC types out there looking to jump on the bandwagon. At that point, there will be plenty of people jumping into the trade and pushing it lower. That being said though, whether or not we make a fresh, new low is a completely different argument as it is all the way down at the 1.15 handle.