The British pound has been rather negative during the week heading into June, just as it has been for the entirety of the month of May. Yes, there have been rallies here and there, but it seems like the British pound cannot hang on to those rallies. At this point, I believe that the British pound is likely to continue going lower and quite frankly it should. The currency markets are focusing on allotted everything right now, not the least of which is the US Treasury market. As the US Treasury market continues to see plenty of inflow, it is likely that the US dollar should continue to gain by default.

Furthermore, the United Kingdom is still having to deal with the Brexit, which the main negotiator mentioned that the “European Union needs to evolve its position in order to get an agreement.” This is not promising and marrying that with the idea of the United Kingdom having the largest amount of deaths in that region of the world due to the pandemic, there is a whole slew of reasons to think that the British pound is going to continue to suffer.

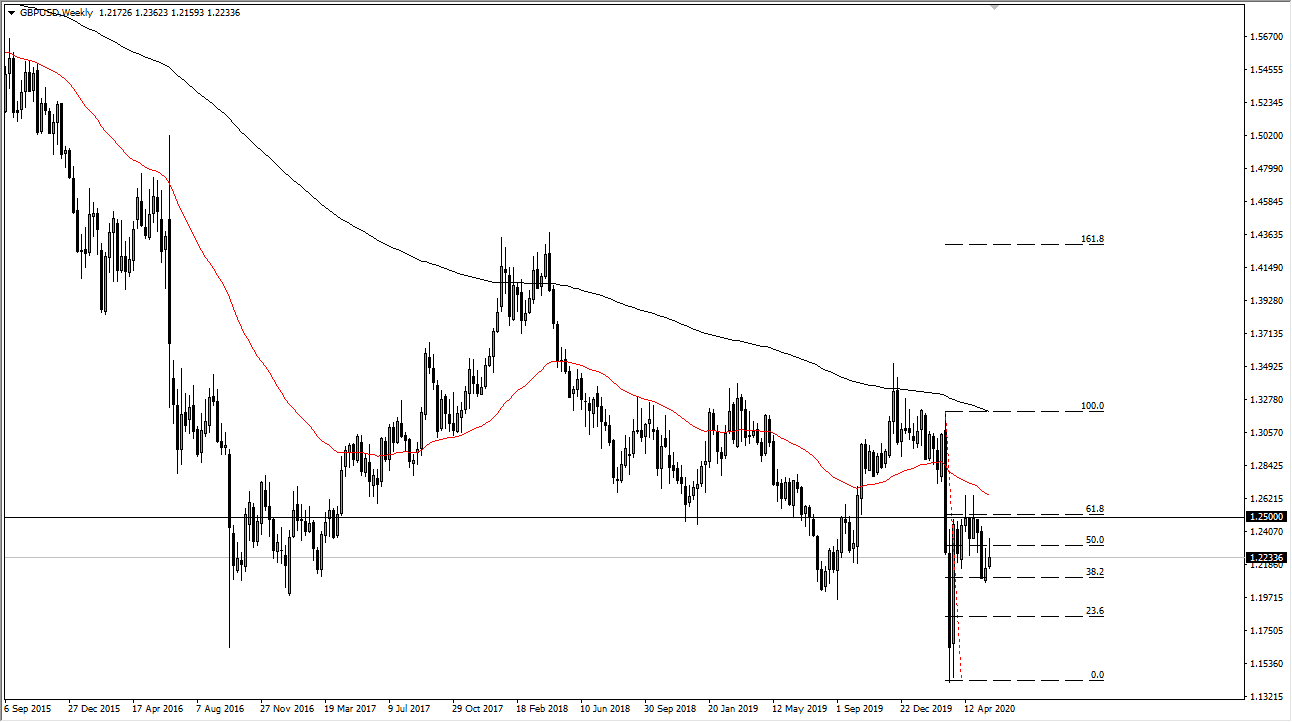

With that in mind, I like the idea of fading rallies and I think that every time this market tries to rally during the month of June there will probably be sellers. The 1.25 level looks to be the absolute “ceiling” at this point, so having said that fading rallies on short-term charts probably continues to pay dividends for those who are willing to hang on for the trade. Longer-term, I believe that the market will probably go looking towards 1.20 level, something that we may very well see during the month of June.

If we did break above the 1.25 level in stock above there for a daily close, I would have to rethink some things but right now that does not look highly likely to happen. Furthermore, people are starting to worry about the overall global trade situation, which of course has people running towards the greenback, irrespective of what is going on with the British pound overall. We are in a downtrend, and there is no reason to think that is going to change in the short term. I believe that we will continue to see plenty of fear and the overall markets during 2020, as the slowing down and quite frankly stopping of the global economy is not something, they get shaken off rather quickly.