Singapore is preparing for a post-Covid-19 economy, where consumer behavior will be changed, more employees opt to work from home, and social distancing a key element moving forward. Industries like travel and hospitality are like to suffer the most, but biotechnology and healthcare are set to flourish. The labor market is poised to transform, with a significant increase in contract work, which will allow companies to navigate an uncertain future while keeping people employed. With Singapore positioned in a leadership position in Asia, the UK is outperforming in Europe. A trend favored accelerating. Yesterday’s economic data sufficed to pressure the GBP/SGD out of its support zone, and the build-up in bullish momentum is likely to extend the breakout sequence.

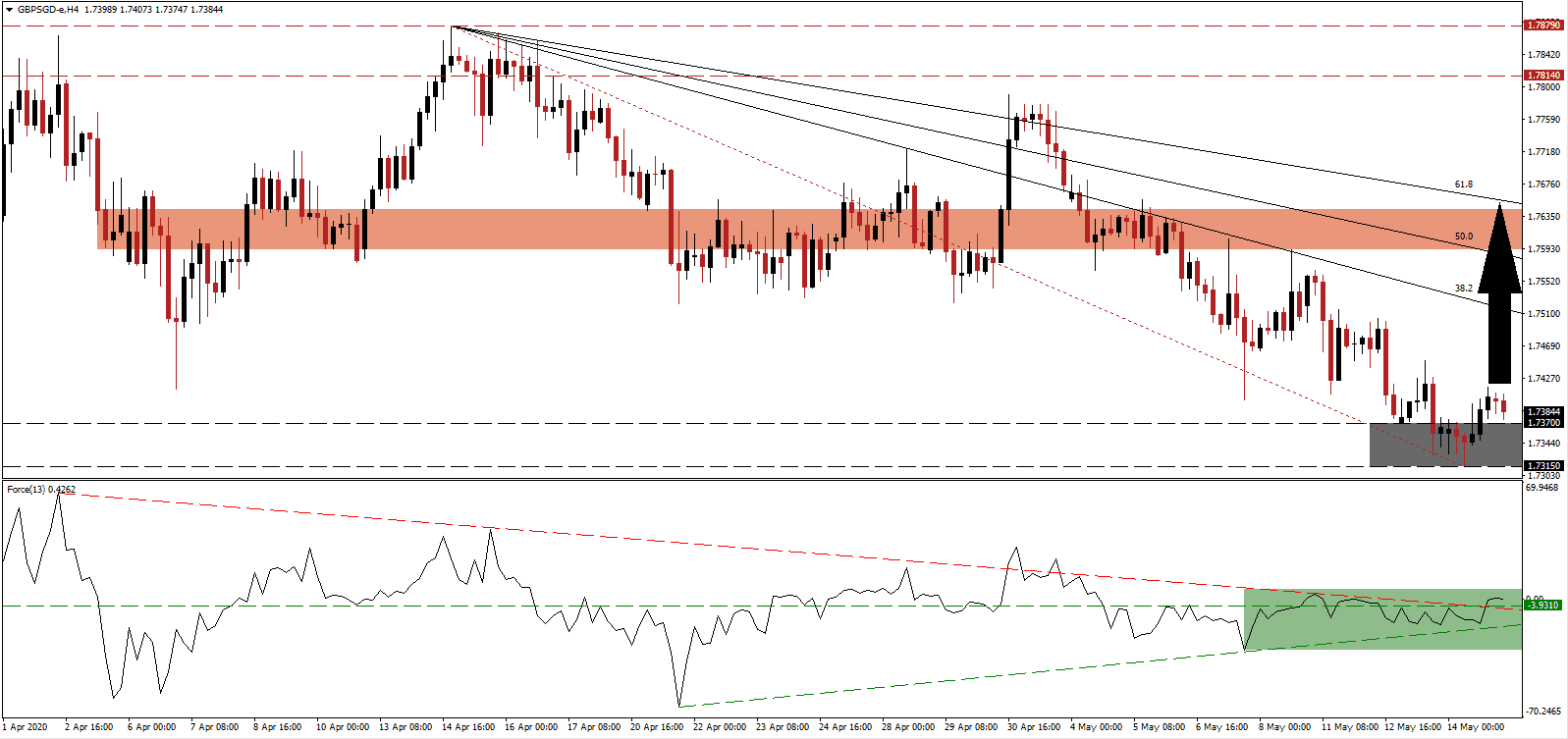

The Force Index, a next-generation technical indicator, rebounded off of its ascending support level and converted its horizontal resistance level into support. Adding to bullish developments was the breakout above its descending resistance level, as marked by the green rectangle. This technical indicator additionally crossed above the 0 center-line, granting bulls control of the GBP/SGD.

Governments around the world started to reopen their economies gradually but witnessed a spike in new infections. Singapore will ease certain restrictions on June 1st and then reassess the situation before opening up more sectors. The UK is on an equally patient roadmap, positioning both economies for sustained recovery. Ensuring a well-functioning test, trace, and isolate (TTI) infrastructure is paramount to combat the pandemic. The GBP/SGD is on track to move farther to the upside after its breakout above the support zone located between 1.7315 and 1.7370, as marked by the grey rectangle.

A short-covering rally is anticipated to emerge, backed by the accumulation of bullish momentum, supported by fundamental developments. Singapore has an edge in the biotechnology sector, but the UK remains in a notable leadership position in finance, especially after the end of the Brexit transition period. The GBP/SGD is expected to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level from where an accelerated advance into its short-term resistance zone is possible. This zone is located between 1.7592 and 1.7643, as identified by the red rectangle.

GBP/SGD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.7385

Take Profit @ 1.7645

Stop Loss @ 1.7325

Upside Potential: 260 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 4.33

In case the Force Index collapses below its ascending support level, the GBP/SGD may be pressured into a breakdown. The next support zone awaits this currency pair between 1.7042 and 1.7151, which represents an excellent second buying opportunity for Forex traders to consider. The long-term outlook for Singapore and the UK is increasingly bullish, with the latter in a superior overall position.

GBP/SGD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.7285

Take Profit @ 1.7125

Stop Loss @ 1.7345

Downside Potential: 160 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 2.67