New Zealand implemented one of the most severe lockdown measures, which was successful in combating the Covid-19 outbreak. New daily infections are in single digits, and the death toll so far is 19, while other countries reported thousands of deaths. The cost to the economy is forecast to be tremendous, with a 20%+ contraction predicted, in the second quarter, and 10.4% annualized. Prime Minister Ardern’s government has no credible plan to adjust the existing model for a sustainable future, placing downside pressure on its currency. The GBP/NZD accelerated out of its short-term support zone with more gains anticipated.

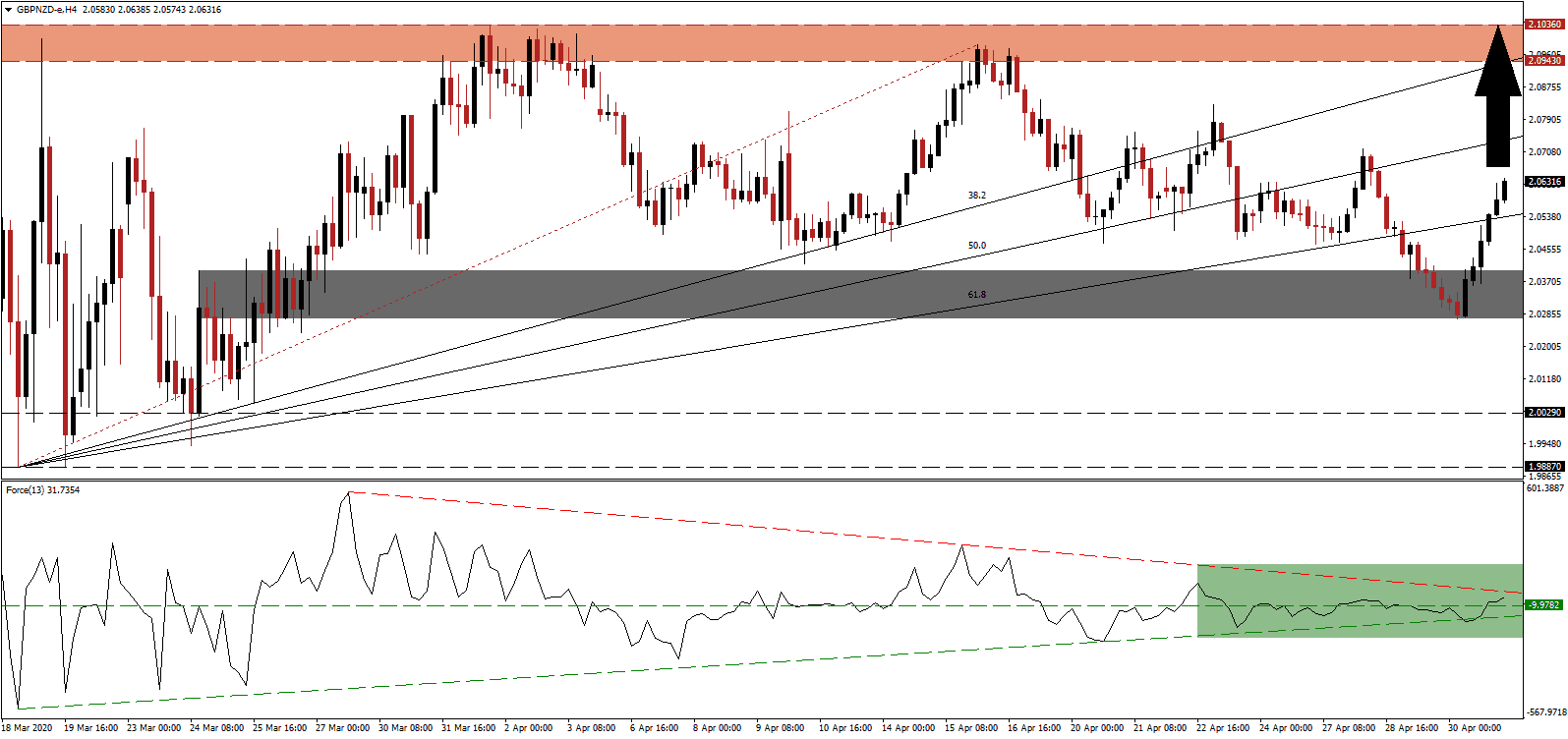

The Force Index, a next-generation technical indicator, points towards the build-up in bullish momentum after bouncing off of its ascending support level. It led to a conversion of its horizontal resistance level into support. The Force Index is now challenging its descending resistance level, as marked by the green rectangle. Bulls took control of the GBP/NZD following the crossover above the 0 center-line by this technical indicator. You can learn more about the Force Index here.

According to the latest data released by the British Chambers of Commerce, one-third of the UK economy functions normal, one-third with difficulties, and one-third has shut down. Roughly 20% of retailers don’t plan to reopen after lockdown measures are lifted. Therefore, it is less severe than in New Zealand, generating a fundamental catalyst for the GBP/NZD. After the GBP/NZD completed a breakout above its short-term support zone located between 2.0273 and 2.0399, as marked by the grey rectangle, it converted its ascending 61.8 Fibonacci Retracement Fan Resistance Level into support.

Forex traders are advised to monitor the intra-day high of 2.0714, the peak from where the most recent sell-off materialized. A breakout is favored to attract the addition of new net buy orders, pushing the GBP/NZD into its next resistance zone. This zone awaits price action between 2.0943 and 2.1036, as identified by the red rectangle. The 38.2 Fibonacci Retracement Fan Resistance Level has entered it, pointing towards more upside potential, if a new catalyst emerges.

GBP/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 2.0630

Take Profit @ 2.1030

Stop Loss @ 2.0515

Upside Potential: 400 pips

Downside Risk: 115 pips

Risk/Reward Ratio: 3.48

In case the Force Index collapses below its ascending support level, the GBP/NZD is likely to face a temporary sell-off. Given existing fundamental conditions, the downside remains limited to the bottom range of its short-term support zone. Forex traders are recommended to consider a retracement of the current advance as an excellent second buying opportunity, on the back of an increasingly bullish outlook, for this currency pair.

GBP/NZD Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 2.0450

Take Profit @ 2.0280

Stop Loss @ 2.0515

Downside Potential: 170 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 2.62