While yesterday’s news regarding a promising Covid-19 vaccine sparked risk-on sentiment, allowing the GBP/JPY to accelerate out of its support zone as demand for the safe-haven Japanese Yen faded, the likelihood of a tax increase in the UK was temporarily brushed aside. According to the Office for Budget Responsibility (OBR), UK government borrowing by the end of 2020 could reach £298.4 billion due to the Covid-19 pandemic. The UK Treasure plans to lessen the financial burden with an increase in the base income tax by 5% to 25%. It will have a tremendous negative impact on the economy. The estimated increase in tax revenues between £25 and £30 billion will be offset by an average economic loss of £906 per taxpayer per year. It positions this currency pair for a new breakdown sequence due to a significant policy mistake unless the Treasury realizes a change of direction is warranted.

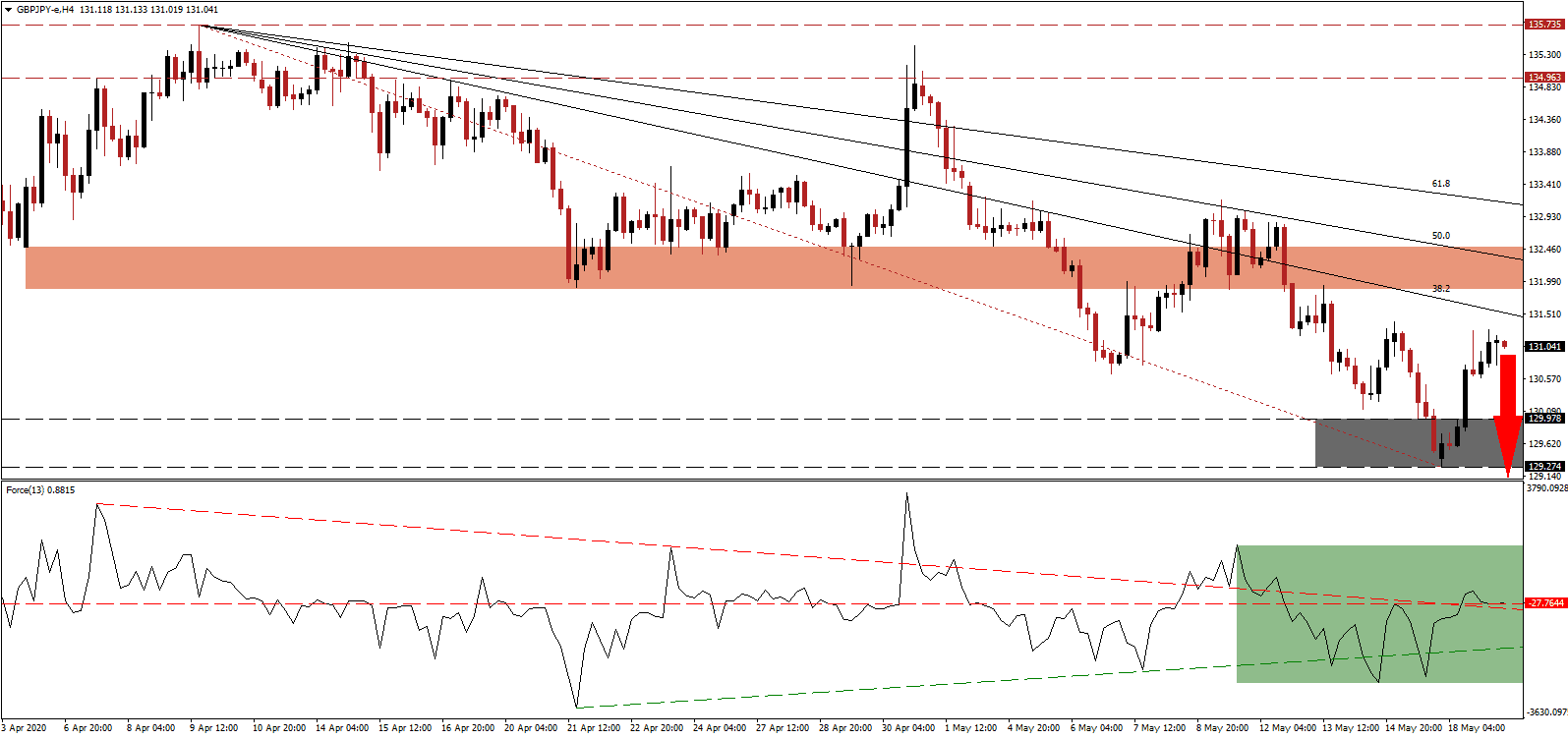

The Force Index, a next-generation technical indicator, temporarily eclipsed its horizontal resistance level before retreating below it. Adding to bearish developments is a significantly lower high, as marked by the green rectangle, from where a contraction in the Force Index below its descending resistance level is favored. This technical indicator is on course to move below the center-line, ceding control of the GBP/JPY to bears, while a collapse below its ascending support level cannot be excluded.

Until the Bank of England understands the potential of a V-shaped economic recovery, the backed base case scenario resembling wishful thinking, policy mistakes remain the most dominant risk to the economy. The Bank of England forecasts a 14% GDP contraction in 2020, followed by a 15% expansion in 2021. Plans by the Treasury to increase taxes renders this outlook completely unrealistic. Price action is being pressured lower by its descending 38.2 Fibonacci Retracement Fan Resistance Level, which moved below its short-term resistance zone. This zone is located between 131.870 and 132.488, as marked by the red rectangle. A downward adjustment is pending a reversal in the GBP/JPY.

Japan confirmed it officially entered a recession as the first-quarter GDP contracted in a move widely anticipated by markets. More hardship is predicted with the bulk of Covid-19 related disruptions in the second quarter, while the third-quarter outlook remains uncertain. Globally, a new infection wave over the summer is a distinct scenario and mispriced across the financial spectrum. It adds a catalyst for the GBP/JPY to challenge its support zone located between 129.274 and 129.978, as identified by the grey rectangle. More downside is probable with the next support zone between 126.371 and 127.324.

GBP/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 131.000

Take Profit @ 126.500

Stop Loss @ 132.300

Downside Potential: 450 pips

Upside Risk: 130 pips

Risk/Reward Ratio: 3.46

In case of a reversal in the Force Index initiated by its descending resistance level, serving as current support, the GBP/JPY may extend its present advance. Given the most recent proposals for a tax increase while the economy is in a recession limits the upside potential to its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders are recommended to consider this as an excellent short-selling opportunity.

GBP/JPY Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 132.550

Take Profit @ 133.100

Stop Loss @ 132.300

Upside Potential: 55 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.20