Mervyn King, the Bank of England Governor during the 2008 financial crisis, warns that overconfidence in a V-shaped recovery is not warranted. He additionally attacked the government's emergency loan guarantee scheme for struggling businesses, cautioning that any economic recovery will take time. King is most worried about the implementation of measures taken to reduce the negative impact of the Covid-19 related nationwide lockdown. The Bank of England presently forecasts a 14% GDP contraction in 2020, followed by a 15% increase in 2021. Despite conflicting assessments, the GBP/CHF maintains its bullish momentum and is drifting towards its resistance zone for a new breakout.

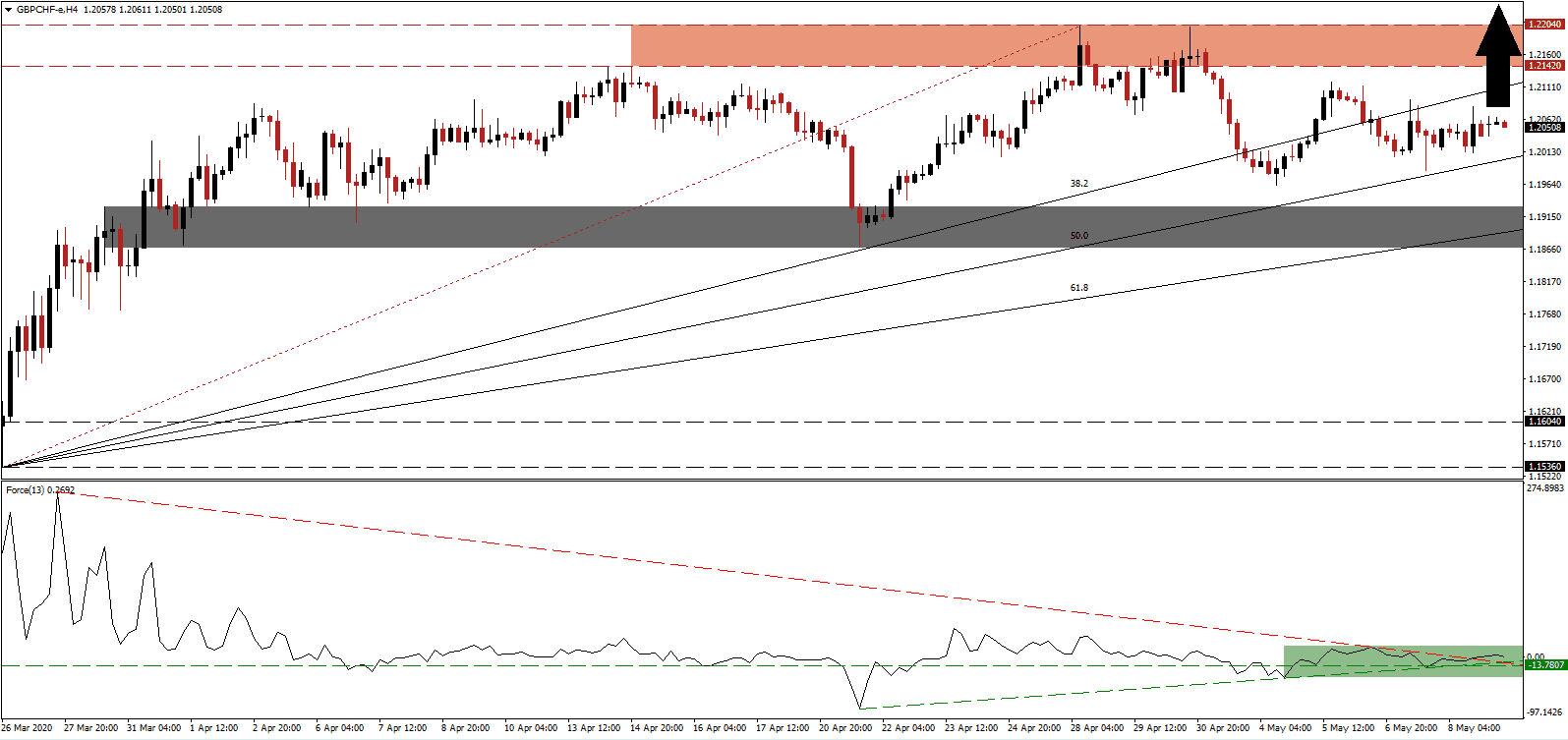

The Force Index, a next-generation technical indicator, bounced off of its ascending support level during its crossover above the horizontal support level. It then added to bullish developments with a breakout above its descending resistance level, as marked by the green rectangle. More upside is expected to follow after this technical indicator moved above the 0 center-line, placing bulls in control of the GBP/CHF.

Boris Johnson, the UK’s Prime Minister, announced the first step of easing nationwide lockdown measures starting today. Employees who are unable to work from home are encouraged to return to work but avoid public transportation if possible. From Wednesday, unlimited outdoor exercise will be allowed, and the hospitality sector may resume operations by July. Mandatory quarantine for travelers arriving in the UK is expected to be implemented. A cautious approach to reopening the economy will benefit growth prospects in the long-term. The GBP/CHF is moving farther away from its short-term support zone located between 1.1867 and 1.1930, as marked by the grey rectangle, which is pending an upward adjustment to reflect the strengthening bullish chart pattern.

Price action is presently guided higher in a bullish channel created by its ascending 50.0 Fibonacci Retracement Fan Support Level and its 38.2 Fibonacci Retracement Fan Resistance Level. The Swiss economy is facing losses up to CHF17 billion per month due to the virus and may need to boost its fiscal response to above CHF100 billion. It adds a short-term catalyst to the GBP/CHF, sufficient to force a breakout above its resistance zone located between 1.2142 and 1.2204, as identified by the red rectangle. More upside is favored to take this currency pair into its next resistance zone awaiting between 1.2395 and 1.2460.

GBP/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.2050

Take Profit @ 1.2450

Stop Loss @ 1.1950

Upside Potential: 400 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 4.00

A breakdown in the Force Index below its ascending support level could lead to a corrective phase in the GBP/CHF. Forex traders are recommended to remain cautious, as the bullish chart pattern remains intact as long as price action maintains its position above the 61.8 Fibonacci Retracement Fan Support Level. Any breakdown should be viewed as an outstanding long-term buying opportunity with the next support zone located between 1.1536 and 1.1604, also awaiting an upward revision.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.1850

Take Profit @ 1.1600

Stop Loss @ 1.1950

Downside Potential: 250 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 2.50