UK economic data released yesterday surprised to the upside but confirmed the massive negative impact of the Covid-19 pandemic. The reports included GDP, construction spending, industrial and manufacturing production, and business investment. Prime Minister Johnson’s patient approach will allow the UK more time to develop the necessary test, trace, and isolate (TTI) infrastructure, which will result in a more easing of the nationwide lockdown in a safer environment. Until the virus is under control, consumers will remain cautious, preventing any recovery from materializing. The GBP/CAD is inside of its support zone, where bullish momentum is rising, favored to initiate a new breakout sequence.

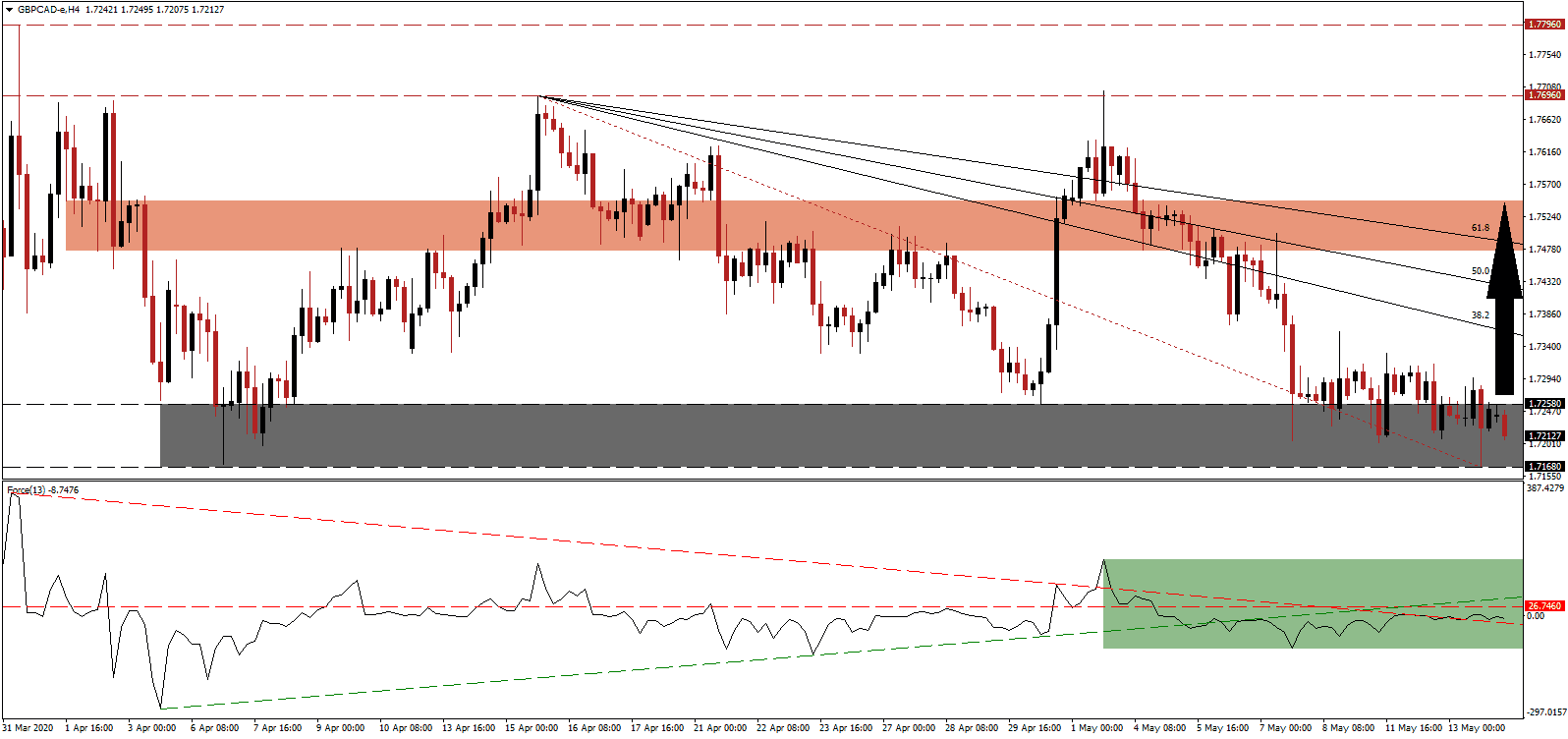

The Force Index, a next-generation technical indicator, started to drift higher while price action registered a more moderate low inside of its support zone. It resulted in the emergence of a positive divergence, suggesting a price action reversal is imminent. The Force Index remains below its horizontal resistance level but is expected to bounce off of its descending resistance level, as marked by the green rectangle. Bulls wait for this technical indicator to cross above the 0 center-line, with a potential spike above its ascending support level, to resume control of the GBP/CAD.

While the Bank of England predicts a 2020 GDP contraction of 14%, the worst since the 15% plunge recorded in 1706, the UK economy has been more resilient than economists were able to identify. This currency pair is well-positioned to push out of its support zone located between 1.7168 and 1.7258, as marked by the grey rectangle. With Canada facing significantly more severe issues, a short-covering rally in the GBP/CAD is anticipated. Over two million jobs were lost in Canada in April, and the collapse in oil prices has added downside pressures to the economy.

According to the Conference Board of Canada, Calgary and Edmonton will suffer the most under the recession, with every major city set to address a recessive environment. The UK will receive a significant long-term bullish fundamental catalyst after the Brexit transition period ends this year, allowing the country to strike trade deals, regaining full control of their economy and borders. A breakout above the descending 38.2 Fibonacci Retracement Fan Resistance Level will clear the path for the GBP/CAD to accelerate into its short-term resistance zone located between 1.7475 and 1.7546, as identified by the red rectangle.

GBP/CAD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.7215

Take Profit @ 1.7545

Stop Loss @ 1.7115

Upside Potential: 330 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 3.30

A collapse in the Force Index below its descending resistance level, serving as current support, can extend the correction in the GBP/CAD with a breakdown. Forex traders are recommended to take advantage of any sell-off, with new net buy orders, on the back of an increasingly long-term bullish outlook for the UK post-Covid-19 economy. Adding to positive progress for this currency pair is a more challenging recovery for Canada. The next support zone is located between 1.6813 and 1.6915.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.7015

Take Profit @ 1.6850

Stop Loss @ 1.7085

Downside Potential: 165 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 2.36