An external member of the Bank of England’s Monetary Policy Committee, Michael Saunders, who voted for an unsuccessful expansion of the bond-buying program, delivered the most bearish outlook on the UK economy from any policymaker to date. He believes too much stimulus is superior to too little, given the damaging blow the Covid-19 pandemic has on the economy. While his point of view remains in the minority, preventing lasting damages due to policy mistakes, he does point out the path to recovery will be prolonged. The GBP/CHF is vulnerable to a temporary breakdown into its support zone, as safe-haven demand is on the rise, primarily due to rising tensions in the Sino-US relationship. It adds a bullish catalyst to the Swiss Franc, a prominent safe-haven currency.

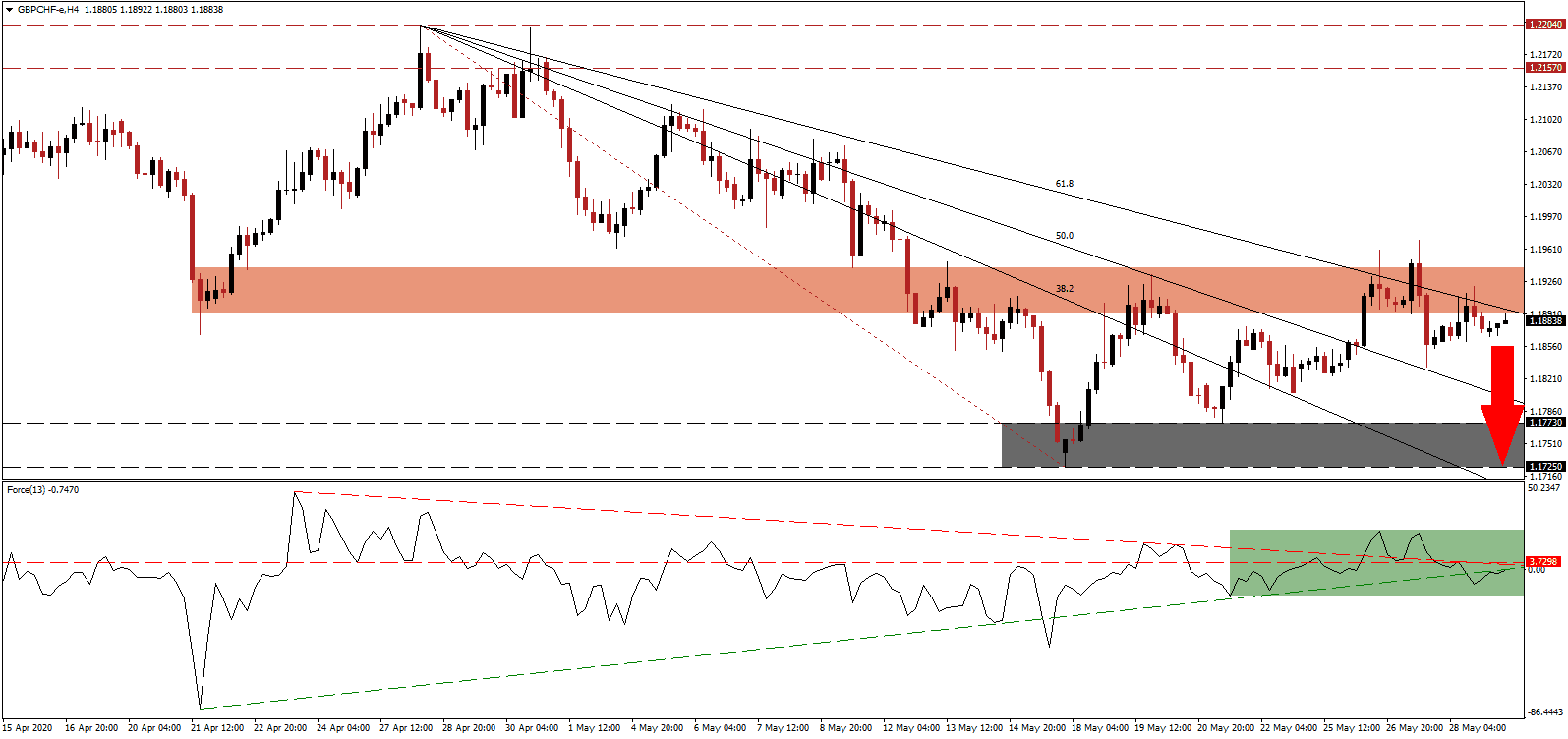

The Force Index, a next-generation technical indicator, reversed its most recent breakout and corrected below its descending resistance level before converting its horizontal support level into resistance. Adding the bearish progress was the breakdown in the Force Index below its ascending support level, as marked by the green rectangle. This technical indicator also moved below the 0 center-line, granting bears control of the GBP/CHF.

UK Prime Minister Johnson announced that five metric to ease the nationwide lockdown were met and that from June 1st, up to six people may meet in public but remains two meters apart. Primary schools and nurseries will also reopen. Healthcare officials warn of a rushed relaxation of rules and the elevated risk of a new global infection wave as a result. Daily confirmed Covid-19 infections are reaching all-time highs, a development ignored by the public. With risks rising and economic data likely to remain depressed throughout 2020, the GBP/CHF is positioned for rejection by its short-term resistance zone located between 1.1891 and 1.1941, as marked by the red rectangle.

Limiting the downside potential is the increased activity by the Swiss National Bank, wary of the safe-haven status of the Swiss Franc, and the negative impact a stringer currency has on its vital export industry. SNB President Jordan acknowledged the central bank's balance sheet is massive at over CHF800 billion, exceeding the total output of the Swiss economy, but confirming the desire to expand it further. The descending 61.8 Fibonacci Retracement Fan Resistance Level is expected to pressure the GBP/CHF into its support zone located between 1.1725 and 1.1773, as identified by the grey rectangle. More downside is possible, with the 38.2 Fibonacci Retracement Fan Support Level already below this zone, but direct market interference by the SNB makes a breakdown extension improbable.

GBP/CHF Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.1885

- Take Profit @ 1.1735

- Stop Loss @ 1.1935

- Downside Potential: 150 pips

- Upside Risk: 50 pips

- Risk/Reward Ratio: 3.00

A breakout in the Force Index above its ascending support level, serving as resistance, followed by a sustained move into positive territory, is favored to result in a push higher in the GBP/CHF. The Bank of England is rumored to expand its bond-buying program next month, and sideline the SNB in the short-term. It may create conditions for price action to challenge its intra-day high of 1.2118, the previous peak before a massive sell-off.

GBP/CHF Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 1.1985

- Take Profit @ 1.2115

- Stop Loss @ 1.1935

- Upside Potential: 130 pips

- Downside Risk: 50 pips

- Risk/Reward Ratio: 2.60