EUR/USD Bullish correction attempts last week's trading culminated by the rise towards the 1.1018 resistance, the highest level in a month, before closing the week's trading around the 1.0980 level. What supported gains of the pair was not the strength of the Euro, but investors retreat from buying the US dollar as a safe haven, amid a general risk-on trend in the markets. Gains may be greatly affected by the renewed accusations between the two largest economies in the world over the cause of the Coronavirus, which paralyzed the global economy. US President Donald Trump's comments have raised concerns about new trade tensions between the United States and China.

US President Donald Trump said he hoped that the total number of COVID-19 deaths in the United States would be less than 100,000, despite admitting that it was "a terrible number." But he said "millions of lives may have been saved" by closing the economy. In Washington State, where the first American case of COVID-19 was confirmed in January, Governor Jay Insley said on Friday that he is extending the home stay system in the state until at least May 31 and that he will ease restrictions in four phases. Millions of workers around the world spend their annual holiday at home trying to prevent the outbreak further, and as a result, companies and factories have been closed, and the length of the closure has paralyzed the US economy.

This week, there will be the important US jobs report for April, in the depth of the outbreak in the United States, and many are awaiting the details of this important report. With millions registering for unemployment claims, we are expecting to see disastrous numbers for the American labor market, the loss of millions of jobs, and a record and historic rise in the US unemployment rate, and certainly a decline in average wages. Projections indicate that American unemployment may reach 16-20%. The results will have a strong and violent impact on the pair.

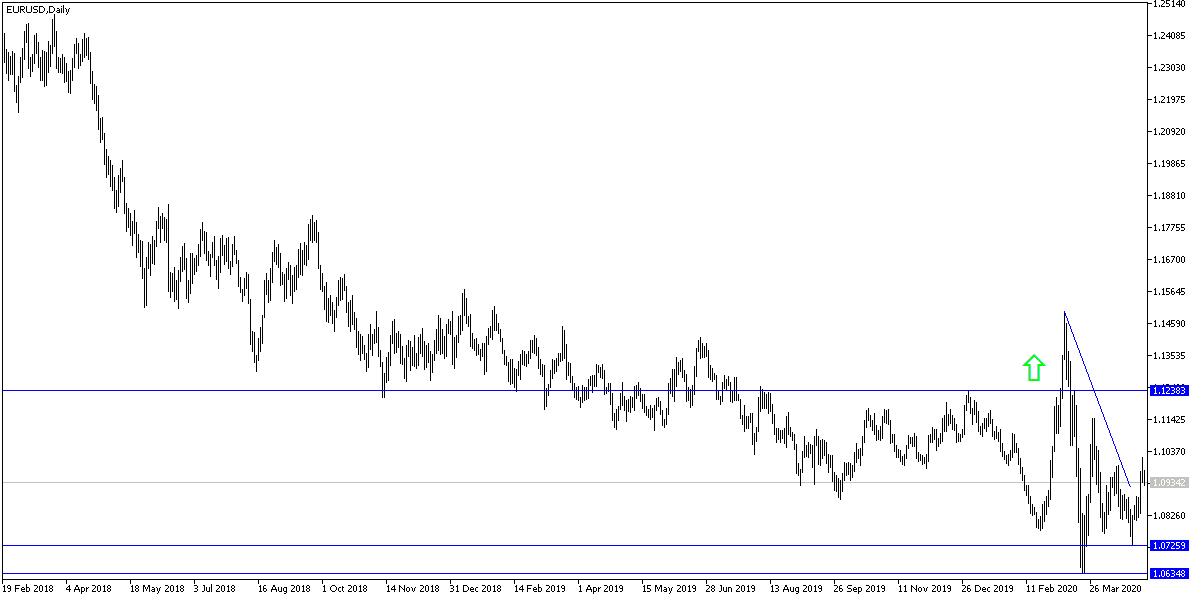

EUR/USD technical analysis

The Euro will react significantly to the outcome of the German Constitutional Court ruling on the legitimacy of the European Central Bank's quantitative easing program (ECB). The decision is expected to be issued sometime on Tuesday. As for economists, they do not expect the court to decide that the public sector purchase program (PSPP) of the European Central Bank violates the German constitution. Such a move could lead to serious market turmoil as well as an unprecedented clash between German law and European Union law.

According to the technical analysis of the pair: Stability above the 1.1000 psychological resistance will motivate the bull’s control, and investors will need to confirm the reversal of the general trend if it succeeds in moving towards resistance levels 1.1065 and 1.1130 respectively. As I mentioned in recent technical analyzes, the 1.0800 support level will remain a strong support for the bear's control again. The general trend of the pair on the long term is still downward, and I still prefer selling from every upper level.

As for the economic calendar data today: From the Eurozone, the Manufacturing PMI reading will be announced alongside the economic outlook report.