The series of negative US economic data results has not ended yet. The beginning was recently with the announcement of further collapse of the American labor market, followed by the sharp decline in US inflation levels represented in the announcement of CPI and PPI readings. Despite this, the demand for the US dollar by investors remained strong, which explains the continued decline of the EUR/USD pair despite the results of these issues. The pair's losses recently reached the 1.0811 support level and the correction attempts did not exceed the 1.0885 and 1.0896 levels for two trading sessions, respectively.

What contributed to USD gains this time was yesterday’s statements by the Governor of the US Federal Reserve, Jerome Powell, which excluded the hypothesis of negative interest rates soon. Speculation has increased sharply ahead of Powell's speech on Wednesday that some kind of gesture will be given to the possibility of introducing negative interest rates in the near future, a result some analysts said would likely curb the dollar's rally.

However, Powell instead insisted that the Fed's ambitions had limits, as the headline and the ensuing responses were used on expectations of canceling the negative interest rates idea. Speaking at the Peterson Institute for International Economics (PIIE), Powell said that the scale of the economic crisis unfolding in the United States and around the world was greater than anything it had seen since World War II, but in the end, there were limits to what the Fed could do to ease the situation.

Powell's said: "The burden has fallen considerably on those who are less able to afford it ... as nearly 40 percent of families earning less than $40,000 a year lost a job in March. This turn around in economic wealth caused a level of pain”. And added: "The scope and speed of the economic downturn doesn’t have a recent precedent," and there is a risk that "the passage of time can turn liquidity problems into problems of solvency."

Powell also said that restoring the US economy to its feet would likely require more action by the government, noting that "the Federal Reserve has lending powers, not spending powers." Powell indicated that a government policy proposal may be required to help the economy, "additional financial support may be costly, but it is worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery."

And while Powell did not refer to negative US interest rates in his specific speech, he did address the problem in the question-and-answer session that followed, saying that a downgrade to negative is not something that is considered in all importance. Powell's messages on the case back up what other Fed members have said on the issue, indicating that the likelihood of this happening is minimal.

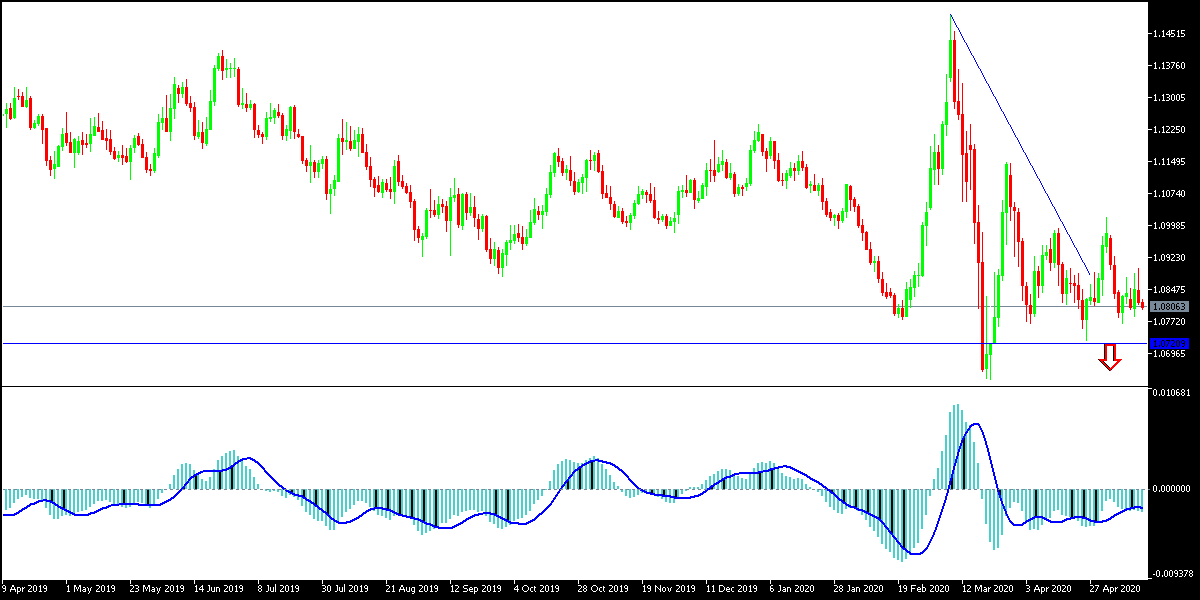

According to technical analysis of the pair: The EUR/USD is trying hard to avoid breaking the 1.0800 psychological support, so as not to exceed selling of the pair, but this may happen in the near time in light of the continued variation of economic performance and monetary policy between the Eurozone and the United States which will ultimately be in the interest of the dollar. Bears dominate performance is still the strongest and is currently closest to testing support levels at 1.0785 and 1.0700, the last level is ideal for buying. As I mentioned before, I confirm now that there will be no shift in the general trend without moving towards 1.1000 resistance.

From the Eurozone, the German consumer price index and the European Central Bank's monthly report will be announced. Then, at a later time, it will be announced that US jobless claims will be read.