For four consecutive trading sessions, the EUR/USD pair continued to correct downward, with losses that reached it to the 1.0781 level of, the lowest level in two weeks ago, before settling around the 1.0795 level in the beginning of Thursday's trading. The pair was subjected to many pressures, with the European economic setback due to the outbreak of the Corona epidemic, as the European stimulus weakness to face the crisis led to the judicial intervention by the largest economy in the Eurozone to hinder stimulus plans carried out by the European Central Bank. In addition to increasing investor appetite for the US dollar as a safe haven, with renewed tensions between the United States of America and China.

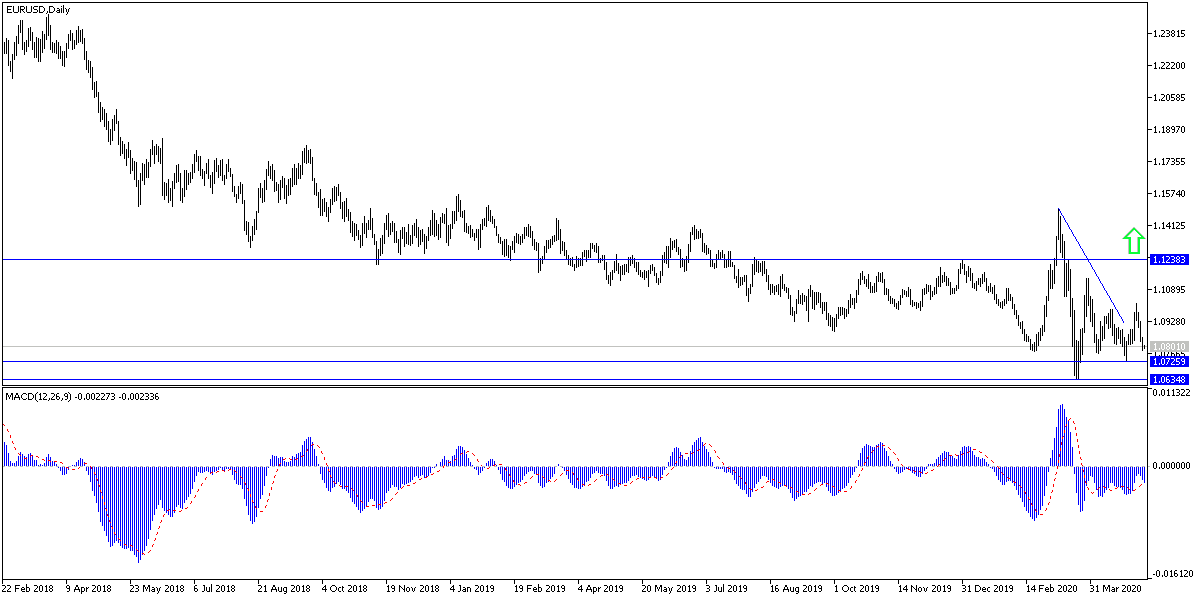

The European single currency fell again to the 1.08 psychological support, after failing to maintain gains at 1.10 in the beginning of the week’s trading, which kept it away from the market’s expectations to rise to 1.12 dollars in the middle of the year. By end of June. Previous expectations were that the EUR/USD pair could reach $1.15 by the end of the year.

The Euro is still suffering from the German Federal Constitutional Court’s decision on Tuesday that the European Central Bank “has not evaluated or demonstrated that the measures stipulated in these decisions meet the principle of proportionality,” when it launched its first quantitative easing program in 2015. The European Central Bank replied to the decision With reference to a previous ruling of the European Court of Justice regarding the veracity of those decisions.

The German Federal Constitutional Court gave the German Central Bank a feasible way to withdraw its participation from the quantitative easing program of the European Central Bank if the Frankfurt-based institution cannot prove within three months that it has evaluated and found that its own procedures are proportionate at that time. This conflict may hamper the bank's plans to cope with the economic shocks caused by the rapid spread of the Coronavirus, which has turned Europe into a hotbed for the disease, forcing governments to pursue a strict closure policy.

Economists believe that the European Central Bank has three months to answer ... and persuade. And if it fails, then it will be a problem, not only for PSPP, but also for PEPP (Pandemic Emergency Purchase Program) and Eurozone. The matter may go far beyond monetary policy, and threatens the future of the European Union and the currency bloc.

The European Central Bank’s controversial quantitative easing program is under threat at a time when the bank’s relevant interventions in the bond market are proving crucial. The dispute came this week at a time when Italy and Spain took their first initial steps to end the "closure" and join an increasing number of other countries on the continent despite the absence of any sign of the promised European "recovery fund" that will now be agreed only as a next step is the EU’s multi-year budget which can take more months to put online, closely followed by some of the worst growth numbers in the economies in living memory and amid signs that new US-China tensions may be in preparation.

According to the technical analysis of the pair: On the daily chart of the EUR/USD pair, bears has a stronger control of performance, especially with the movement below the 1.0800 psychological support, and despite technical indicators reaching oversold areas, the pressure on the Euro is stronger and prepares for bigger losses. The closest of them is currently 1.0765 And 1.0690 and 1.0600 respectively. And there will be no chance for a bullish correction without returning to the 1.1000 resistance after the German decision. The Euro may remain under pressure until a convincing response from the European Central Bank to this.

As for the economic calendar data today: The industrial production rate will be announced from Germany and France, and later, statements by the governor of the European Central Bank. During the American session, unemployed claims, non-farm productivity and the cost of employment data will be released.