The EUR/USD currency pair deepened its losses, reaching towards the 1.0825 support before settling around the 1.0840 level at the beginning of Wednesday’s trading. Adding to the pressure on the European single currency recently, was investor increased anxiety after a court ruling raised uncertainty about whether Germany would be able to continue to participate in the European Central Bank's quantitative easing program (QE). As the Constitutional Court in Germany decisively canceled what was a temporary improvement in the market appetite for the Euro, and the currency pair gave up recent gains, which came in response to a proposal from the European Central Bank that it would stand behind the “marginal” bond markets if falling prices and high returns hampered efforts to support financially weak economies in Southern Europe.

The Supreme Court of Germany requested more information about the way in which quantitative facilities are implemented, to clarify their compatibility with German law, and gave the Bundesbank a vital way to withdraw its participation in quantitative facilities if compliance with German law was not confirmed within three months.

However, this QE program is increasingly the only monetary policy game in the Eurozone due to the European Central Bank's key interest rates being lowered to the lowest level.

After the decision, analysts at Saxo Bank see that the ruling of the German Constitutional Court regarding the illegitimacy of some measures of the European Central Bank’s asset-purchase program has sparked new concerns from the European Union, and places a heavy burden on the Euro and the risk appetite on a larger scale. The European Central Bank is increasingly operating as a risk-sharing force by beginning to violate the principles of non-capital-based purchases (according to the size of the member states' GDP), while there is no EU finance ministry or mutual debt. We don’t know if this is the spark for the exciting new pressure on the European Union again, but it certainly puts the feet of European Union politicians on fire.

Unless the European Central Bank proves over the next three months that its actions are proportionate, German Bundesbank participation in Eurozone policy processes such as QE may stop. Given that quantitative easing is increasingly becoming the only tool of the European Central Bank monetary policy, it can be said that non-participation leads, in a circular fashion, to something like the half-entry and half-exit method for Germany from the Eurozone. The country has long been the largest subscriber to the European single currency.

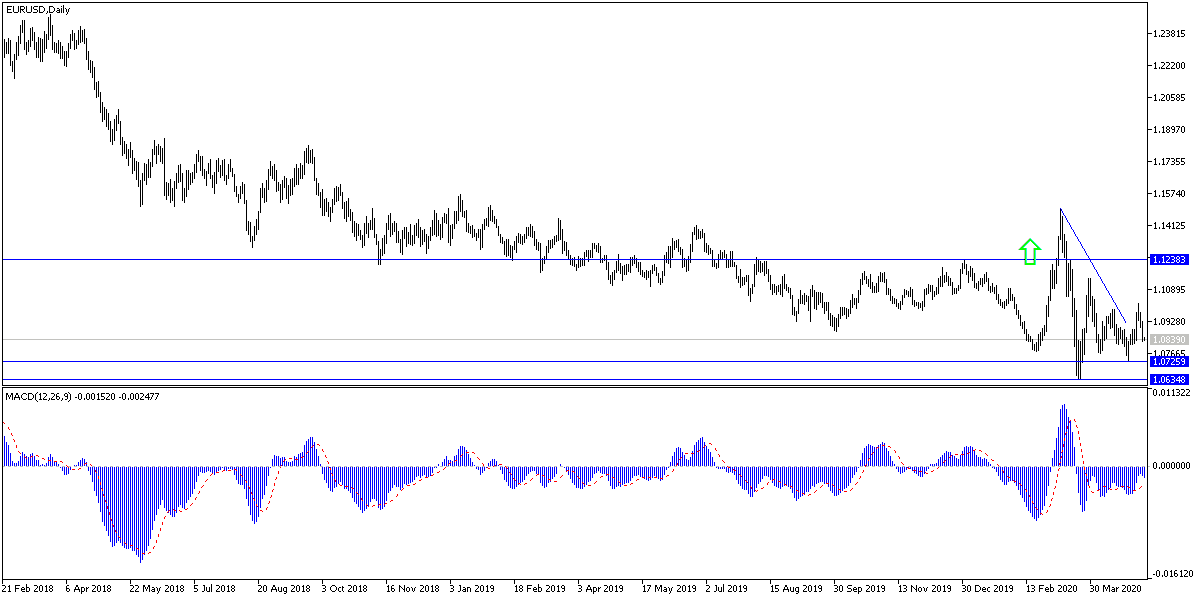

According to the technical analysis of the pair: The EUR/USD approaching the 1.0800 psychological support will increase the bear's control of performance for a longer period of time, and therefore the pair was exposed to pressures that push it towards stronger support levels. The closest support levels are currently 1.0800, 1.0745 and 1.0660, respectively. The further the pair away from the 1.1000 psychological resistance, the stronger bears control will remain. I still prefer to sell the pair from every upper level.

As for the economic calendar data: The beginning will be with the announcement of German factory orders, then the services PMI reading for Eurozone economies, and the retail sales figure for the block. From the United States, ADP measure of the change in the number of non-farm jobs will be announced.