For the second day in a row, the EUR/USD continues the bullish correction with stronger gains that pushed it towards the 1.1030 resistance, the highest level of for nearly two months, before settling around the 1.1000 level in the beginning of Thursday's trading, and before the announcement of a package of important and influential US economic data. Yesterday's gains in the European single currency came with support from the announcement of long-awaited European stimulus plans. Investors welcomed the European Commission’s proposals to fund the Corona Recovery Fund, but the community is divided on its outlook and some have warned that the Euro may soon change course.

European Commission President Ursula von der Leyen will propose a historic increase of 750 billion euros (677 billion pounds) to the Executive Board’s budget to finance a mix of grants and loans to help European Union members pull their economies out of the Covid-19 virus. The details were posted in a Tweet by European Economic Commissioner Paolo Gentiloni before a letter from von der Lin to the European Parliament.

The plan will be funded by borrowing by the European Commission from the market, which is unprecedented and rare. It expands last week's French-German proposal for grants worth 500 billion euros. France and Germany’s proposal was met with rejection from the northern European Union members, who over the weekend opposed a 500 billion Euro loan package.

While citizens across Europe are slowly returning to work, students gradually moving away from the Internet and returning to the classroom, the hardest hit countries such as Italy and Spain remain in dire need of money and want to avoid any long-standing hassles. But it is unlikely that everyone will welcome the new plan. European Commission President Ursula von der Leyn told European Union lawmakers as they unveiled the plan: “Our unique model, which has been built over 70 years, has been challenged as never before in our history. This is the moment for Europe. Our desire to act must be at the level of challenges that we all face. ”

Von der Lein added that the fund - which is called the next generation of the European Union and must have the support of every country - "provides an ambitious answer," and urged European countries to allocate their divisions on budget on the way forward. She said: "Either we all go alone, we leave the countries, regions and people behind, and we accept a union of who possess and those who do not possess, or take this path together, and take that jump forward. For me, the choice is simple, I want to take a new bold step together. ”

To fund this move, the committee suggests borrowing money from financial markets. The European Union's executive arm has a triple credit rating and says it will give it access to very favorable loan terms and moderate interest rates. Repayments will not begin before 2028, with the full amount due after 30 years. The funds raised will go to the next EU long-term budget, which starts on January 1 and runs through December 31, 2027. After that it will be directed to a series of programs beneficial to the economies of member states.

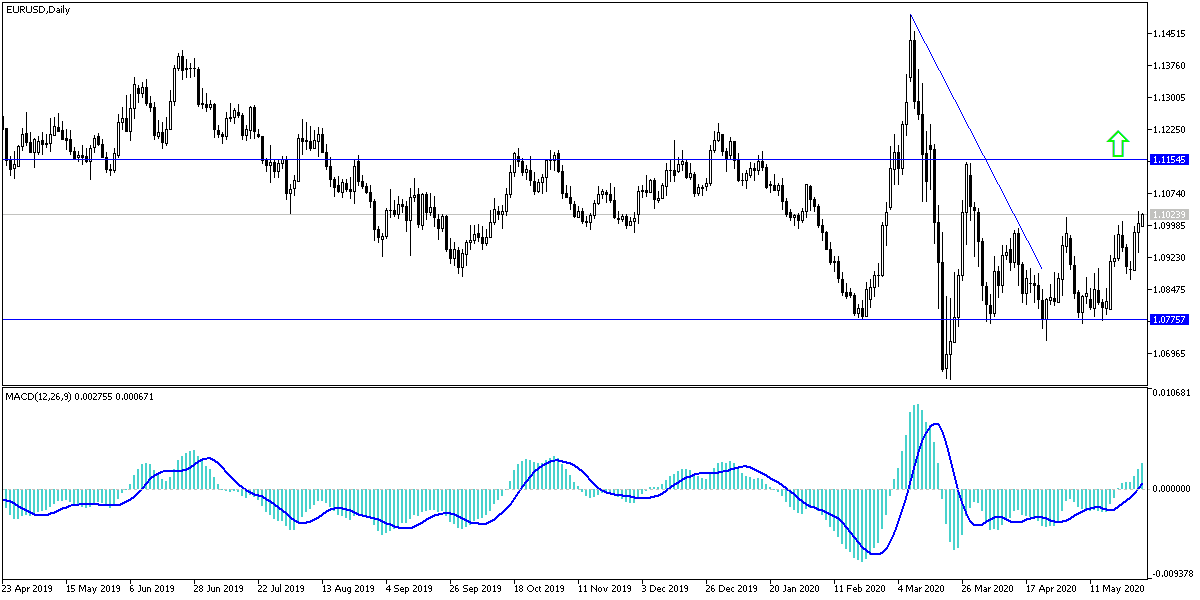

According to the technical analysis of the pair: As I mentioned before that the EUR/USD holding at 1.1000 psychological resistance will give bulls a strong motive to correct the general trend stronger towards the decline. The pair will need to move towards stronger resistance levels to confirm the strength of the reversal, and the closest current levels are 1.1060 and 1.1135 respectively. On the other hand, a move towards the 1.0945 and 1.0880 support levels will give the bears the power of control again.

As for the economic calendar data today: From the Eurozone, the German and Spanish consumer price index will be announced. During the US session, the important US GDP growth rate, jobless claims, durable goods orders and pending home sales will be announced.