With gains of more than 100 points, the EUR/USD pair succeeded in correcting upwards with gains reaching the 1.0995 resistance, and close to the 1.1000 psychological resistance, amid an improved investor risk appetite and abandoning the US dollar as a safe haven, coinciding with the global economies' willingness to end some of the economic closures, along with the increasing news that a pandemic vaccine is coming soon. Despite its gains, the Euro remains vulnerable to losses in the coming weeks, in light of more political and economic risks. Market activity increased after the end of the long holiday in Britain and the United States.

European single currency gains increased amid more loosening of “closure” restrictions in some European countries, along with the suggestion made by ECB policy maker Francois Villeroy that more monetary easing would be rolled out soon, and the IFO survey showing the sentiment between 9,000 German companies are better than expected. Nevertheless, analysts at Bank of America still expect the Euro to decline from the 1.0977 level to the 1.0500 level in the coming weeks, amid a series of pressure factors, including weak global outlook, more severe economic stagnation in the Eurozone compared to the United States, Eurozone policy constraints, peripheral sovereign risk, and the long position of the Euro market.

All of this came after France and Germany surprised the markets with a proposal for the European Commission to borrow 500 billion Euros (447 billion pounds) in order to be able to provide grants to weaker members who were most affected by the virus and are struggling to cover the cost of closing the national economy without adding significantly to their debt to GDP ratios, but they risk a destabilizing rebellion in the bond markets. The Euro has a negative relationship with "margin" returns, which rise when investors are upset.

The Franco-German proposals will only limit the extent to which the Coronavirus crisis exacerbates the unsustainable debt dynamics of southern Europe, assuming that it has not been “mitigated”. The upcoming EU leaders’ meeting will determine the fate of this important initiative. If successful, the fund could bolster the recovery of the bloc and the severely depleted Crisis Kit, but it requires the unanimous approval of European Union leaders at the European Council meeting on June 18-19, while some have already voiced objections. The counter-proposals came from Austria, Denmark, the Netherlands and Sweden over the weekend, calling for loans instead of grants and a two-year time limit for the program. The European Commission is due to present its own ideas, which are based on the Franco-German proposal, this week.

June is shaping up as a fateful month for European currencies and perhaps even global financial markets if the growing tensions between the United States and China reach their climax. The Euro often follows the Chinese Yuan. Next month’s European Council meeting will see Prime Minister Boris Johnson choose between extending Brexit and giving up on talks in favor of the new preparations for 2021 “no-deal Brexit.”

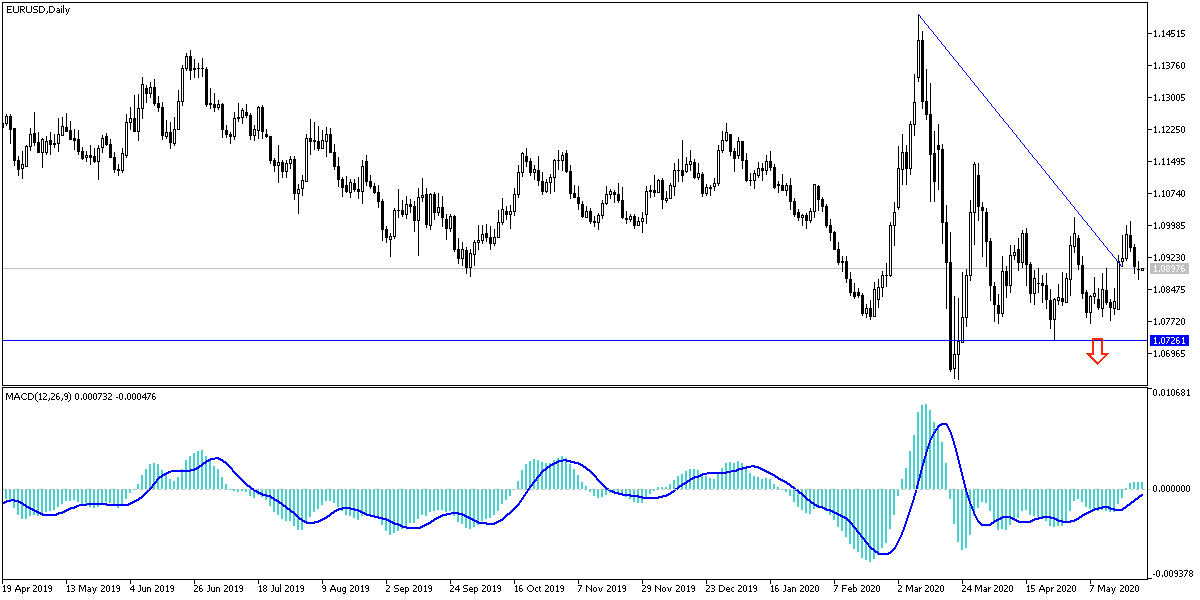

According to the technical analysis of the pair: the EUR/USD’s bullish momentum will increase with the stability of the pair above the 1.1000 psychological resistance, which is the closest to it now. This resistance shows a new break of the downtrend on the daily chart. Returning to the vicinity of the 1.0895 support will restore the bear's strength again. In general, I still prefer to sell the pair from each upside level and the nearest resistance levels are now 1.1025 and 1.1100, respectively.

As for the economic calendar data today: There are only comments from the governor of the European Central Bank, Lagarde. There are no significant US economic data.