A quiet start to the EUR/USD pair in a limited range between the 1.0870 support and the 1.0914 level, despite the announcement of a positive German IFO index reading. The results of economic data showed that a leading indicator of German business expectations rose up in May as more companies and economic activities reopened - but the index remained well below normal readings as Germany faces a long journey towards a full recovery from a slowdown caused by the Corona epidemic.

The revised official figures published separately on Monday showed that the German economy has now recorded two consecutive quarters of lower production, which confirms the technical stagnation of the largest economy in the Eurozone.

The IFO institute, which is based on corporate polls, rose to a reading of 79.5 from 74.2 in April, a strong increase but still much lower than usual. Commenting on this, IFO President Clemens Voest said: "The gradual easing of the closures provides a ray of hope". Also in this regard, Karsten Brzezsky, chief Eurozone economist at ING, said in a research note that “IFO today is repeating more signals in real time that economic and social activity has started to rise significantly since the first lifting of the closure measures in late April”.

He added that the rise from its historical lows was "very welcomed" but "there is no reason for complacency or even arrogance". He said that the German economy is unlikely to return to its pre-crisis level before 2022, even if there is no second wave of the virus outbreak.

Official statistics released yesterday confirmed a previous reading that the German economy contracted - 2.2% in the first quarter compared to the same period in 2019. This was the biggest quarterly decline since the 2008-2009 global financial crisis. The more detailed figures in the second edition showed that private consumption and exports were the most affected. Investments in the engineering, construction and public spending sectors have helped prevent a further slump.

The numbers revised growth in the last quarter of 2019 to minus 0.1%, which means that the country has recorded two consecutive quarters of lower production. And the second quarter numbers must show a deeper regression because the first quarter numbers only took part of the closing time to contain the spread of the epidemic.

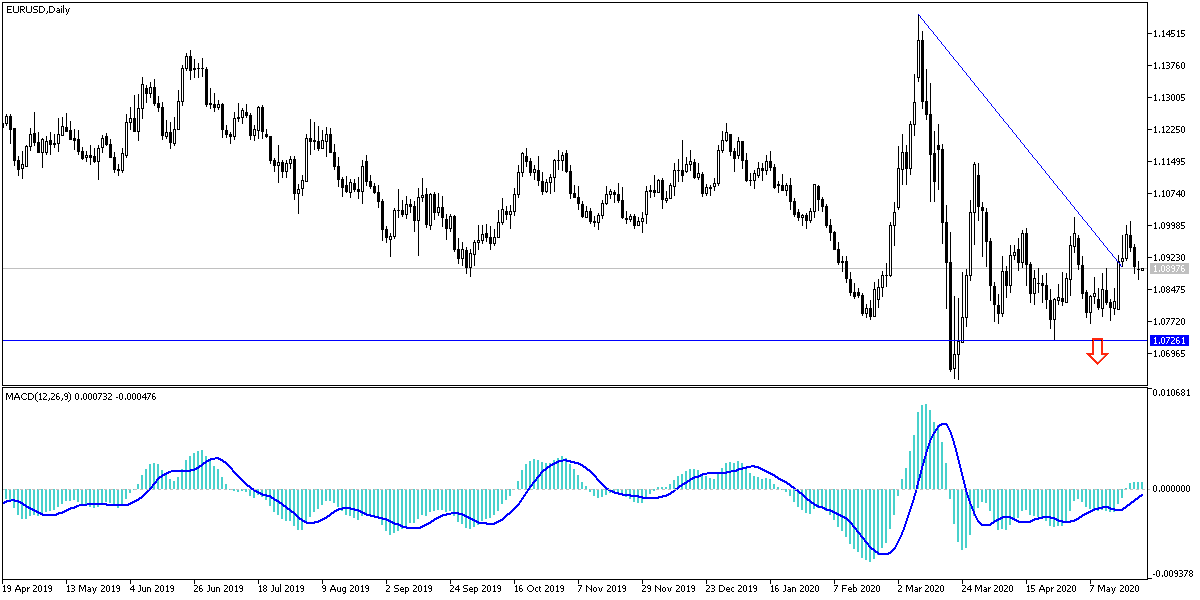

According to technical analysis: There is no change in my technical view towards the EUR/USD pair, as the general trend is still bearish and the recent attempt for a bullish correction has been unsuccessful as long as it did not hold above the 1.1000 psychological resistance. Approaching the psychological support level of 1.0800 continues to support the bear's control. The divergent economic performance and monetary policy between the United States and the Eurozoneis still in favor of the pair’s weakness for a longer period. Therefore, I still prefer to sell the pair from every higher level.

As for the economic calendar data today: First, the German GFK Survey will be announced. During the US session, the important US consumer confidence and new home sales will be announced.