A new attempt by the bulls to push the EUR/USD pair to breach the 1.1000 psychological resistance, which supports the last correction, but gains stopped around 1.0998 before settling around 1.0975 at the beginning of Thursday's trading. The pair benefited from the drop in the USD, even if temporarily. Losing momentum for the Euro, despite massive stimulus attempts, may support the pair staying stuck between the 1.0800 support and 1.1000 resistance for a while. Forex traders recently focused on buying the Euro and benefiting from the optimism that prevailed in the markets recently from the German and French agreement to stimulate European countries and economic sectors that were severely affected by the rapid spread of the Coronavirus.

In addition to stimulus plans, investor’s risk appetite has increased, as investors are enthusiastic about hopes that the vaccine against the virus will put an end to the disease that has killed thousands and paralyzed the global economy as a whole.

The Franco-German Agreement seeks to support the bloc's political future by providing grants instead of loans to the most vulnerable members who are due to the virus, which will help them cover the unprecedented cost of national economic closures used to contain the coronavirus, without directly adding to their debt and GDP and risk destabilizing rebellion in the bond markets. This idea comes from the governments of France and Germany after weeks of cruelty in Europe, where countries of the south criticized for the apparent lack of "solidarity" at the height of the coronavirus pandemic, which struck the heavily indebted "parties" and financially weak, more than what hit the northern countries.

The European Recovery Fund could have significant and long-term effects on the bloc, but it will face obstacles in the coming weeks, particularly because it needs to obtain unanimous approval in the European Council, where some northern members may oppose the idea of members to member’s grants instead of loans. Some in the North have always opposed exchanging debt, which would oppose the foundations of the European Union’s finance ministry, although many have long said that it is necessary to ensure the sustainability of the Euro and the European Union.

Economic data yesterday showed that consumer confidence in the Eurozone recovered slightly in May as several countries in the single currency bloc started to ease restrictions imposed during the closing period to slow the spread of Coronavirus. Accordingly, the Eurozone Consumer Confidence Index rose to -18.8 from -22.7 in April. Economists had expected more weakness to -24. The corresponding index for the European Union rose to -19.5 from -22 in the previous month. However, both indicators remained well below their long-term averages at -11.1 and -10.4, respectively. The European Commission is to publish the detailed data, along with the results of the full business and consumer survey, on May 28.

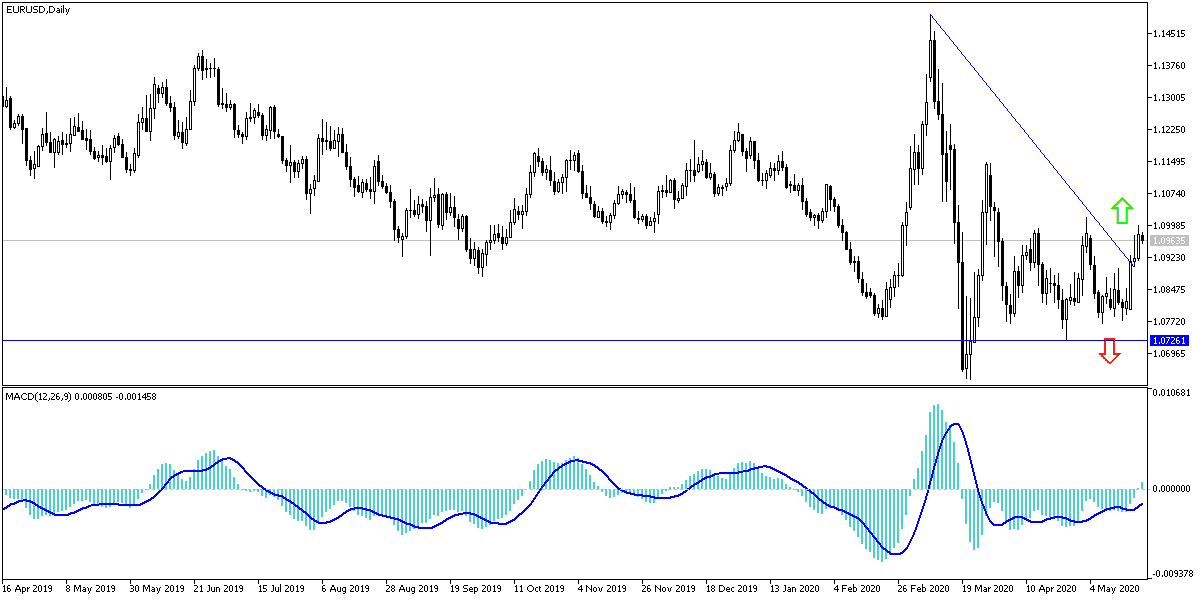

According to technical analysis of the pair: There is no change in my technical view of the EUR/USD as bulls await the move to breach the 1.1000 psychological resistance to confirm their control over the performance, and push the pair to higher resistance levels. The pair will remain in a narrow range until the European approval of the German-French initiative to stimulate the European economy in the face of the devastating effects of the Corona pandemic. Despite the recent optimism, the general trend on the long term is still particularly bearish, in case the pair returns to the 1.0800 psychological support, gains are still facing risks of the German-French initiative rejection. Therefore, I still prefer to sell the pair from every upper level.

As for the economic calendar data today: All focus will be on announcing the PMI reading for the Eurozone industrial and services sectors in the era of the economically devastating Corona epidemic. Then at a later time the announcement of the US session data, which contains unemployed claims, Philadelphia Industrial Index, Industrial PMI and the existing US home sales, and later statements of the Federal Reserve Governor, Jerome Powell.