EUR/USD gains for the 3 consecutive sessions culminated by testing the 1.0975 resistance, the highest level in 2 weeks, before settling back around the 1.0920 at the begging of Wednesday trading, and before the announcement of the Eurozone inflation figures. The Euro lost the recent momentum that was a result of the European Recovery Fund led by Germany and France. Tensions between the U.S and China overshadowed the recent optimism. The pair jumped above the 1.09 resistance after receiving support from a sudden French German agreement to provide the European Commission with extra budget resources to aid continental recovery out of Covid19 crises. In addition to that, investors got support from reports of advancement made by the American bio-tech company, Moderna, in developing a vaccine that would eliminate the pandemic, which pushed stocks and risk currencies higher since the beginning of this week’s trading.

European tension resumed, as the Patriots North European leaders continue to oppose the idea of the French German Recovery Fund before the European Summit in June, when the details of the funds were supposed to be discussed. The fund aims to provide members with grants from the European Commission’s budget instead of loans, in an attempt to reduce burdens on national budgets. This means that the European Institutions have covered close to 10% of the block’s GDP to support the most affected members.

Yet, Austria, Netherlands, Denmark and Sweden all opposed the idea of grants instead of loans, and will present their alternative proposals for the fund. North Europe always opposed debt exchange, but South Europe is severely damaged by the virus and was under debt burdens, so some of these countries had to seek help from Europe. Disagreements around the best way for a group response caused a negative effect on the Euro.

On the American side, President Trump threatened on Tuesday to pull the U.S out of the World Health Organization if they don’t commit to “Fundamental Enhancements” on the way they work in the next 30 days, after accusing the organization of affectively aiding China’s alleged attempts to cover up for the initial steps of the outbreak. Trump tweeted the his threat over twitter hours before the WHO vote on a decision for an independent review of the coronavirus outbreak, including the origins of the virus, which is something that China have made clear attempts to cover up.

The U.S, China and other countries exchanged accusations regarding the responsibility of the outbreak through the WHO, only days after president Trump told Fox News: “We can cut all relations with China” and with increasing trade tensions again.

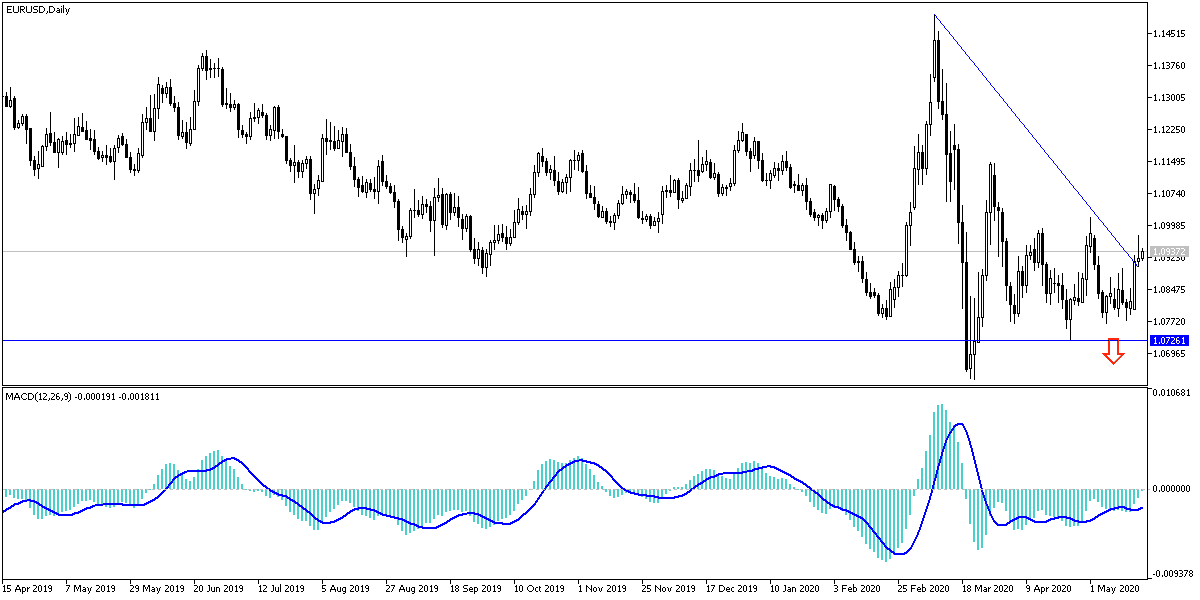

According to technical analysis: EUR/USD gains were on the verge of the second resistance to confirm the upward correction power, which was at 1.1000, but failed again this time, and will still have a chance by stabilizing above the 1.0920 resistance.

As previously expected, I now confirm that the pair’s returning to the 1.0800 psychological resistance area confirms the bears short term as well as long term control.

As for economic data today: Focus will first be on the inflation and current account numbers from the Eurozone. During the U.S session, focus will be on the Fed’s Reserve last meeting minutes.