In the beginning of this week’s trading, the EUR/USD pair gained momentum to achieve gains after a longer period of losses, and extended its gains towards the 1.0926 level after abandoning the 1.0800 psychological support, even if temporarily, and started trading today, Tuesday, stable around the 1.0910 level. The pair's first support came from Fed Chairman Jerome Powell, who expressed optimism that the US economy could start recovering from the devastating recession in the second half of the year, assuming that the coronavirus will not spread in a second wave. But he suggested that a full recovery would not be possible before a vaccine arrives to completely eliminate the disease.

The additional momentum for the Euro was from decisive steps taken towards a common European financial response to the economic massacres caused by the Coronavirus crisis, which improved investor sentiment towards European assets and the Euro’s exchange rate. The strength of the Euro was supported by the announcement of the details of a French-German plan to provide 500 billion Euros for the economies hit by the crisis.

Under the plan, the European Union's executive body - the European Commission - is allowed to borrow from international markets, confirming the pooling of risks by all European Union countries.

A virtual joint press conference between German Chancellor Angela Merkel and French President Emmanuel Macron witnessed the leaders of the most influential European Union countries, who are committed to distributing money to the European Union, with payments based on contributions to the bloc's budget. The move goes somewhat towards issuing a joint debt, whereby the European Union issues the debt as a whole and distributes it to the worst affected countries. This ensures that beneficiaries receive financing at much lower levels than would be the case if they went to the markets separately.

The move towards a common approach (often referred to as Coronabond) was a long time coming, with much disagreement over the issue of consolidated debt blocking progress, as some members such as the Netherlands and Austria opposed the move. The market has shown that it supports this approach, as evidenced by a broad recovery in the value of the Euro in response to the announced plans.

After the announcement, the value of Italian bonds jumped further since March, ensuring that the yield paid on ten-year bonds (the cost of borrowing) fell by 20 basis points to 1.68%. Also, the risk premium on German bonds, which fell on the impact of the news, narrowed to 216 basis points, the lowest level this month.

Merkel said that the money will be in the framework of the European Union budget, and the European Commission will have the authority to borrow money from capital markets. For his part, Macron said that the distribution will depend on the needs of member states, while the payment will be linked to the sums paid in the blocs' treasuries. "When Germany and France take the initiative, this encourages the process of expressing opinion in the European Union," Merkel said after a video conference. "We will have to work together in order to get out of this crisis."

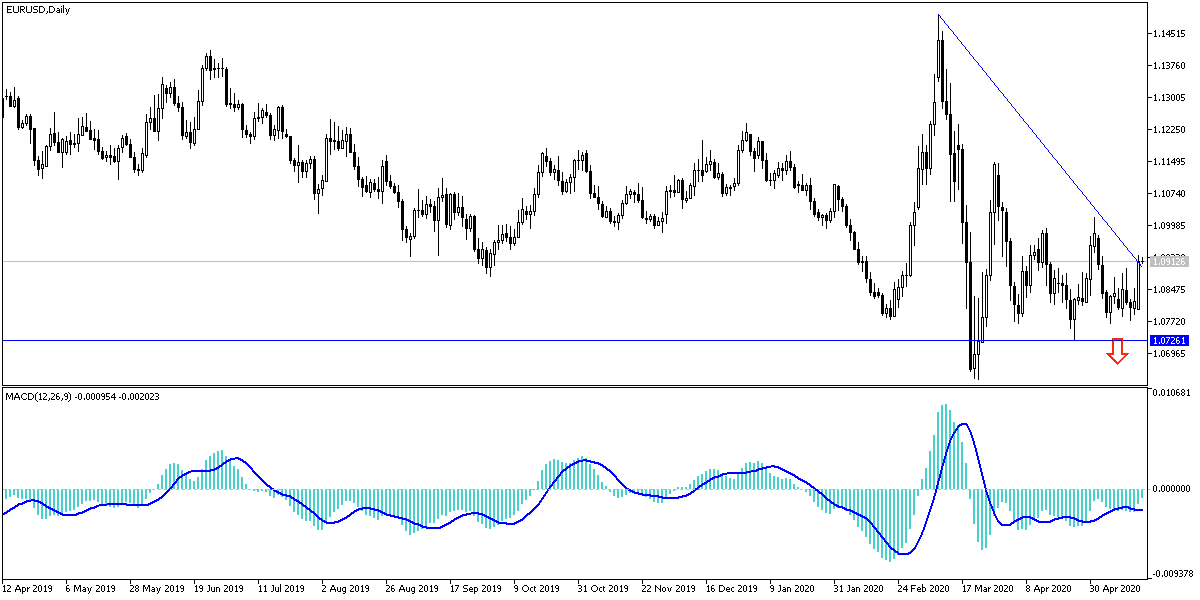

According to the technical analysis of the pair: the recent gains of the EUR/USD are considered a first stage towards an upward correction, and these attempts will be strengthened to move towards and above the 1.1000 psychological resistance. The pair may reach there soon, as markets remain optimistic about the steps of the recent European move. Bears may return to control performance, as is the case on the long run, if the pair returns to the 1.0800 psychological support Again.

As for the economic calendar data today: From the Eurozone, the German ZEW index reading will be announced, and from the United States, building permits and housing starts will be announced. Later, an important testimony by US Federal Reserve Governor Jerome Powell.