Despite the alarming figures from the American economy, the most recent of which were job numbers and yesterday inflation figures, which confirmed the extent of the suffering faced by the largest economy in the world from the outbreak of the Corona pandemic, but the EUR/USD bullish correction attempts did not exceed the 1.0885 resistance before returning to stability around the 1.0847 level in the beginning of trading today, Wednesday. This performance still confirms the weakness of the single European currency. The dollar’s weakness, according to some analysts, and at least for the time being, is a symptom of the risk appetite across the market, even though the weakening sterling was the result of something more sinister. The British currency has now become something of a "sick man of Europe" given that all other major economies are taking steps to gradually exit from the "closure" policies, while the UK is at least three weeks away from a similar move, and the pound is also likely to experience a new bout of sales related to Brexit as well.

The US dollar fell, as along the negative economic releases, many analysts attributed the shift to China's decision to waive tariffs on about 79 US-imported products and increase soybean purchases, in a clear attempt to maintain the “Phase 1 deal” singed in January 2020, that largely ended the trade war between the world's two largest economies.

This comes after President Donald Trump said on Monday that he was "not happy" with China and that he had no interest in renegotiating the agreement, when asked about newspaper reports indicating that some one the ruling Communist Party of China wanted to reopen the talks. The comments came after speculation indicates China's alleged lack of honesty in response to the coronavirus outbreak, which could lead to new customs tariffs on the country's exports to the United States.

The EUR/USD price movement came after President Trump tweeted that negative interest rates should be decided by the Federal Reserve, just days after the beginning of forward interest rate pricing, that negative rates may be in the pipeline. Trump's tweets were ignored, as Neil Kashkari, member of the Federal Reserve Bank, and a number of colleagues in the circle, spoke and gave their views on the exact topic. Where members of the Federal Open Market Committee mostly opposed negative interest rates, although some have warned that their views might change with circumstances.

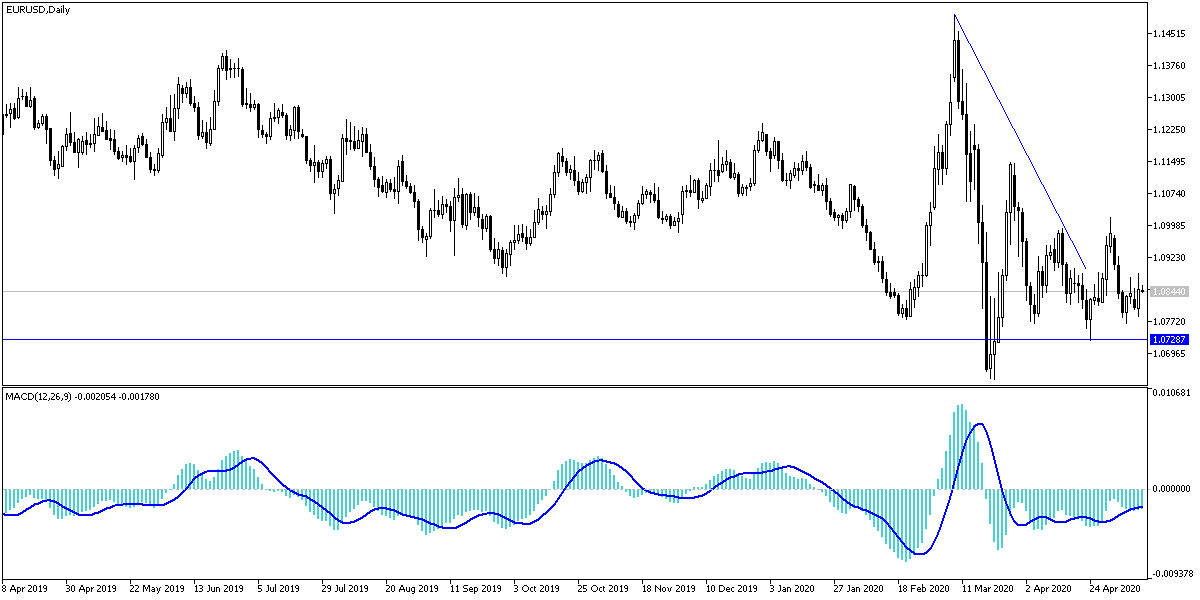

According to technical analysis of the pair: There is no significant change in my technical view of the EUR/USD pair, as the general trend is still bearish with the support of the 1.0800 psychological support, and I still prefer selling from each upward level, and the closest resistance levels for the pair are currently 1.0885, 1.0945 and 1.1020 respectively. The single European currency may continue to suffer for a longer period, as European leaders ignore demands for more stimulus to cope with the economic shocks caused by the Corona virus.

As for the economic calendar data today: The Eurozone industrial production data will be announced. The greatest interest will be in the announcement of the U.S Producer Price Index and upcoming statements by Federal Reserve Governor Jerome Powell.