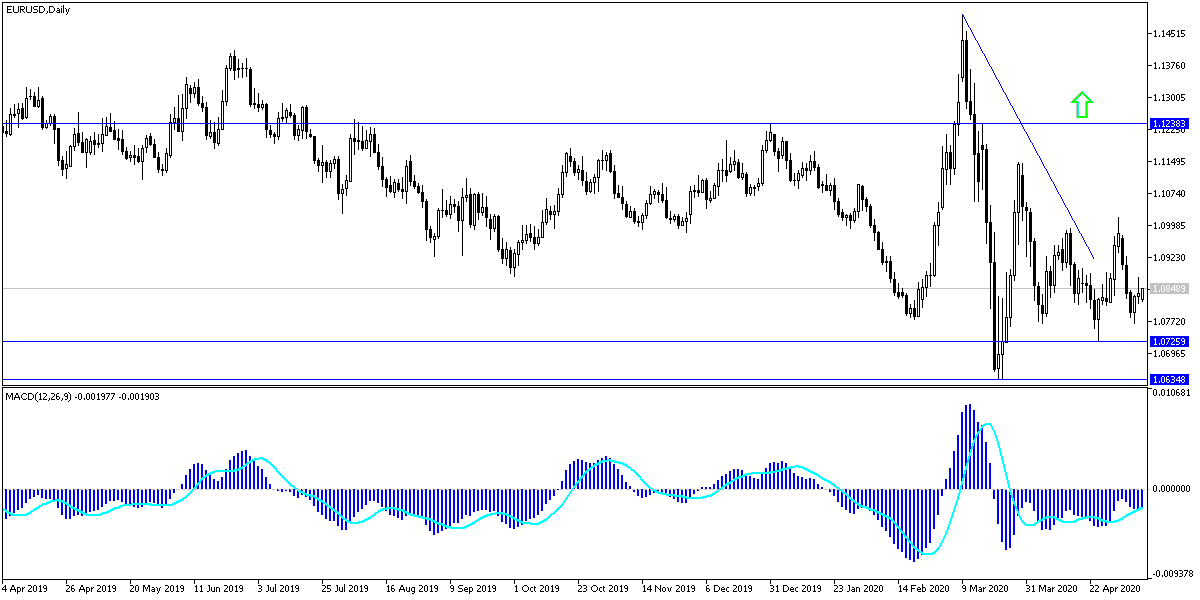

Despite the EUR/USD attempt to avoid more downward pressure benefiting from the weak results of the US jobs report in the Corona era, the trend still supports more losses, as the pair fell towards the 1.0766 support, its lowest in two weeks. Losses of US employment figures pushed it to the 1.0875 level as an attempt to exploit the results, and it began this week’s trading around the 1.0827 level, awaiting investors’ reaction to the latest US data and the numbers of infections and deaths from the Coronavirus with the resumption of the opening of global economies. According to the analysts' view, the pair’s bullish trend may be limited in the face of the increase of political headwinds as Europe remains divided over the face of the crisis.

The US dollar retreated in response to allegations of progress by the United States and China in efforts to implement the Phase1 deal reached in January 2020, which sparked investors’ risk appetite, as well as speculation about a possible shift to negative interest rates by the US Federal Reserve.

Before that, the single European currency suffered a setback from the ruling of the German Constitutional Court, which placed a question mark on the legitimacy of the European Central Bank's quantitative easing program at a time when the central bank was the only source standing between the “terminal” bond markets and unsustainable governmental borrowing costs that could threaten financial stability. For its part, the Supreme Court in Germany gave the Bundesbank - the German Central Bank - a vital way to withdraw its participation in the quantitative easing program of the European Central Bank if the Frankfurt-based institution could not prove within three months that it had evaluated and found that its own procedures were proportionate at the time It launched the bond purchase plan in January 2015. Failure to do so could risk the view of the largest leakage of monetary policy in the bank and disrupt response to the coronavirus crisis.

For economic news. The US unemployment rate hit 14.7% in April, the highest rate since the Great Depression, as 20.5 million jobs disappeared in the worst recorded monthly loss. The figures are stark evidence of the damage the coronavirus has caused to the already devastated economy. The losses reported by the Ministry of Labor reflect what has become a severe recession due to the sudden shutdown of businesses in almost all sectors of the economy. According to the results, all of the US job growth that occurred during the 11-year economic recovery period of the Great Recession, was lost in one month.

The collapse of the American labor market happened at an amazing speed. Last February, the unemployment rate was at 3.5%, its lowest level in five decades, and employers added jobs for a record time of 113 consecutive months. In March, the unemployment rate was only 4.4%.

According to the technical analysis of the pair: The recent EUR/USD retracement gains will be temporary and if it succeeded in achieving stronger gains, even to the 1.1000 psychological resistance, it may be a target to sell the pair again. On the downside, the 1.0800 psychological support is still supportive of the bears controlling performance, as is the case on the long term. I expect a quiet movement for the pair during today's trading in light of the lack of economic important economic issues, both from the Eurozone and the United States of America.