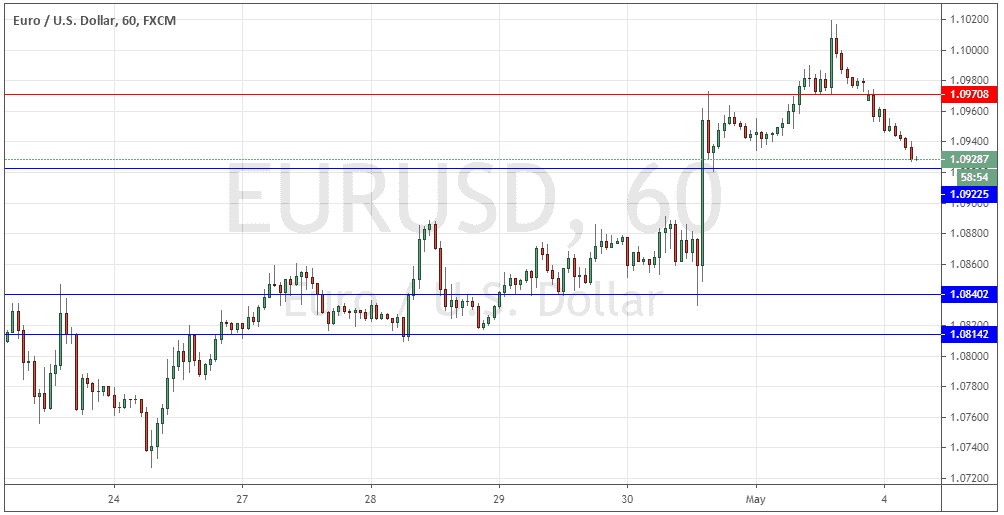

EUR/USD: Pivotal Point @1.0923

Last Thursday’s signals were accurate about support and resistance, especially the support level at 1.0840, but the price bounced so far so quickly from 1.0840 there was no real trade entry set up.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered before 5pm London time today.

Short Trade Idea

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0971.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0923 or 1.0840.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that the day’s action in this currency pair was relatively unpredictable as the European Central Bank would be giving its monthly policy release later. The best approach I thought may be to fade any spike which occurred here just after that release as it touched any key support or resistance level, if it bounced.

This was a great call as the ECB release prompted a move up to the next resistance level at 1.0971 within two hours, and the bearish bounce off that level gave about 50 pips of short trade profit if taken on a shorter time frame.

The picture is more bearish today, as talk of new U.S. tariffs on China plus the beginning of corporate earnings season in the U.S. seems to have finally forced enough focus to send major stock markets tumbling again as the economic impact of the coronavirus pandemic begins to be truly felt. This has strengthened the Japanese Yen most of all, followed by the U.S. Dollar. The Euro has long-term weakness but is not especially weak over the short term.

The price is now close to the support level at 1.0923 which is likely to be pivotal. However, I would not want to take a long trade here even if there is a supportive bounce as it is likely to be a quiet Monday. Standing aside and waiting might be the best action. Concerning the EUR, there will be a release of EU economic forecasts today. Regarding the USD, there is nothing of high importance due today.

Concerning the EUR, there will be a release of EU economic forecasts today. Regarding the USD, there is nothing of high importance due today.