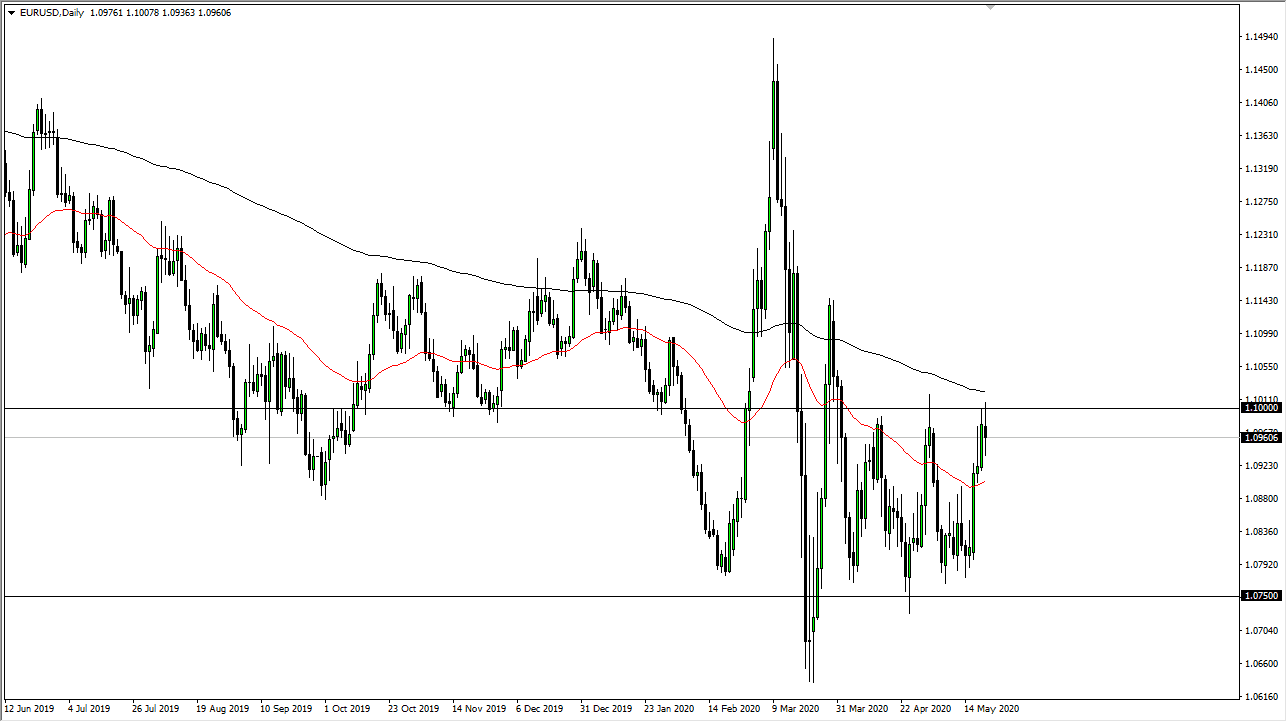

The Euro went back and forth during the trading session on Thursday, as we have seen the 1.10 level cause issues yet again. Ultimately, the market looks as if it is going to continue to try to figure out where to go next, as the candlestick was somewhat neutral with more of a negative slant. What does not show up on the daily chart is that we broke down pretty significantly and rapidly as New York came online, so this is something to pay attention to as the Americans have been extraordinarily optimistic. Having said that, there was a little bit of buying late in the day but ultimately it looks as if we are likely to stay within the same risk range we have been in.

If you have been following my analysis here at Daily Forex for some time, you recognize that the Euro has been bouncing around between the 1.10 level on the top and the 1.0750 level underneath as support. Because of this, and the fact that we failed so dramatically during the trading session, I do not know that much has changed. Furthermore, the 200 day EMA above the wick that makes of the candlestick for the trading session on Thursday as something to pay attention to. Ultimately, it will be interesting to see how this plays out, but I think that we are likely to see a lot of noise more than anything else. That is what this pair does, it chops around sideways for long periods of time.

The market continues to see a lot of noise and certainly the economic background suggests that the US dollar should continue to strengthen in general, but that does not necessarily mean that the market is paying attention to. Frankly, if we were trading on fundamentals at this point the stock market would not be anywhere near where it is. The candlestick is slightly negative, which makes quite a bit of sense considering that the resistance is an area where a lot of traders probably took profit. That being said, if we were to break down below the bottom of the candlestick for the session on Friday, I think it is likely we go looking towards 1.09 level, and then down to the 1.08 level after that. Keep in mind also that the US Treasury market has attract a lot of inflow longer-term, and that does not lift the value of the greenback in general.