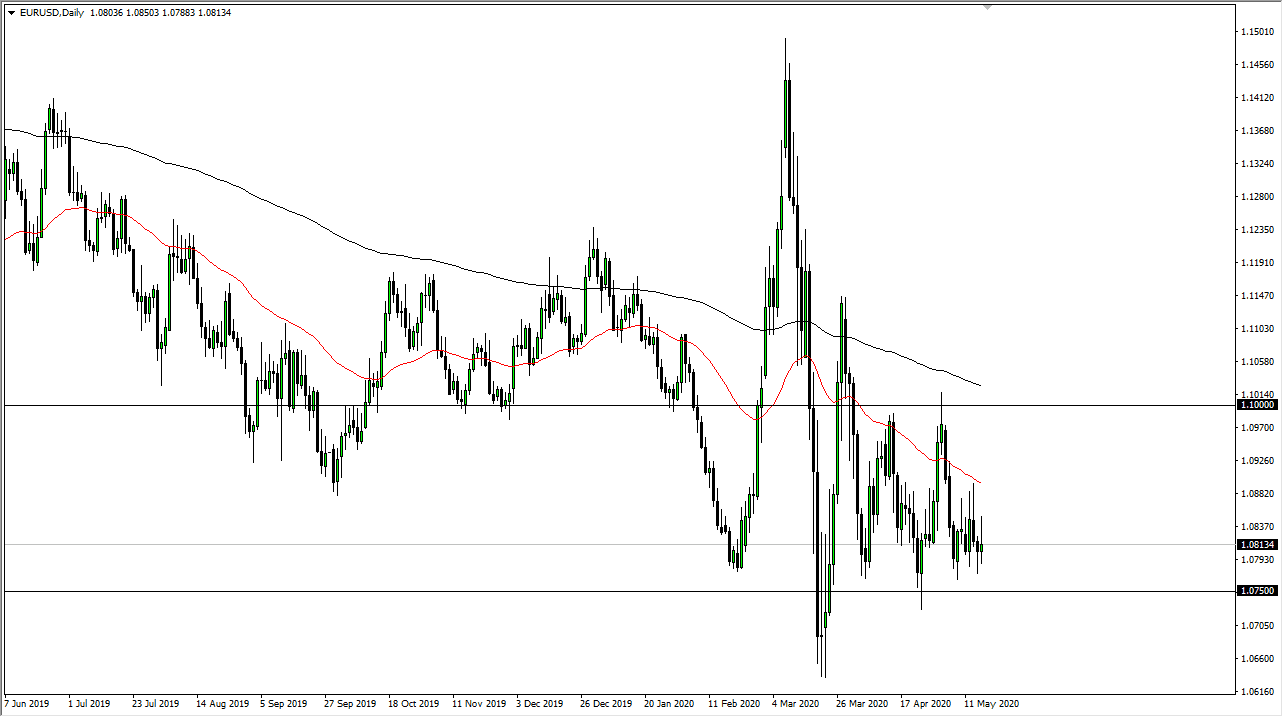

The Euro has gone back and forth during the trading session on Friday again, and as a result it is obvious that the market has been dancing around the 1.08 level. At this point in time, the market is highly likely to continue to see support down to the 1.0750 level. This is a market that quite obviously has a clearly defined range, with the 1.10 level above being massive resistance. Having said that, there is a significant amount of before that level, especially near the 1.09 level which coincides nicely with the 50 day EMA. The 50 day EMA is sloping lower, and that of course suggests that we are still very much in a downtrend.

Keep in mind that the European Union has a whole plethora of issues, and although the United States is not exactly spotless, it is the “cleanest shirt in the dirty laundry.” That being said, it is highly likely that rallies will continue to be sold into, as the US dollar is favored in times of fear. Beyond that, several actions by the ECB lately have people concerned, and as a result the Euro will cause issues. The shape of the candlestick for the trading session on Friday only confirms just how weak the Euro is. We continue to see exhaustive candlesticks, and that is a sign that every time we rally, the sellers jump all over the buyers. Furthermore, the buyers simply do not have the wherewithal to hang on to keep the gains going. If that is going to be the case, then it is obvious that the market will continue to see a lot of volatility, but in the end, it is obvious that the sellers have much more strength than the buyers. The US dollar continues to be attractive in this fear driven market, and of course the massive amounts of debt around the world that are priced in US dollars continues to make the lack of US dollars a major problem for a lot of other economies, driving up demand.

If we do break down below the 1.0750 level then the market goes towards the 1.0650 handle, and then possibly the 1.05 level after that. A breakdown below the 1.05 level would be extraordinarily negative, opening up the “trapdoor” to much lower levels, possibly even as low as the 0.80 level, which was a historic level that has been important based upon the old Deutschmark days.