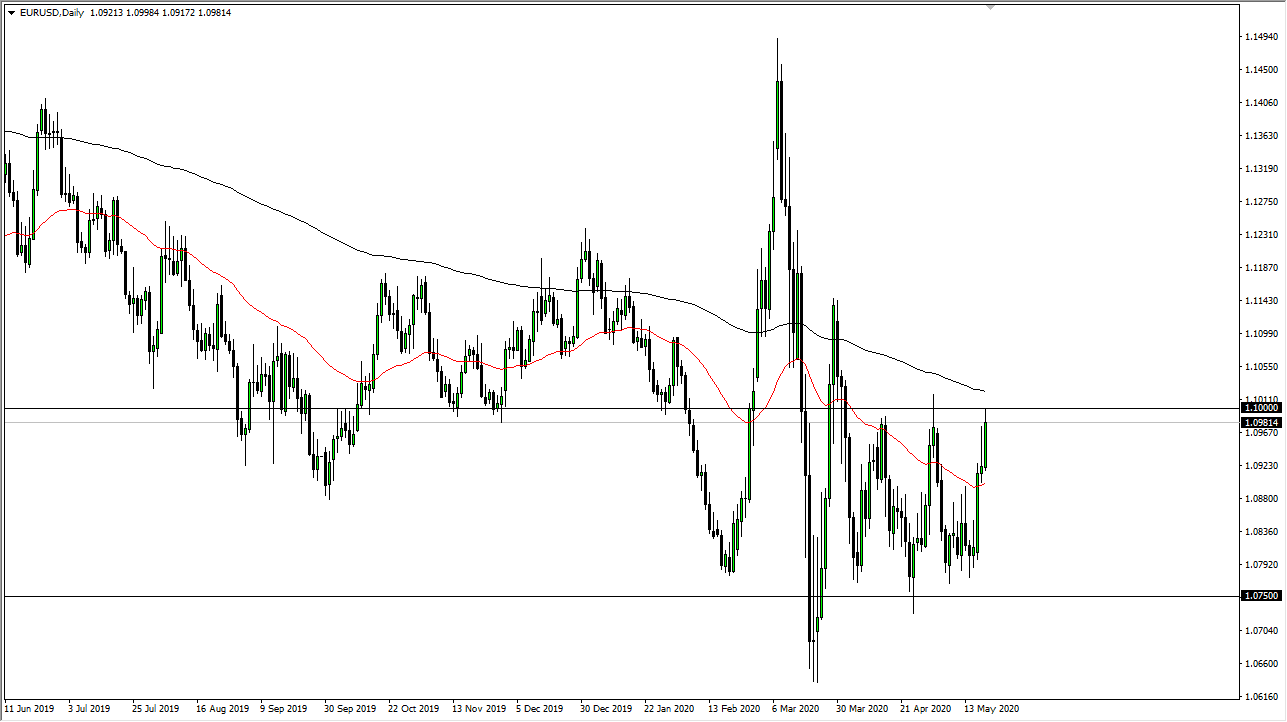

The Euro has rallied significantly during the trading session on Wednesday, reaching towards the 1.10 level. Having said that, the market looks highly likely to continue to look at the 1.10 level as massive resistance. Furthermore, there is also the 200 day EMA just above that should come into play as well, so I fully anticipate that we will see quite a bit of noise just waiting to push this market back down. It should be noted that we stopped just below the 1.10 level, and therefore it is likely that we will continue to see the area attract selling pressure again. Ultimately, the US dollar has gotten its head handed to itself recently, but we have seen this in the past, a couple of good days for risk appetite only to see things rolled right back over.

Looking at this chart, it is also obvious that we have a significant amount of support extending from 1.08 down to the 1.0750 level, which has been the case for a couple of months now. This point in time, the market looks as if it is really trying to break out but with the 200 day EMA sitting just above I suspect that the resistance will eventually hold. Because of this, I am fading this pair, but I also recognize that if we break above the 200 day EMA on a daily close, it could send this market higher. When you look at the monthly chart, that does of course suggest importance.

If we break down below the 1.0750 level, it is possible that the market goes down to the 1.0650 level, and then eventually the 1.05 handle. From a fundamental standpoint, the US dollar should continue to strengthen due to the massive amounts of debt around the world that are denominated in US dollars, naturally driving up the demand for the greenback. All things being equal, this is a market that simply goes back and forth, and at this point it is possible that we may see more of the same. The market has been extraordinarily negative for some time, even though we do get the occasional rip to the upside. At this point, we have a long way to go before changing the trend completely, but it certainly looks as if we are not ready to implode and go falling drastically either. As the markets in general continue to move back and forth, it is a great proxy for just how erratic other markets are right now.