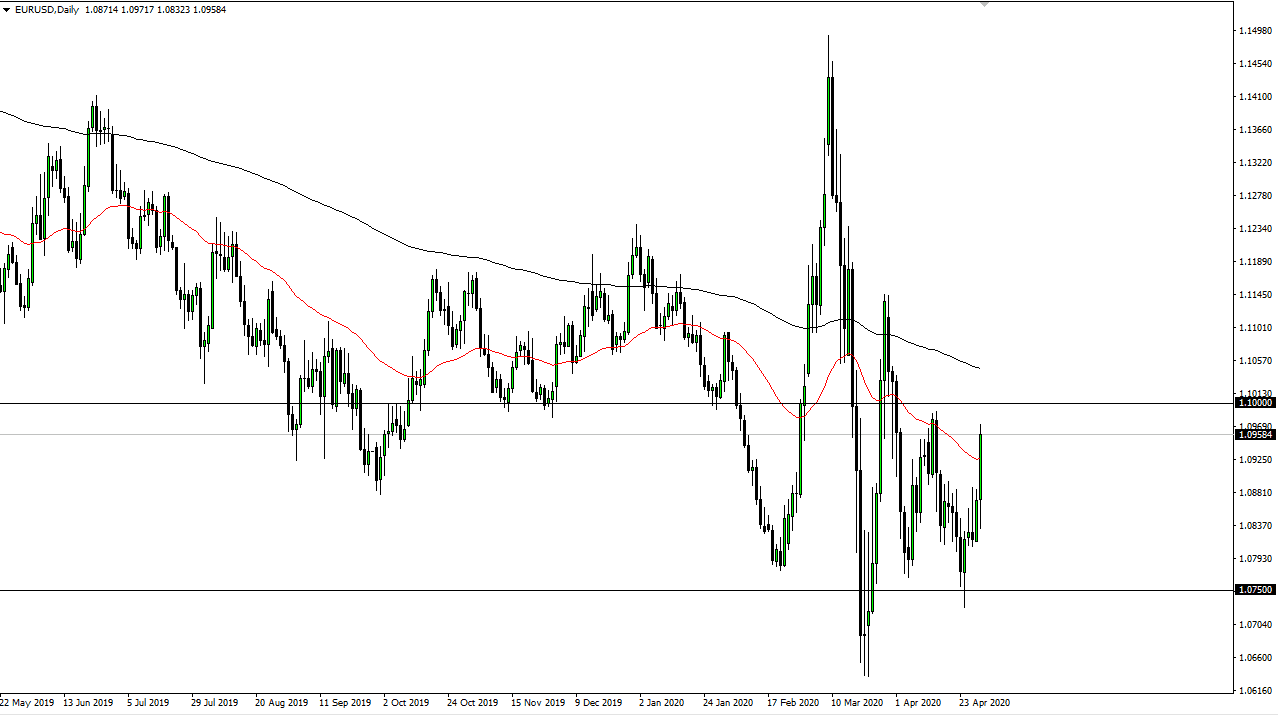

The Euro rallied significantly during the trading session on Thursday, reaching towards the 1.10 level as Christine Largarde did not give the markets the monetary methadone that they desperately needed during the press conference after the interest rate decision. While they did make borrowing for European banks realize negative rates, the reality is that it was not enough to impress the market. In fact, the Euro took off to the upside after that due to the fact that the Federal Reserve seems to be much more proactive when it comes to liquefy the markets, thereby putting serious pressure on the US dollar.

Having said all of that, we are still within the trading range that we had been previously, and I do think that the 1.10 level could cause some issues. That is an area that has caused issues previously, and therefore I do think that it is only a matter of time before the sellers would come back in and push this market lower. Furthermore, the 200 day EMA is starting to race towards the 1.10 level so I think what we are looking at is a perfect set up for a “fading the rallies” type of situation. Having said that, I do believe that if we break above the 200 day EMA on a daily close, that could send this market higher.

To the downside, I do not think that the Euro is going to suddenly fall apart, and I do believe that the 1.0750 level will cause a lot of support. I do not even know that we get there in the short term, but I do think that the Euro has gotten a little bit stretched at this point. The Friday close will be crucial, but you should also keep in mind that it is also made a in the European Union, so that makes a big difference as far as liquidity is concerned.

The size of the candlestick is rather impressive, but it still falls within the purview of the normal trading that we have seen as of late. At this point, I think it is probably best to fade signs of exhaustion near the 1.10 level, but I would not jump “all in” as far as position size is concerned. If we do break out to the upside, it could be the beginning of something rather special to the upside, but it is going to be choppy and difficult affair regardless of what happens next.