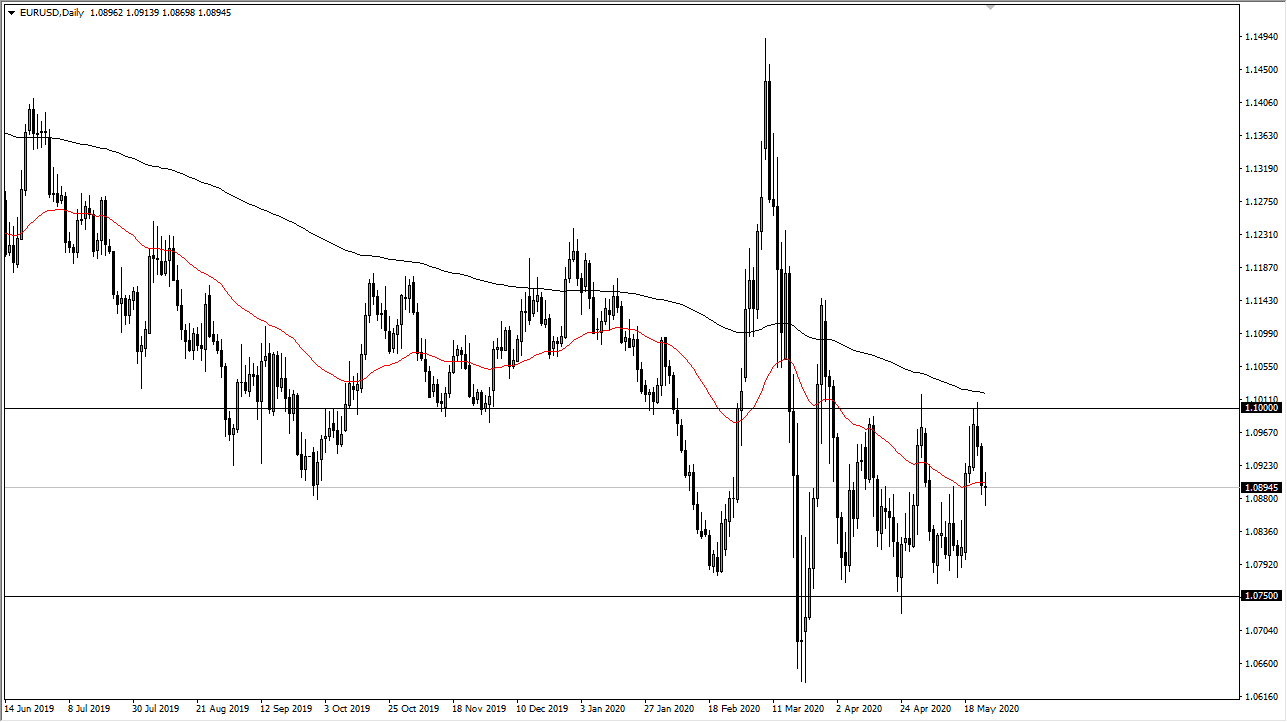

The Euro currently sits around the 1.09 level, as would be expected as the Memorial Day holiday kept a lot of liquidity away from the markets. It was also a bank holiday in the United Kingdom, so you should not have been trading this market. The Euro sits at the 50 day EMA which attracts a lot of attention in and of itself, so I think at this point what we are likely to see is a lot of back and forth in and short-term trading overall.

Looking at the market from a longer-term perspective, the 1.10 level has obviously been resistance, and I think it will continue to be so. I would not read too much into the neutrality of the candlestick for the Monday session, because there just was nobody there. The 50 day EMA is a bit of a target and of course a magnet for price, so I am not surprised at all to see that we are simply going back and forth in this general vicinity. If we break down below the bottom of the candlestick during the trading session on Monday, then it opens up the possibility of a move down to the 1.08 level, possibly even the 1.0750 level. I do not think that we are going to see a breakout of this larger range though, because there is no reason to think that the market is certainly going to change. This is typical behavior for the Euro going back and forth and banging around as high-frequency traders kick this market back and forth.

All things being equal, I am much more comfortable shorting this market than buying it, so I do like the idea of fading if we get closer to the top. However, I recognize that if we were to break above the 200 day EMA which is currently sitting just above the 1.10 level, then it is possible that we may get a move that extends the Euro to the 1.11 handle at that point. I would hold my breath for that though, I think it is likely that the market is simply to frozen with questions about the global economy and of course all of the issues that continue to plague the European Union. The US dollar is a safety currency, but at the same time the Federal Reserve is pumping the markets full of liquidity so that of course works against the value of the US dollar. Because of all of this, the market simply goes back and forth.