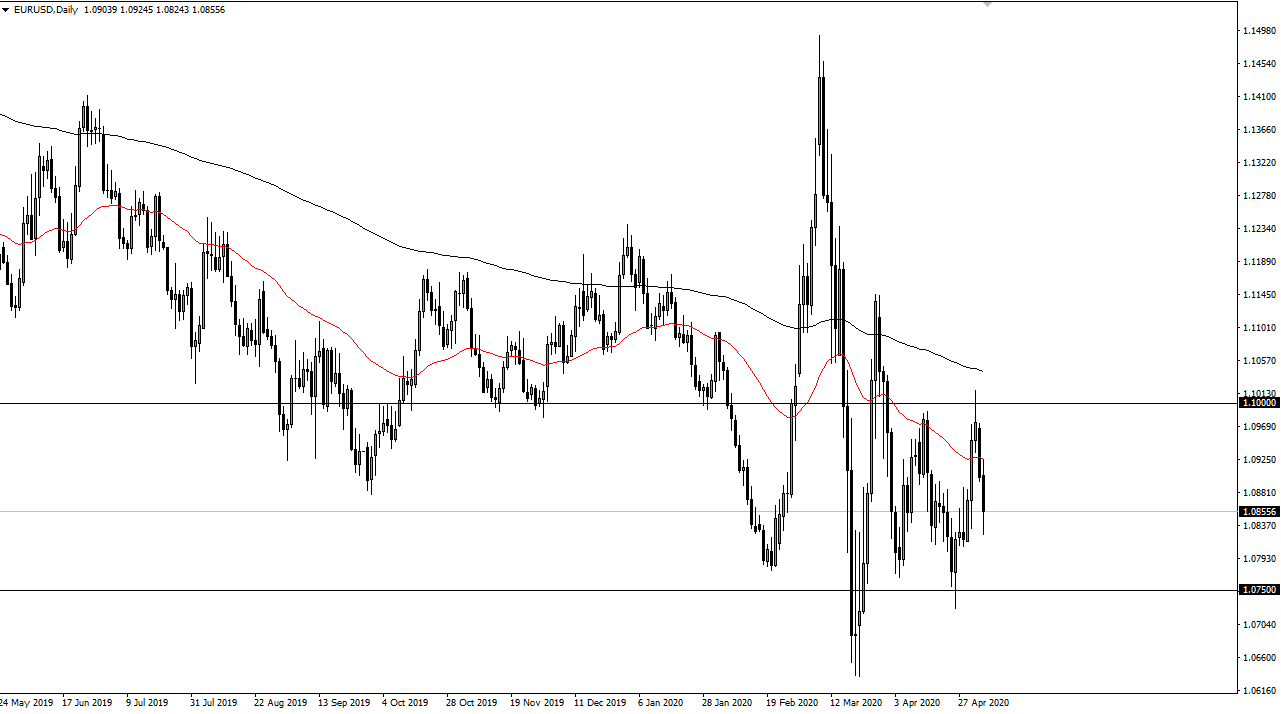

The Euro has fallen after initially trying to rally during the trading session on Tuesday. The market has tested the 50 day EMA above, but then failed there as the sellers rushed to punish the Euro as the German Supreme Court ruled that several of the schemes that the European Central Bank has concocted is unconstitutional under German law. If Germany does not participate, then anything that the ECB does is completely irrelevant.

The market crashed into the 1.0825 level, but then bounced a bit from there towards the end of the day. That being said, cooler heads will prevail when they remember that this is not the first time that the German Supreme Court has ruled against something the ECB wanted to do, and in the past has always turn things back around. In other words, they will do what Brussels tells them over the long term. In the short term though, it is likely that we continue to look at the Euro with a bit of suspicion, as the US dollar continues to attract a lot of inflow when it comes to the idea of buying US Treasuries. At this, it drives up the value of the greenback in general due to simple supply and demand.

Underneath, the 1.0750 level has offered support in the past, and I suspect at this point it will continue to be an area that people pay attention to as well. If we were to break down below there, then the Euro could go looking towards the lows again at the 1.0650 level. The alternate scenario is that we turn around and reach towards 1.10 level, which was the most recent highs that the market, and the top of the overall consolidation range. That being said, the market is simply going back and forth, and as we are in the middle of this range it makes sense that we sit on the sidelines when it comes to this market in the meantime, as the choppy behavior in this pair will more than likely continue as per normal. We have a clear risk range to deal with, so at this point I suspect as we are in the middle of it is simply a matter of waiting until we get to the extremes to put a position on. All things being equal though, I do prefer shorting this market than trying to buy it.